As global markets continue to rally, with U.S. stocks reaching record highs amid optimism for softer tariffs and AI investments, growth stocks have notably outperformed value shares for the first time this year. In such a buoyant market environment, companies with high insider ownership can be particularly appealing as they often signal strong confidence from those closest to the business.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 41.2% |

| Duc Giang Chemicals Group (HOSE:DGC) | 31.4% | 25.7% |

| Seojin SystemLtd (KOSDAQ:A178320) | 32.1% | 39.9% |

| Clinuvel Pharmaceuticals (ASX:CUV) | 10.4% | 26.2% |

| SKS Technologies Group (ASX:SKS) | 29.7% | 24.8% |

| Laopu Gold (SEHK:6181) | 36.4% | 36.6% |

| Medley (TSE:4480) | 34.1% | 27.3% |

| Plenti Group (ASX:PLT) | 12.7% | 120.1% |

| Fine M-TecLTD (KOSDAQ:A441270) | 17.2% | 135% |

| HANA Micron (KOSDAQ:A067310) | 18.2% | 119.4% |

Let's take a closer look at a couple of our picks from the screened companies.

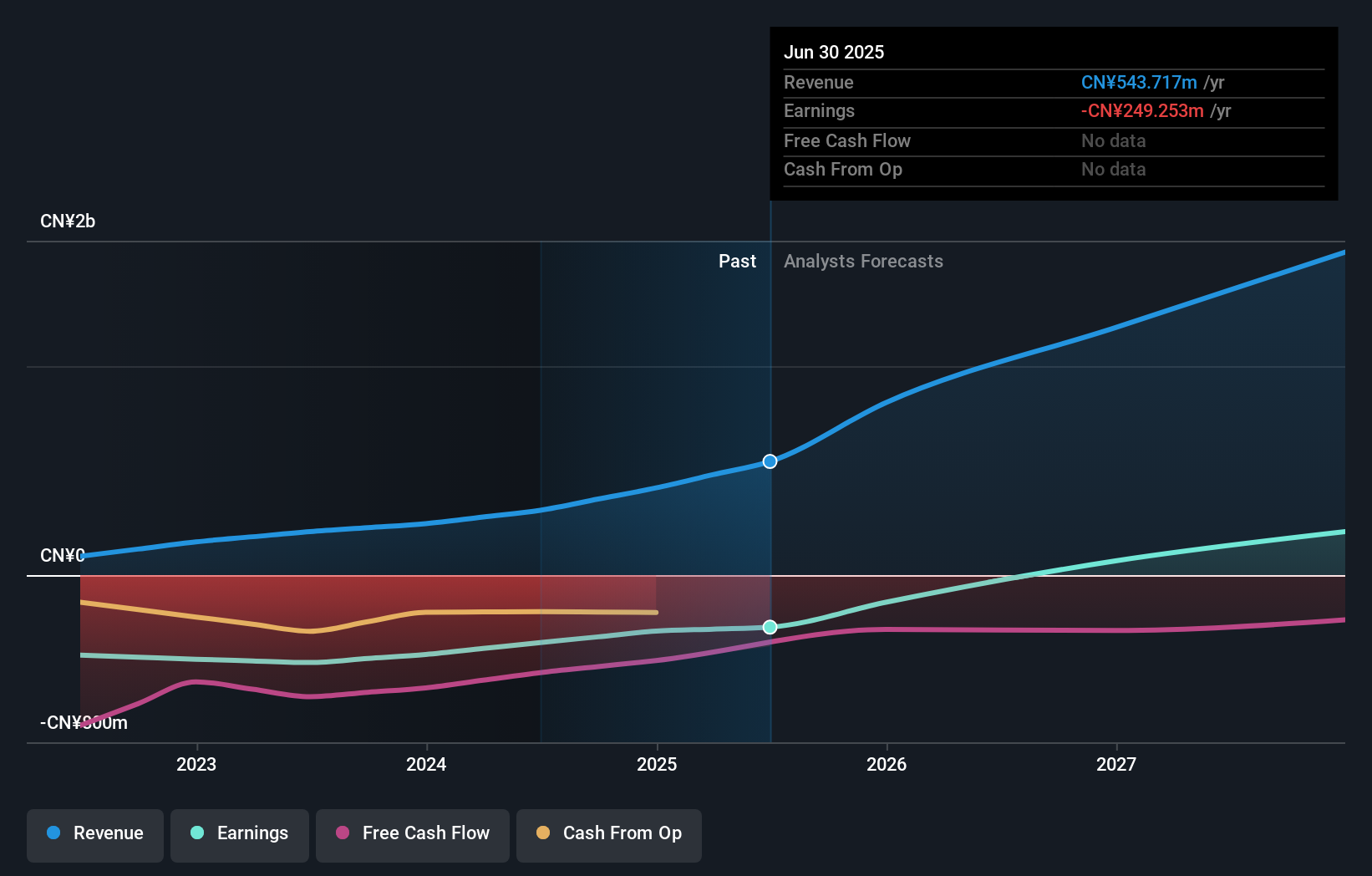

Ocumension Therapeutics (SEHK:1477)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Ocumension Therapeutics, along with its subsidiaries, operates as an ophthalmic pharmaceutical platform company in the People's Republic of China, with a market cap of HK$3.54 billion.

Operations: The company's revenue segment focuses on discovering, developing, and commercializing ophthalmic therapies, generating CN¥310.29 million.

Insider Ownership: 20.4%

Ocumension Therapeutics is positioned for significant growth, with revenue forecasted to increase 33.8% annually, outpacing the Hong Kong market. Despite past shareholder dilution, earnings are expected to grow over 100% per year and become profitable within three years. Recent executive changes include Dr. Qin Xie's appointment as a non-executive director, bringing extensive industry expertise. The company’s key drug candidate OT-301 is progressing through phase III trials in China and the US, indicating potential future market impact.

- Click here and access our complete growth analysis report to understand the dynamics of Ocumension Therapeutics.

- According our valuation report, there's an indication that Ocumension Therapeutics' share price might be on the cheaper side.

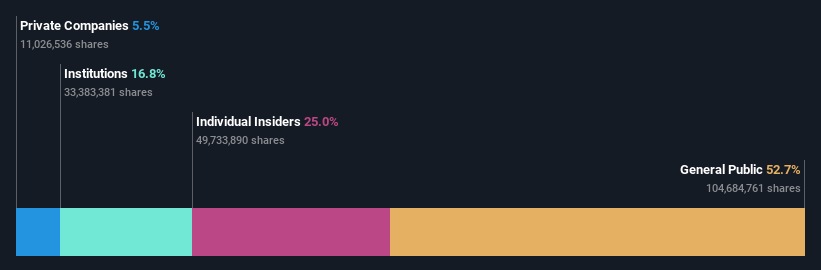

PharmaBlock Sciences (Nanjing) (SZSE:300725)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: PharmaBlock Sciences (Nanjing), Inc. offers chemistry products and services for pharmaceutical research, development, and commercial production, with a market cap of CN¥6.21 billion.

Operations: The company's revenue from its drug research and development and production-related business amounts to CN¥1.56 billion.

Insider Ownership: 25%

PharmaBlock Sciences (Nanjing) is projected to see earnings grow significantly at 28.5% annually, outpacing the broader Chinese market. However, revenue growth is expected to be below 20% per year. Recent board changes include new independent and non-independent directors, potentially impacting governance positively. Despite a low forecasted return on equity and an unstable dividend track record, the absence of substantial insider trading in recent months suggests confidence among insiders in the company's future prospects.

- Delve into the full analysis future growth report here for a deeper understanding of PharmaBlock Sciences (Nanjing).

- Insights from our recent valuation report point to the potential overvaluation of PharmaBlock Sciences (Nanjing) shares in the market.

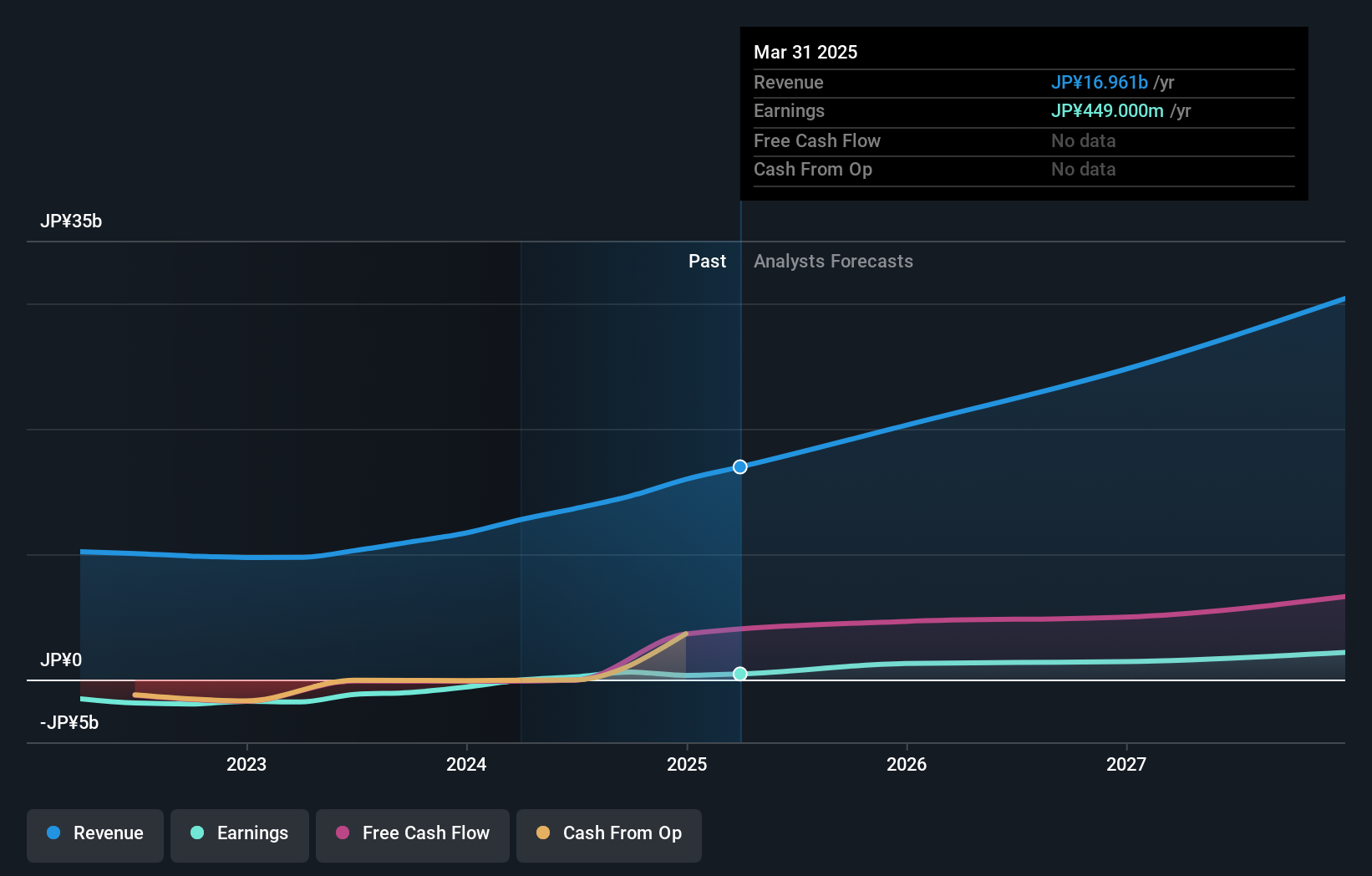

BASEInc (TSE:4477)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: BASE, Inc. is involved in the planning, development, and operation of web services in Japan with a market cap of ¥39.79 billion.

Operations: The company's revenue segments are comprised of ¥8.65 billion from the BASE Business, ¥5.25 billion from the PAY.JP Business, and ¥743 million from the YELL BANK Business.

Insider Ownership: 15.9%

BASEInc. is projected to experience significant earnings growth of 34.83% annually, surpassing the JP market's average growth rate. Despite its volatile share price and a forecasted low return on equity of 8.3%, the company recently became profitable, indicating potential for future expansion. The board's decision to acquire Estore Corporation could enhance BASEInc.'s strategic positioning, although insider trading activity has not been substantial in recent months, suggesting stable internal sentiment.

- Get an in-depth perspective on BASEInc's performance by reading our analyst estimates report here.

- The analysis detailed in our BASEInc valuation report hints at an inflated share price compared to its estimated value.

Summing It All Up

- Reveal the 1482 hidden gems among our Fast Growing Companies With High Insider Ownership screener with a single click here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300725

PharmaBlock Sciences (Nanjing)

Provides chemistry products and services throughout the pharmaceutical research and development, and commercial production.

Reasonable growth potential with adequate balance sheet.

Market Insights

Community Narratives