As global markets navigate a landscape marked by cautious consumer behavior and fluctuating economic indicators, the small-cap sector has shown resilience, with indices like the Russell 2000 posting gains amid hopes for favorable monetary policy shifts. In this context, identifying promising small-cap stocks in Asia requires a keen understanding of market dynamics and an eye for companies that demonstrate strong fundamentals and growth potential despite broader economic uncertainties.

Top 10 Undiscovered Gems With Strong Fundamentals In Asia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Soliton Systems K.K | 0.47% | 2.84% | 2.40% | ★★★★★★ |

| Bonny Worldwide | 47.86% | 17.97% | 41.71% | ★★★★★★ |

| Maxigen Biotech | NA | 10.31% | 23.99% | ★★★★★★ |

| Center International GroupLtd | 13.20% | -0.33% | -19.78% | ★★★★★★ |

| GDEP ADVANCEInc | NA | 27.84% | 19.61% | ★★★★★★ |

| Kinpo Electronics | 102.23% | 5.04% | 44.47% | ★★★★★☆ |

| Unitech Computer | 48.86% | 2.82% | -0.17% | ★★★★★☆ |

| ShenZhen Click TechnologyLTD | 2.65% | 28.95% | 21.45% | ★★★★★☆ |

| TSTE | 37.68% | 4.91% | -5.78% | ★★★★★☆ |

| Lucky Cement | 49.27% | 4.40% | 18.92% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

Tanwan (SEHK:9890)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Tanwan Inc. is a publisher of online game products serving Mainland China, Hong Kong, and international markets with a market capitalization of approximately HK$8.40 billion.

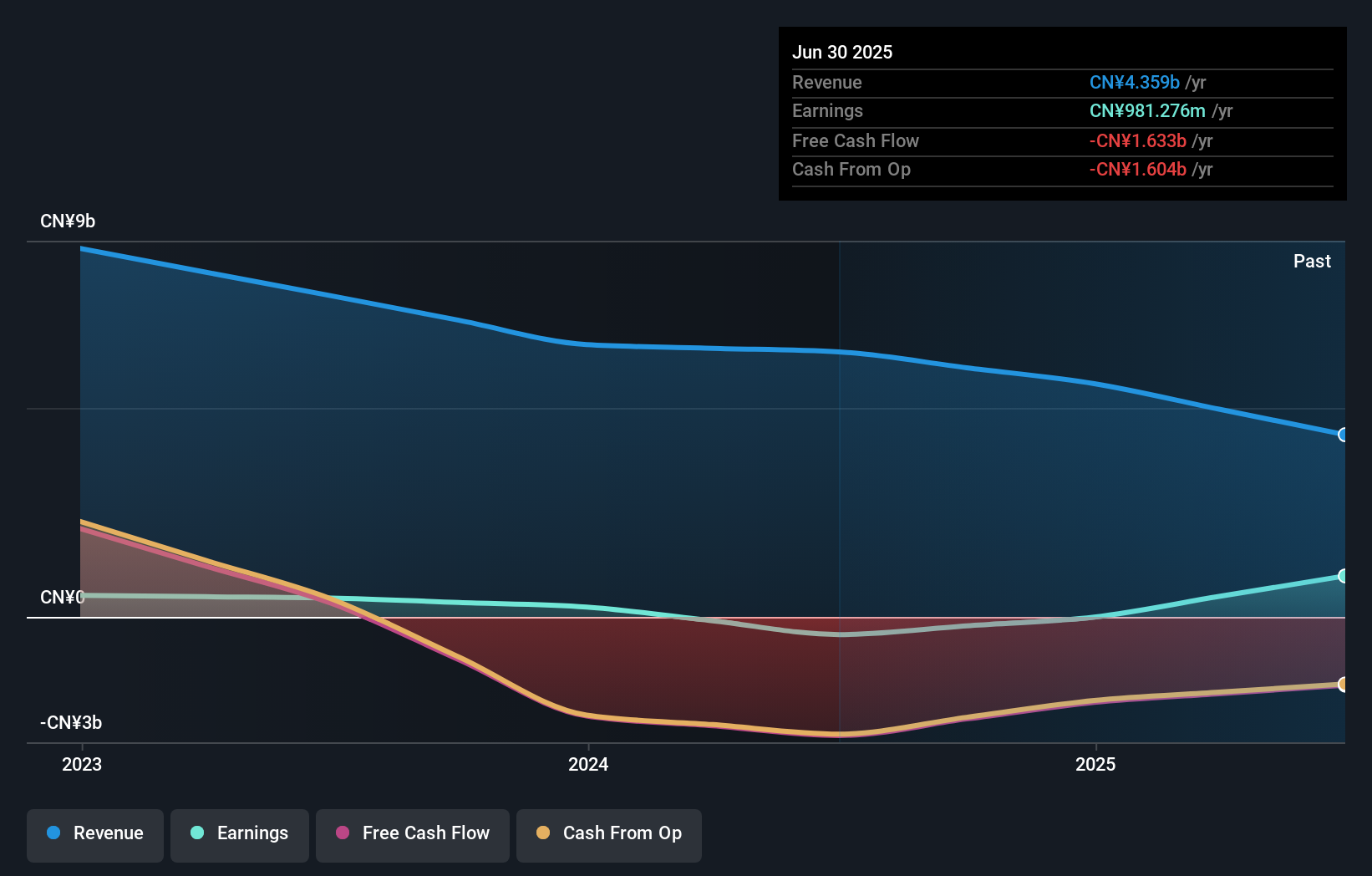

Operations: Tanwan's revenue primarily stems from its direct marketing segment, amounting to CN¥4.36 billion. The company's gross profit margin is a notable aspect of its financial performance, reflecting the efficiency of its cost management strategies in the online gaming sector.

Tanwan, a small player in the entertainment sector, has recently turned profitable and is making waves with its strategic expansion into the pop toy industry. The company's price-to-earnings ratio stands at 7.8x, notably below the Hong Kong market average of 12.3x, suggesting potential value. A recent agreement with COEXIST Group enhances Tanwan's artistic IP portfolio by integrating over 200 artists for derivative product development. Despite not being free cash flow positive lately, Tanwan's strong cash position relative to its debt and high-quality earnings offer a solid foundation for future growth in this niche market.

- Unlock comprehensive insights into our analysis of Tanwan stock in this health report.

Explore historical data to track Tanwan's performance over time in our Past section.

Solar Applied Materials Technology (TPEX:1785)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Solar Applied Materials Technology Corporation engages in the manufacturing, processing, recycling, refining, and trading of sputtering for thin film materials, precious metal materials, and automotive chemicals across Taiwan, China, and internationally with a market cap of NT$38.03 billion.

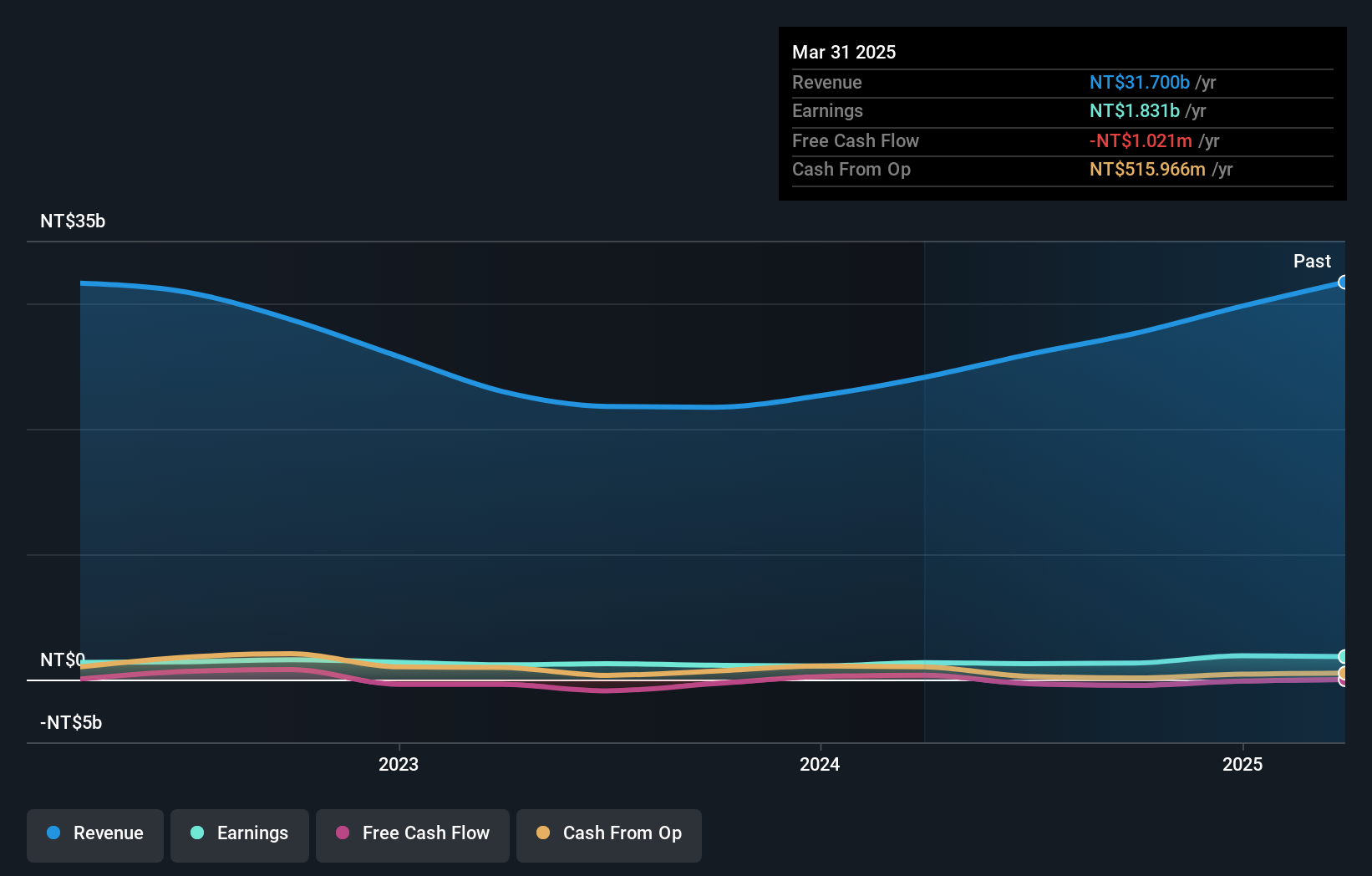

Operations: The company's primary revenue streams are from Taiwan SOLAR and Kunshan Solar, contributing NT$14.37 billion and NT$19.79 billion, respectively. The financial data highlights a significant adjustment and write-off of NT$2.61 billion impacting overall figures.

Solar Applied Materials Technology has shown solid growth, with earnings increasing by 6.5% over the past year, outpacing the Chemicals industry average of -1.6%. The company reported third-quarter sales of TWD 10.43 billion, up from TWD 7.62 billion a year ago, and a net income of TWD 694 million compared to TWD 458 million previously. Despite its high net debt to equity ratio of 82%, interest payments are well covered by EBIT at a ratio of 14x. However, free cash flow remains negative and debt coverage by operating cash flow appears insufficient, indicating areas for improvement in financial health management.

- Navigate through the intricacies of Solar Applied Materials Technology with our comprehensive health report here.

Learn about Solar Applied Materials Technology's historical performance.

Walton Advanced Engineering (TWSE:8110)

Simply Wall St Value Rating: ★★★★★☆

Overview: Walton Advanced Engineering, Inc. operates in Taiwan and China, offering semiconductor packaging and testing services with a market capitalization of NT$25 billion.

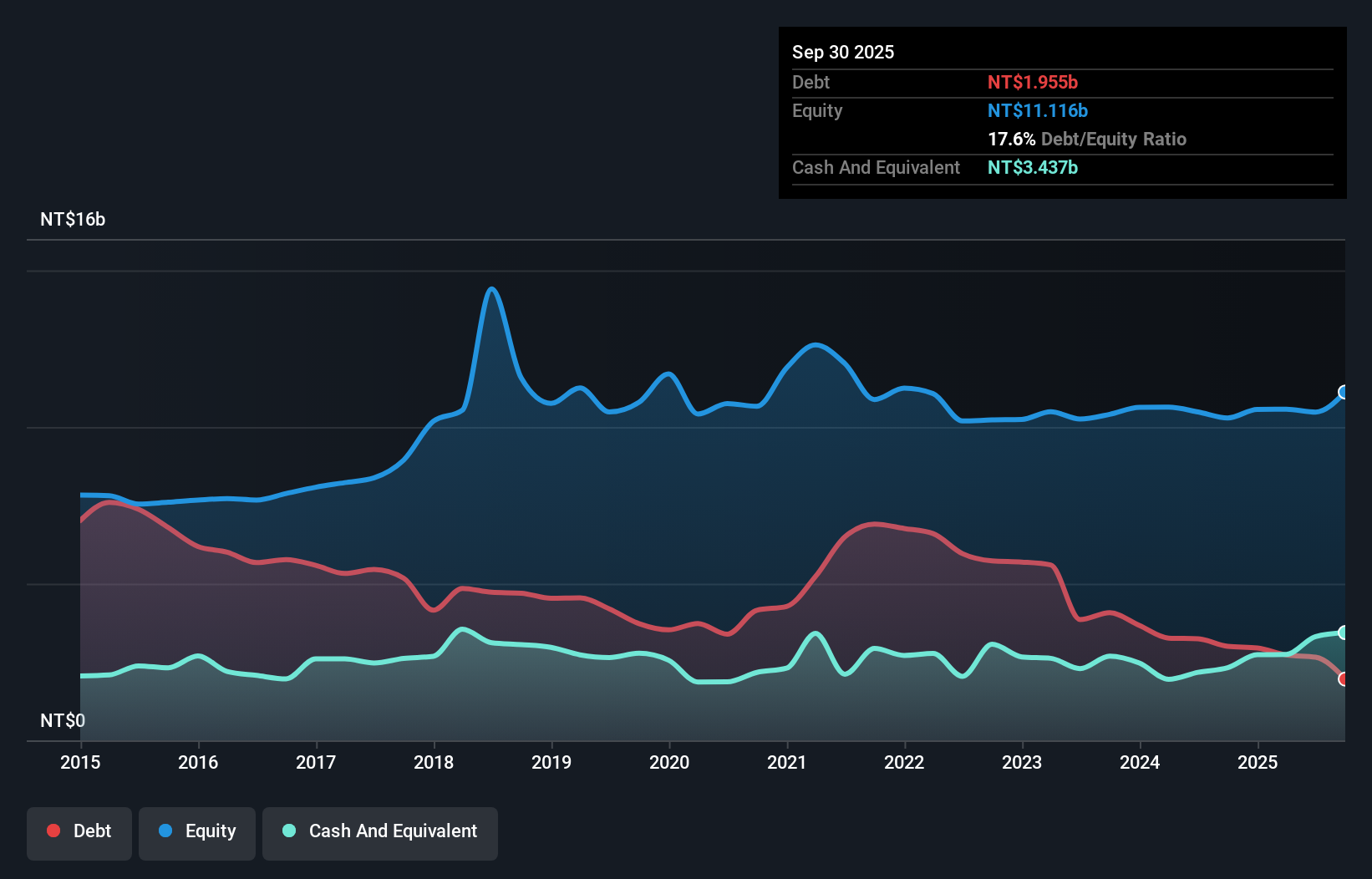

Operations: The company's revenue is primarily derived from its semiconductor packaging and testing services, with package testing contributing NT$7.33 billion.

Walton Advanced Engineering has shown a remarkable turnaround with earnings growth of 298.1% over the past year, outpacing the semiconductor industry. Despite a volatile share price recently, this small player in the market reported a net income of TWD 871.76 million for Q3 2025 compared to a loss last year, reflecting its improved financial footing. The debt-to-equity ratio decreased from 38.9% to 17.6% over five years, indicating better financial management and stability with more cash than total debt on hand. A notable one-off gain of NT$886 million impacted recent results but highlights potential for future profitability improvements.

Turning Ideas Into Actions

- Click this link to deep-dive into the 2487 companies within our Asian Undiscovered Gems With Strong Fundamentals screener.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TPEX:1785

Solar Applied Materials Technology

Manufactures, processes, recycles, refines, and trades sputtering for thin film materials, precious metal materials, precious metal materials and automotive chemicals in Taiwan, China, and internationally.

Adequate balance sheet with acceptable track record.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Deep Value Multi Bagger Opportunity

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Trending Discussion