There's Reason For Concern Over Innovent Biologics, Inc.'s (HKG:1801) Massive 27% Price Jump

Innovent Biologics, Inc. (HKG:1801) shareholders are no doubt pleased to see that the share price has bounced 27% in the last month, although it is still struggling to make up recently lost ground. Looking further back, the 11% rise over the last twelve months isn't too bad notwithstanding the strength over the last 30 days.

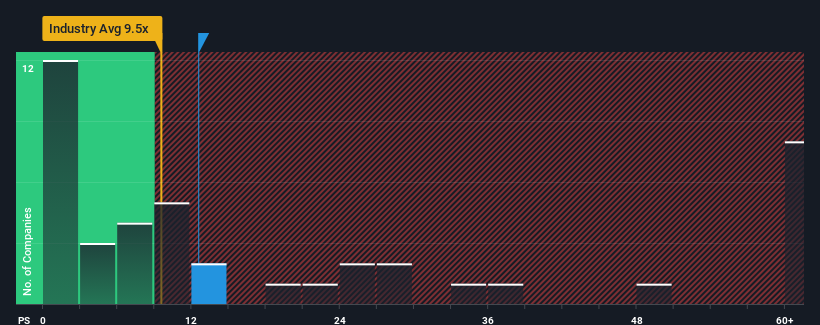

After such a large jump in price, Innovent Biologics' price-to-sales (or "P/S") ratio of 12.6x might make it look like a sell right now compared to the wider Biotechs industry in Hong Kong, where around half of the companies have P/S ratios below 9.5x and even P/S below 2x are quite common. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Innovent Biologics

How Innovent Biologics Has Been Performing

Recent times haven't been great for Innovent Biologics as its revenue has been rising slower than most other companies. It might be that many expect the uninspiring revenue performance to recover significantly, which has kept the P/S ratio from collapsing. However, if this isn't the case, investors might get caught out paying too much for the stock.

Keen to find out how analysts think Innovent Biologics' future stacks up against the industry? In that case, our free report is a great place to start.Do Revenue Forecasts Match The High P/S Ratio?

Innovent Biologics' P/S ratio would be typical for a company that's expected to deliver solid growth, and importantly, perform better than the industry.

Retrospectively, the last year delivered a decent 9.9% gain to the company's revenues. Pleasingly, revenue has also lifted 198% in aggregate from three years ago, partly thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing revenues over that time.

Looking ahead now, revenue is anticipated to climb by 31% per annum during the coming three years according to the analysts following the company. With the industry predicted to deliver 68% growth per year, the company is positioned for a weaker revenue result.

With this information, we find it concerning that Innovent Biologics is trading at a P/S higher than the industry. Apparently many investors in the company are way more bullish than analysts indicate and aren't willing to let go of their stock at any price. There's a good chance these shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

The Key Takeaway

Innovent Biologics' P/S is on the rise since its shares have risen strongly. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

It comes as a surprise to see Innovent Biologics trade at such a high P/S given the revenue forecasts look less than stellar. Right now we aren't comfortable with the high P/S as the predicted future revenues aren't likely to support such positive sentiment for long. At these price levels, investors should remain cautious, particularly if things don't improve.

Don't forget that there may be other risks. For instance, we've identified 1 warning sign for Innovent Biologics that you should be aware of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1801

Innovent Biologics

A biopharmaceutical company, develops and commercializes monoclonal antibodies and other drug assets in the fields of oncology, ophthalmology, autoimmune, and cardiovascular and metabolic diseases in the People’s Republic of China.

Good value with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives