- Hong Kong

- /

- Entertainment

- /

- SEHK:8368

Here's Why Creative China Holdings Limited's (HKG:8368) CEO Compensation Is The Least Of Shareholders' Concerns

Key Insights

- Creative China Holdings will host its Annual General Meeting on 13th of May

- Salary of CN¥1.12m is part of CEO Philip Yang's total remuneration

- Total compensation is similar to the industry average

- Over the past three years, Creative China Holdings' EPS fell by 2.2% and over the past three years, the total shareholder return was 177%

Under the guidance of CEO Philip Yang, Creative China Holdings Limited (HKG:8368) has performed reasonably well recently. As shareholders go into the upcoming AGM on 13th of May, CEO compensation will probably not be their focus, but rather the steps management will take to continue the growth momentum. We present our case of why we think CEO compensation looks fair.

See our latest analysis for Creative China Holdings

Comparing Creative China Holdings Limited's CEO Compensation With The Industry

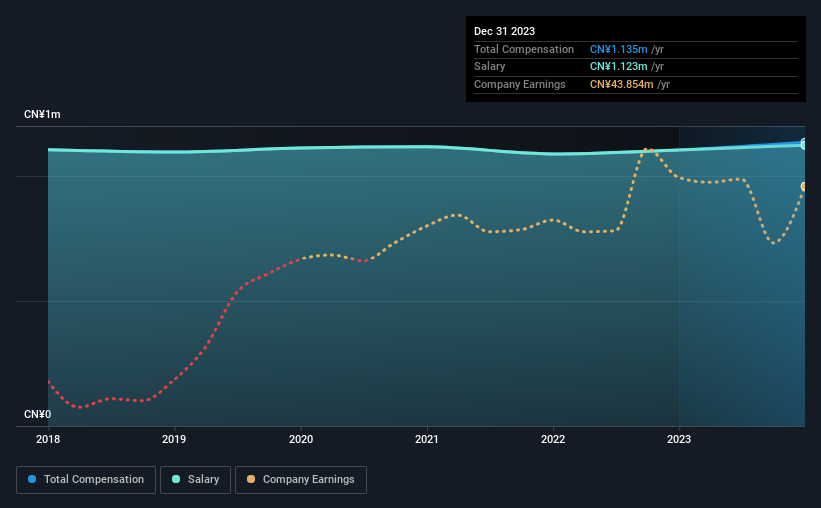

At the time of writing, our data shows that Creative China Holdings Limited has a market capitalization of HK$520m, and reported total annual CEO compensation of CN¥1.1m for the year to December 2023. That's mostly flat as compared to the prior year's compensation. In particular, the salary of CN¥1.12m, makes up a huge portion of the total compensation being paid to the CEO.

In comparison with other companies in the Hong Kong Entertainment industry with market capitalizations under HK$1.6b, the reported median total CEO compensation was CN¥1.1m. So it looks like Creative China Holdings compensates Philip Yang in line with the median for the industry.

| Component | 2023 | 2022 | Proportion (2023) |

| Salary | CN¥1.1m | CN¥1.1m | 99% |

| Other | CN¥12k | - | 1% |

| Total Compensation | CN¥1.1m | CN¥1.1m | 100% |

On an industry level, roughly 91% of total compensation represents salary and 9% is other remuneration. Creative China Holdings is focused on going down a more traditional approach and is paying a higher portion of compensation through salary, as compared to non-salary benefits. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

Creative China Holdings Limited's Growth

Over the last three years, Creative China Holdings Limited has shrunk its earnings per share by 2.2% per year. Its revenue is up 21% over the last year.

Investors would be a bit wary of companies that have lower EPS On the other hand, the strong revenue growth suggests the business is growing. These two metrics are moving in different directions, so while it's hard to be confident judging performance, we think the stock is worth watching. We don't have analyst forecasts, but you could get a better understanding of its growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

Has Creative China Holdings Limited Been A Good Investment?

Boasting a total shareholder return of 177% over three years, Creative China Holdings Limited has done well by shareholders. So they may not be at all concerned if the CEO were to be paid more than is normal for companies around the same size.

In Summary...

Creative China Holdings pays its CEO a majority of compensation through a salary. Although the company has performed relatively well, we still think there are some areas that could be improved. Still, we think that until shareholders see an improvement in EPS growth, they may find it hard to justify a pay rise for the CEO.

We can learn a lot about a company by studying its CEO compensation trends, along with looking at other aspects of the business. In our study, we found 2 warning signs for Creative China Holdings you should be aware of, and 1 of them makes us a bit uncomfortable.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:8368

Creative China Holdings

An investment holding company, primarily provides film and television program original script creation, adaptation, production and licensing, and related services in the People’s Republic of China, Hong Kong, and Southeast Asia.

Excellent balance sheet low.

Market Insights

Community Narratives