- Hong Kong

- /

- Entertainment

- /

- SEHK:9857

Revenues Tell The Story For Linmon Media Limited (HKG:9857) As Its Stock Soars 26%

Despite an already strong run, Linmon Media Limited (HKG:9857) shares have been powering on, with a gain of 26% in the last thirty days. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 29% over that time.

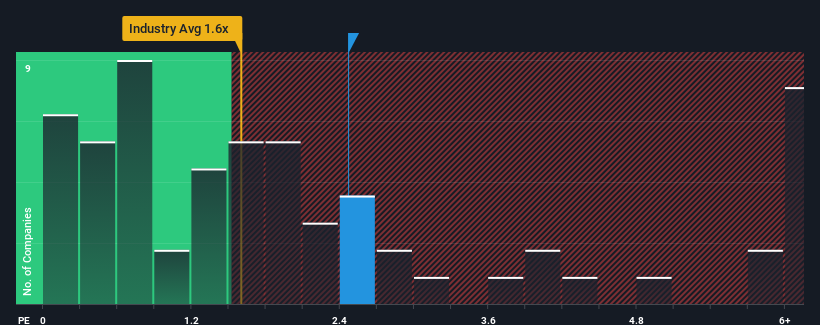

After such a large jump in price, you could be forgiven for thinking Linmon Media is a stock not worth researching with a price-to-sales ratios (or "P/S") of 2.5x, considering almost half the companies in Hong Kong's Entertainment industry have P/S ratios below 1.6x. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

See our latest analysis for Linmon Media

What Does Linmon Media's Recent Performance Look Like?

With revenue growth that's inferior to most other companies of late, Linmon Media has been relatively sluggish. It might be that many expect the uninspiring revenue performance to recover significantly, which has kept the P/S ratio from collapsing. However, if this isn't the case, investors might get caught out paying too much for the stock.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Linmon Media.Do Revenue Forecasts Match The High P/S Ratio?

The only time you'd be truly comfortable seeing a P/S as high as Linmon Media's is when the company's growth is on track to outshine the industry.

Retrospectively, the last year delivered an exceptional 28% gain to the company's top line. Despite this strong recent growth, it's still struggling to catch up as its three-year revenue frustratingly shrank by 14% overall. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Turning to the outlook, the next three years should generate growth of 29% each year as estimated by the dual analysts watching the company. Meanwhile, the rest of the industry is forecast to only expand by 18% per annum, which is noticeably less attractive.

In light of this, it's understandable that Linmon Media's P/S sits above the majority of other companies. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

What We Can Learn From Linmon Media's P/S?

Linmon Media shares have taken a big step in a northerly direction, but its P/S is elevated as a result. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As we suspected, our examination of Linmon Media's analyst forecasts revealed that its superior revenue outlook is contributing to its high P/S. Right now shareholders are comfortable with the P/S as they are quite confident future revenues aren't under threat. Unless these conditions change, they will continue to provide strong support to the share price.

A lot of potential risks can sit within a company's balance sheet. Our free balance sheet analysis for Linmon Media with six simple checks will allow you to discover any risks that could be an issue.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:9857

Linmon Media

An investment holding company, engages in the production, distribution, and licensing of broadcasting rights of drama series in Mainland China and internationally.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives