- Hong Kong

- /

- Entertainment

- /

- SEHK:8172

Here's Why We're Not Too Worried About Lajin Entertainment Network Group's (HKG:8172) Cash Burn Situation

Even when a business is losing money, it's possible for shareholders to make money if they buy a good business at the right price. For example, biotech and mining exploration companies often lose money for years before finding success with a new treatment or mineral discovery. But the harsh reality is that very many loss making companies burn through all their cash and go bankrupt.

So should Lajin Entertainment Network Group (HKG:8172) shareholders be worried about its cash burn? For the purposes of this article, cash burn is the annual rate at which an unprofitable company spends cash to fund its growth; its negative free cash flow. We'll start by comparing its cash burn with its cash reserves in order to calculate its cash runway.

See our latest analysis for Lajin Entertainment Network Group

Does Lajin Entertainment Network Group Have A Long Cash Runway?

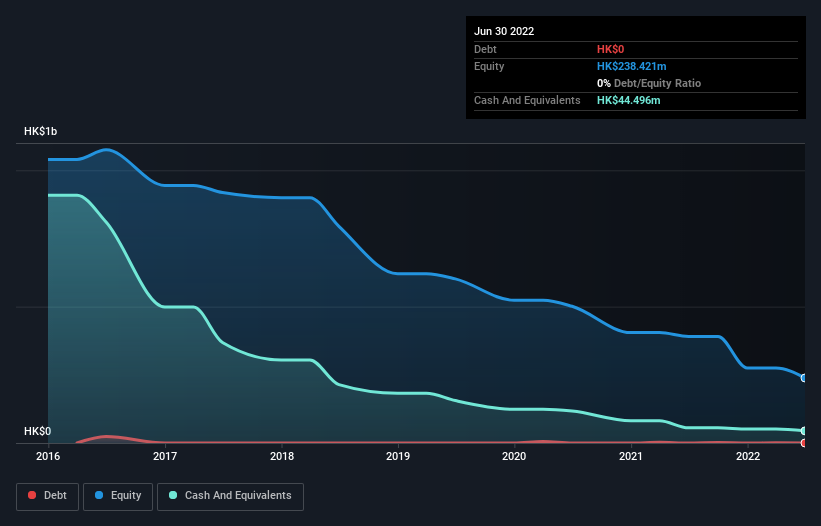

A cash runway is defined as the length of time it would take a company to run out of money if it kept spending at its current rate of cash burn. In June 2022, Lajin Entertainment Network Group had HK$44m in cash, and was debt-free. Looking at the last year, the company burnt through HK$30m. So it had a cash runway of approximately 18 months from June 2022. That's not too bad, but it's fair to say the end of the cash runway is in sight, unless cash burn reduces drastically. You can see how its cash balance has changed over time in the image below.

How Well Is Lajin Entertainment Network Group Growing?

We reckon the fact that Lajin Entertainment Network Group managed to shrink its cash burn by 53% over the last year is rather encouraging. Unfortunately, however, operating revenue declined by 36% during the period. Considering the factors above, the company doesn’t fare badly when it comes to assessing how it is changing over time. In reality, this article only makes a short study of the company's growth data. This graph of historic earnings and revenue shows how Lajin Entertainment Network Group is building its business over time.

How Easily Can Lajin Entertainment Network Group Raise Cash?

Lajin Entertainment Network Group seems to be in a fairly good position, in terms of cash burn, but we still think it's worthwhile considering how easily it could raise more money if it wanted to. Generally speaking, a listed business can raise new cash through issuing shares or taking on debt. Many companies end up issuing new shares to fund future growth. We can compare a company's cash burn to its market capitalisation to get a sense for how many new shares a company would have to issue to fund one year's operations.

Since it has a market capitalisation of HK$564m, Lajin Entertainment Network Group's HK$30m in cash burn equates to about 5.3% of its market value. Given that is a rather small percentage, it would probably be really easy for the company to fund another year's growth by issuing some new shares to investors, or even by taking out a loan.

How Risky Is Lajin Entertainment Network Group's Cash Burn Situation?

Even though its falling revenue makes us a little nervous, we are compelled to mention that we thought Lajin Entertainment Network Group's cash burn relative to its market cap was relatively promising. Cash burning companies are always on the riskier side of things, but after considering all of the factors discussed in this short piece, we're not too worried about its rate of cash burn. On another note, we conducted an in-depth investigation of the company, and identified 3 warning signs for Lajin Entertainment Network Group (1 is concerning!) that you should be aware of before investing here.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies insiders are buying, and this list of stocks growth stocks (according to analyst forecasts)

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:8172

Lajin Entertainment Network Group

An investment holding company, provides movies, TV program, and internet content services in Mainland China.

Excellent balance sheet with low risk.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

PRME remains a long shot but publication in the New England Journal of Medicine helps.

This one is all about the tax benefits

Estimated Share Price is $79.54 using the Buffett Value Calculation

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026