Here's Why I Think CSPC Pharmaceutical Group (HKG:1093) Is An Interesting Stock

Like a puppy chasing its tail, some new investors often chase 'the next big thing', even if that means buying 'story stocks' without revenue, let alone profit. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.'

If, on the other hand, you like companies that have revenue, and even earn profits, then you may well be interested in CSPC Pharmaceutical Group (HKG:1093). While that doesn't make the shares worth buying at any price, you can't deny that successful capitalism requires profit, eventually. Loss-making companies are always racing against time to reach financial sustainability, but time is often a friend of the profitable company, especially if it is growing.

See our latest analysis for CSPC Pharmaceutical Group

How Fast Is CSPC Pharmaceutical Group Growing?

The market is a voting machine in the short term, but a weighing machine in the long term, so share price follows earnings per share (EPS) eventually. It's no surprise, then, that I like to invest in companies with EPS growth. Impressively, CSPC Pharmaceutical Group has grown EPS by 29% per year, compound, in the last three years. If the company can sustain that sort of growth, we'd expect shareholders to come away winners.

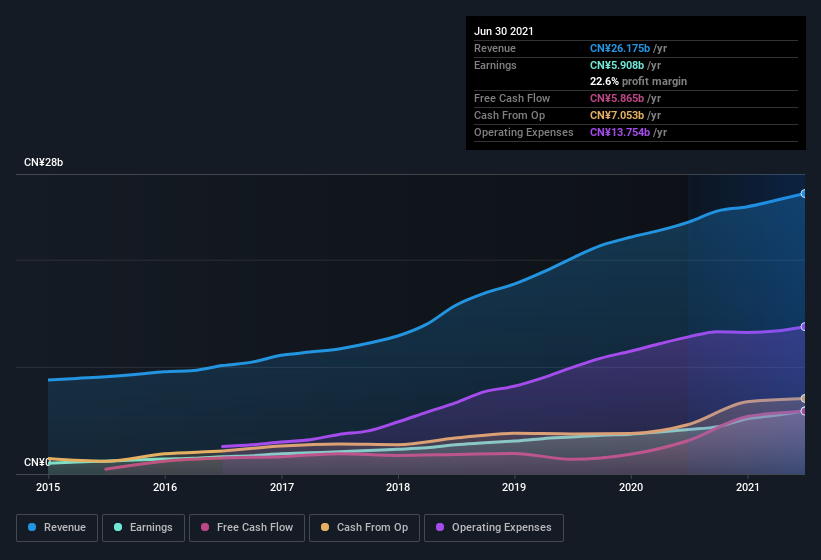

I like to take a look at earnings before interest and (EBIT) tax margins, as well as revenue growth, to get another take on the quality of the company's growth. CSPC Pharmaceutical Group shareholders can take confidence from the fact that EBIT margins are up from 20% to 23%, and revenue is growing. That's great to see, on both counts.

The chart below shows how the company's bottom and top lines have progressed over time. Click on the chart to see the exact numbers.

The trick, as an investor, is to find companies that are going to perform well in the future, not just in the past. To that end, right now and today, you can check our visualization of consensus analyst forecasts for future CSPC Pharmaceutical Group EPS 100% free.

Are CSPC Pharmaceutical Group Insiders Aligned With All Shareholders?

Like standing at the lookout, surveying the horizon at sunrise, insider buying, for some investors, sparks joy. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

One shining light for CSPC Pharmaceutical Group is the serious outlay one insider has made to buy shares, in the last year. Specifically, in one large transaction Executive Chairman & CEO Dongchen Cai paid HK$103m, for stock at HK$7.47 per share. Big insider buys like that are almost as rare as an ocean free of single use plastic waste.

The good news, alongside the insider buying, for CSPC Pharmaceutical Group bulls is that insiders (collectively) have a meaningful investment in the stock. Indeed, they have a glittering mountain of wealth invested in it, currently valued at CN¥26b. Coming in at 23% of the business, that holding gives insiders a lot of influence, and plenty of reason to generate value for shareholders. Very encouraging.

Does CSPC Pharmaceutical Group Deserve A Spot On Your Watchlist?

For growth investors like me, CSPC Pharmaceutical Group's raw rate of earnings growth is a beacon in the night. Better still, insiders own a large chunk of the company and one has even been buying more shares. So it's fair to say I think this stock may well deserve a spot on your watchlist. Even so, be aware that CSPC Pharmaceutical Group is showing 1 warning sign in our investment analysis , you should know about...

The good news is that CSPC Pharmaceutical Group is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

If you're looking to trade CSPC Pharmaceutical Group, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:1093

CSPC Pharmaceutical Group

An investment holding company, engages in the research and development, manufacture, and sale of pharmaceutical products in the People’s Republic of China, other Asian regions, North America, Europe, and internationally.

Excellent balance sheet and good value.

Market Insights

Community Narratives