- Singapore

- /

- Construction

- /

- SGX:E3B

Asian Penny Stocks Spotlight: Viva Biotech Holdings And Two More To Consider

Reviewed by Simply Wall St

Amidst global economic uncertainties, Asian markets have shown resilience, with a focus on growth strategies to navigate challenges such as trade tensions and inflationary pressures. In this context, penny stocks—often representing smaller or newer companies—continue to capture investor interest due to their potential for significant returns. While the term may seem outdated, these stocks can offer a blend of affordability and growth potential when backed by strong financials.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Financial Health Rating |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD2.35 | SGD9.28B | ★★★★★☆ |

| Lever Style (SEHK:1346) | HK$1.28 | HK$812.53M | ★★★★★★ |

| Bosideng International Holdings (SEHK:3998) | HK$4.23 | HK$48.48B | ★★★★★★ |

| Activation Group Holdings (SEHK:9919) | HK$0.89 | HK$662.82M | ★★★★★★ |

| Xiamen Hexing Packaging Printing (SZSE:002228) | CN¥3.05 | CN¥3.53B | ★★★★★★ |

| Beng Kuang Marine (SGX:BEZ) | SGD0.21 | SGD41.83M | ★★★★★★ |

| Interlink Telecom (SET:ITEL) | THB1.53 | THB2.13B | ★★★★☆☆ |

| China Zheshang Bank (SEHK:2016) | HK$2.36 | HK$79.91B | ★★★★★★ |

| Playmates Toys (SEHK:869) | HK$0.60 | HK$708M | ★★★★★★ |

| Jiumaojiu International Holdings (SEHK:9922) | HK$3.30 | HK$4.61B | ★★★★★★ |

Click here to see the full list of 1,162 stocks from our Asian Penny Stocks screener.

Let's uncover some gems from our specialized screener.

Viva Biotech Holdings (SEHK:1873)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Viva Biotech Holdings is an investment holding company that provides structure-based drug discovery services to biotech and pharmaceutical clients globally, with a market cap of HK$3.17 billion.

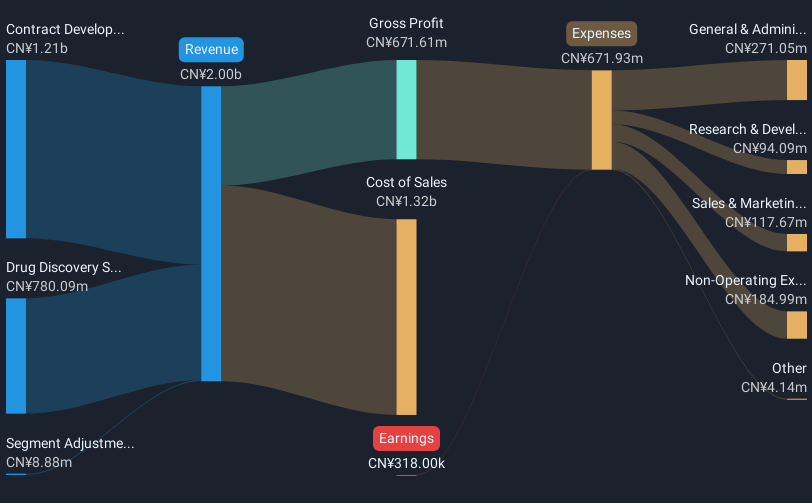

Operations: The company's revenue is primarily generated from its Drug Discovery Services, which account for CN¥780.09 million, and its Contract Development Manufacture Organisation (CDMO) and Commercialisation Services, contributing CN¥1.21 billion.

Market Cap: HK$3.17B

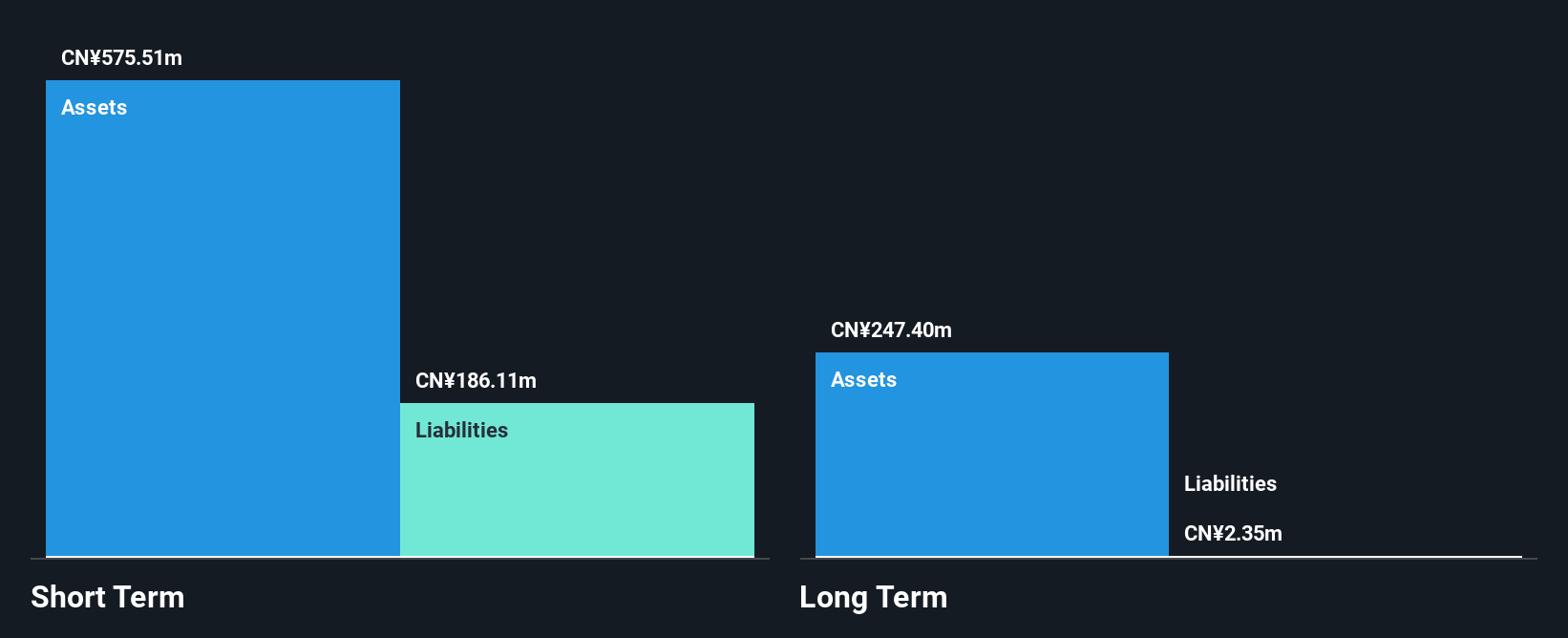

Viva Biotech Holdings, with a market cap of HK$3.17 billion, focuses on drug discovery and manufacturing services. The company generates significant revenue from its Drug Discovery Services (CN¥780.09 million) and CDMO/Commercialisation Services (CN¥1.21 billion). Despite being unprofitable, it maintains a positive cash flow with a sufficient runway for over three years. Its short-term assets exceed liabilities but fall short for long-term obligations. Recent expansions include a new branch in Boston, enhancing its global presence and collaboration opportunities within the biopharma sector, potentially strengthening its service capabilities across North America and beyond amidst high share price volatility.

- Get an in-depth perspective on Viva Biotech Holdings' performance by reading our balance sheet health report here.

- Understand Viva Biotech Holdings' track record by examining our performance history report.

Wee Hur Holdings (SGX:E3B)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Wee Hur Holdings Ltd. is an investment holding company involved in general building and civil engineering construction in Singapore and Australia, with a market cap of SGD418.26 million.

Operations: The company's revenue segments include Building Construction (SGD123.74 million), Workers Dormitory (SGD84.69 million), Property Development in Singapore (SGD47.45 million) and Australia (SGD0.94 million), Fund Management (SGD5.54 million), PBSA Operations (SGD2.09 million) and the Corporate Segment (SGD3.56 million).

Market Cap: SGD418.26M

Wee Hur Holdings Ltd., with a market cap of SGD418.26 million, shows financial stability through its diversified revenue streams, including Building Construction (SGD123.74 million) and Workers Dormitory (SGD84.69 million). The company maintains a healthy debt profile, with short-term assets exceeding liabilities and satisfactory net debt to equity ratio at 9.5%. Despite recent negative earnings growth impacted by a large one-off loss of SGD41.4 million, the firm is expanding via its new subsidiary KK39 Investments Pte. Ltd., while planning a dividend increase pending shareholder approval, indicating confidence in future prospects amidst stable weekly volatility.

- Click to explore a detailed breakdown of our findings in Wee Hur Holdings' financial health report.

- Gain insights into Wee Hur Holdings' future direction by reviewing our growth report.

Shenzhen Hemei GroupLTD (SZSE:002356)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Shenzhen Hemei Group Co., LTD. operates in the sale of clothing and accessories both in China and internationally, with a market cap of CN¥4.21 billion.

Operations: There are no specific revenue segments reported for Shenzhen Hemei Group Co., LTD.

Market Cap: CN¥4.21B

Shenzhen Hemei Group Co., LTD., with a market cap of CN¥4.21 billion, is currently unprofitable but has managed to reduce its losses by a significant rate over the past five years. The company benefits from being debt-free and has sufficient cash runway for over a year based on current free cash flow, extending to 1.4 years if growth continues at historical rates. While short-term assets comfortably cover both short and long-term liabilities, the board's average tenure of 2.2 years suggests inexperience. Recent stability in weekly volatility adds some predictability amidst these challenges.

- Dive into the specifics of Shenzhen Hemei GroupLTD here with our thorough balance sheet health report.

- Evaluate Shenzhen Hemei GroupLTD's historical performance by accessing our past performance report.

Summing It All Up

- Access the full spectrum of 1,162 Asian Penny Stocks by clicking on this link.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Wee Hur Holdings, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Wee Hur Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SGX:E3B

Wee Hur Holdings

An investment holding company, engages in general building and civil engineering construction business in Singapore and Australia.

Flawless balance sheet and undervalued.

Market Insights

Community Narratives