- Hong Kong

- /

- Entertainment

- /

- SEHK:9958

Litian Pictures Holdings Limited (HKG:9958) Shares May Have Slumped 45% But Getting In Cheap Is Still Unlikely

Unfortunately for some shareholders, the Litian Pictures Holdings Limited (HKG:9958) share price has dived 45% in the last thirty days, prolonging recent pain. Looking at the bigger picture, even after this poor month the stock is up 88% in the last year.

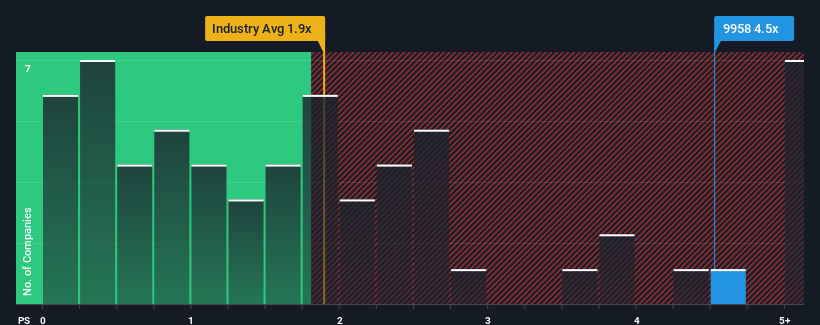

Although its price has dipped substantially, when almost half of the companies in Hong Kong's Entertainment industry have price-to-sales ratios (or "P/S") below 1.9x, you may still consider Litian Pictures Holdings as a stock not worth researching with its 4.5x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

View our latest analysis for Litian Pictures Holdings

How Has Litian Pictures Holdings Performed Recently?

Recent times have been quite advantageous for Litian Pictures Holdings as its revenue has been rising very briskly. It seems that many are expecting the strong revenue performance to beat most other companies over the coming period, which has increased investors’ willingness to pay up for the stock. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Litian Pictures Holdings' earnings, revenue and cash flow.What Are Revenue Growth Metrics Telling Us About The High P/S?

In order to justify its P/S ratio, Litian Pictures Holdings would need to produce outstanding growth that's well in excess of the industry.

Taking a look back first, we see that the company's revenues underwent some rampant growth over the last 12 months. Despite this strong recent growth, it's still struggling to catch up as its three-year revenue frustratingly shrank by 75% overall. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Comparing that to the industry, which is predicted to deliver 20% growth in the next 12 months, the company's downward momentum based on recent medium-term revenue results is a sobering picture.

In light of this, it's alarming that Litian Pictures Holdings' P/S sits above the majority of other companies. It seems most investors are ignoring the recent poor growth rate and are hoping for a turnaround in the company's business prospects. There's a very good chance existing shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the recent negative growth rates.

What We Can Learn From Litian Pictures Holdings' P/S?

A significant share price dive has done very little to deflate Litian Pictures Holdings' very lofty P/S. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Our examination of Litian Pictures Holdings revealed its shrinking revenue over the medium-term isn't resulting in a P/S as low as we expected, given the industry is set to grow. When we see revenue heading backwards and underperforming the industry forecasts, we feel the possibility of the share price declining is very real, bringing the P/S back into the realm of reasonability. Unless the recent medium-term conditions improve markedly, investors will have a hard time accepting the share price as fair value.

It is also worth noting that we have found 3 warning signs for Litian Pictures Holdings (2 are a bit concerning!) that you need to take into consideration.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:9958

Litian Pictures Holdings

A drama series distribution company, develops, markets, and distributes films and television (TV) dramas in the People’s Republic of China.

Good value with adequate balance sheet.

Market Insights

Community Narratives