YiChang HEC ChangJiang Pharmaceutical Co., Ltd.'s (HKG:1558) Business Is Trailing The Industry But Its Shares Aren't

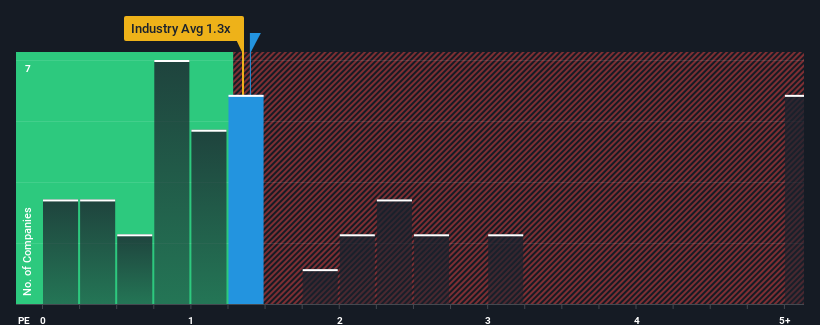

It's not a stretch to say that YiChang HEC ChangJiang Pharmaceutical Co., Ltd.'s (HKG:1558) price-to-sales (or "P/S") ratio of 1.4x right now seems quite "middle-of-the-road" for companies in the Pharmaceuticals industry in Hong Kong, where the median P/S ratio is around 1.3x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

See our latest analysis for YiChang HEC ChangJiang Pharmaceutical

How Has YiChang HEC ChangJiang Pharmaceutical Performed Recently?

YiChang HEC ChangJiang Pharmaceutical certainly has been doing a good job lately as it's been growing revenue more than most other companies. One possibility is that the P/S ratio is moderate because investors think this strong revenue performance might be about to tail off. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on YiChang HEC ChangJiang Pharmaceutical.How Is YiChang HEC ChangJiang Pharmaceutical's Revenue Growth Trending?

There's an inherent assumption that a company should be matching the industry for P/S ratios like YiChang HEC ChangJiang Pharmaceutical's to be considered reasonable.

Retrospectively, the last year delivered an exceptional 182% gain to the company's top line. Revenue has also lifted 8.1% in aggregate from three years ago, mostly thanks to the last 12 months of growth. Accordingly, shareholders would have probably been satisfied with the medium-term rates of revenue growth.

Shifting to the future, estimates from the dual analysts covering the company suggest revenue should grow by 15% over the next year. With the industry predicted to deliver 19% growth, the company is positioned for a weaker revenue result.

In light of this, it's curious that YiChang HEC ChangJiang Pharmaceutical's P/S sits in line with the majority of other companies. Apparently many investors in the company are less bearish than analysts indicate and aren't willing to let go of their stock right now. Maintaining these prices will be difficult to achieve as this level of revenue growth is likely to weigh down the shares eventually.

The Key Takeaway

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

When you consider that YiChang HEC ChangJiang Pharmaceutical's revenue growth estimates are fairly muted compared to the broader industry, it's easy to see why we consider it unexpected to be trading at its current P/S ratio. When we see companies with a relatively weaker revenue outlook compared to the industry, we suspect the share price is at risk of declining, sending the moderate P/S lower. A positive change is needed in order to justify the current price-to-sales ratio.

The company's balance sheet is another key area for risk analysis. Our free balance sheet analysis for YiChang HEC ChangJiang Pharmaceutical with six simple checks will allow you to discover any risks that could be an issue.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1558

YiChang HEC ChangJiang Pharmaceutical

YiChang HEC ChangJiang Pharmaceutical Co., Ltd.

Excellent balance sheet and fair value.

Market Insights

Community Narratives