- Hong Kong

- /

- Entertainment

- /

- SEHK:797

We Think 7Road Holdings' (HKG:797) Healthy Earnings Might Be Conservative

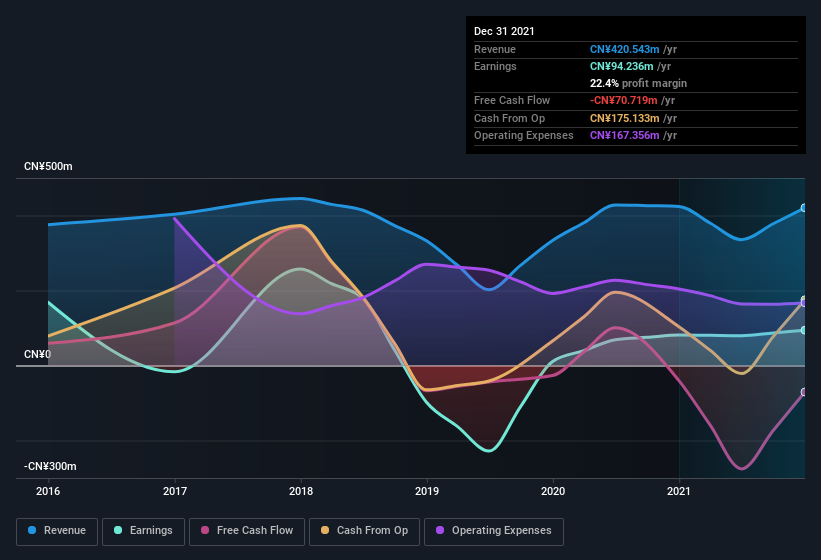

7Road Holdings Limited's (HKG:797) recent earnings report didn't offer any surprises, with the shares unchanged over the last week. We did some digging, and we think that investors are missing some encouraging factors in the underlying numbers.

Check out our latest analysis for 7Road Holdings

The Impact Of Unusual Items On Profit

To properly understand 7Road Holdings' profit results, we need to consider the CN¥36m expense attributed to unusual items. It's never great to see unusual items costing the company profits, but on the upside, things might improve sooner rather than later. When we analysed the vast majority of listed companies worldwide, we found that significant unusual items are often not repeated. And that's hardly a surprise given these line items are considered unusual. 7Road Holdings took a rather significant hit from unusual items in the year to December 2021. As a result, we can surmise that the unusual items made its statutory profit significantly weaker than it would otherwise be.

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of 7Road Holdings.

An Unusual Tax Situation

Just as we noted the unusual items, we must inform you that 7Road Holdings received a tax benefit which contributed CN¥6.9m to the bottom line. This is of course a bit out of the ordinary, given it is more common for companies to be paying tax than receiving tax benefits! The receipt of a tax benefit is obviously a good thing, on its own. However, the devil in the detail is that these kind of benefits only impact in the year they are booked, and are often one-off in nature. In the likely event the tax benefit is not repeated, we'd expect to see its statutory profit levels drop, at least in the absence of strong growth. So while we think it's great to receive a tax benefit, it does tend to imply an increased risk that the statutory profit overstates the sustainable earnings power of the business.

Our Take On 7Road Holdings' Profit Performance

In its last report 7Road Holdings received a tax benefit which might make its profit look better than it really is on a underlying level. Having said that, it also had a unusual item reducing its profit. Based on these factors, we think that 7Road Holdings' profits are a reasonably conservative guide to its underlying profitability. So while earnings quality is important, it's equally important to consider the risks facing 7Road Holdings at this point in time. Case in point: We've spotted 1 warning sign for 7Road Holdings you should be aware of.

Our examination of 7Road Holdings has focussed on certain factors that can make its earnings look better than they are. But there is always more to discover if you are capable of focussing your mind on minutiae. For example, many people consider a high return on equity as an indication of favorable business economics, while others like to 'follow the money' and search out stocks that insiders are buying. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:797

7Road Holdings

An investment holding company, develops and distributes of web and mobile games in the People’s Republic of China and internationally.

Excellent balance sheet very low.

Market Insights

Community Narratives