- Hong Kong

- /

- Entertainment

- /

- SEHK:9990

It's Down 27% But Archosaur Games Inc. (HKG:9990) Could Be Riskier Than It Looks

The Archosaur Games Inc. (HKG:9990) share price has softened a substantial 27% over the previous 30 days, handing back much of the gains the stock has made lately. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 41% share price drop.

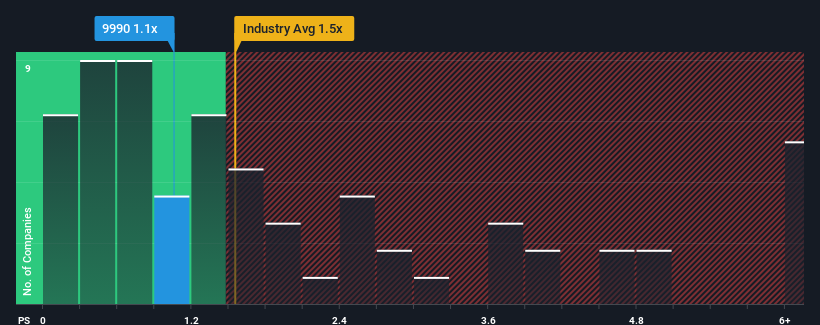

Although its price has dipped substantially, you could still be forgiven for feeling indifferent about Archosaur Games' P/S ratio of 1.1x, since the median price-to-sales (or "P/S") ratio for the Entertainment industry in Hong Kong is also close to 1.5x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

See our latest analysis for Archosaur Games

What Does Archosaur Games' P/S Mean For Shareholders?

Archosaur Games certainly has been doing a good job lately as it's been growing revenue more than most other companies. Perhaps the market is expecting this level of performance to taper off, keeping the P/S from soaring. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Archosaur Games.How Is Archosaur Games' Revenue Growth Trending?

The only time you'd be comfortable seeing a P/S like Archosaur Games' is when the company's growth is tracking the industry closely.

If we review the last year of revenue growth, the company posted a terrific increase of 44%. However, this wasn't enough as the latest three year period has seen the company endure a nasty 19% drop in revenue in aggregate. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Shifting to the future, estimates from the lone analyst covering the company suggest revenue should grow by 29% over the next year. That's shaping up to be materially higher than the 13% growth forecast for the broader industry.

In light of this, it's curious that Archosaur Games' P/S sits in line with the majority of other companies. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

The Key Takeaway

Archosaur Games' plummeting stock price has brought its P/S back to a similar region as the rest of the industry. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Archosaur Games currently trades on a lower than expected P/S since its forecasted revenue growth is higher than the wider industry. When we see a strong revenue outlook, with growth outpacing the industry, we can only assume potential uncertainty around these figures are what might be placing slight pressure on the P/S ratio. At least the risk of a price drop looks to be subdued, but investors seem to think future revenue could see some volatility.

Don't forget that there may be other risks. For instance, we've identified 2 warning signs for Archosaur Games that you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:9990

Archosaur Games

An investment holding company, develops mobile games in Mainland China and internationally.

Flawless balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives