Insider Buying: The Sino Biopharmaceutical Limited (HKG:1177) Founder & Senior Vice Chairman Just Bought 4.7% More Shares

Those following along with Sino Biopharmaceutical Limited (HKG:1177) will no doubt be intrigued by the recent purchase of shares by Ping Tse, Founder & Senior Vice Chairman of the company, who spent a stonking HK$481m on stock at an average price of HK$6.87. While that only increased their holding size by 4.7%, it is still a big swing by our standards.

See our latest analysis for Sino Biopharmaceutical

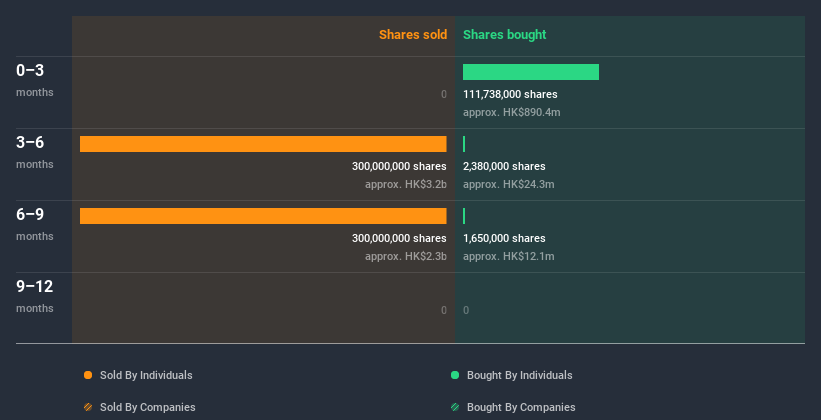

The Last 12 Months Of Insider Transactions At Sino Biopharmaceutical

In fact, the recent purchase by Founder & Senior Vice Chairman Ping Tse was not their only trade of Sino Biopharmaceutical shares this year. They previously made a sale of -HK$3.1b worth of shares at a price of HK$10.50 per share. While we don't usually like to see insider selling, it's more concerning if the sales take place at a lower price. It's of some comfort that this sale was conducted at a price well above the current share price, which is HK$6.81. So it is hard to draw any strong conclusion from it.

Happily, we note that in the last year insiders paid HK$851m for 115.77m shares. But they sold 600.00m shares for HK$5.4b. Ping Tse sold a total of 600.00m shares over the year at an average price of CN¥9.03. The chart below shows insider transactions (by companies and individuals) over the last year. If you click on the chart, you can see all the individual transactions, including the share price, individual, and the date!

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Does Sino Biopharmaceutical Boast High Insider Ownership?

Another way to test the alignment between the leaders of a company and other shareholders is to look at how many shares they own. We usually like to see fairly high levels of insider ownership. Sino Biopharmaceutical insiders own about HK$46b worth of shares (which is 35% of the company). Most shareholders would be happy to see this sort of insider ownership, since it suggests that management incentives are well aligned with other shareholders.

So What Does This Data Suggest About Sino Biopharmaceutical Insiders?

It's certainly positive to see the recent insider purchases. However, the longer term transactions are not so encouraging. The recent buying by some insiders , along with high insider ownership, suggest that Sino Biopharmaceutical insiders are fairly aligned, and optimistic. While we like knowing what's going on with the insider's ownership and transactions, we make sure to also consider what risks are facing a stock before making any investment decision. In terms of investment risks, we've identified 2 warning signs with Sino Biopharmaceutical and understanding these should be part of your investment process.

Of course Sino Biopharmaceutical may not be the best stock to buy. So you may wish to see this free collection of high quality companies.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions, but not derivative transactions.

If you decide to trade Sino Biopharmaceutical, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About SEHK:1177

Sino Biopharmaceutical

An investment holding company, operates as a research and development pharmaceutical conglomerate in the People’s Republic of China.

Flawless balance sheet with moderate growth potential.

Market Insights

Community Narratives