- Hong Kong

- /

- Entertainment

- /

- SEHK:777

Assessing NetDragon Websoft (SEHK:777) Valuation Following a 32% One-Month Share Price Surge

Reviewed by Kshitija Bhandaru

NetDragon Websoft Holdings (SEHK:777) shares have been on the move lately, with the stock rising over 32% in the past month. The recent momentum has prompted investors to revisit its fundamentals and explore what is driving this trend.

See our latest analysis for NetDragon Websoft Holdings.

The company’s recent 1-month share price return of 32% stands out, especially given steady momentum over the last 90 days and a consistent multi-year total shareholder return above 29%. This suggests that positive sentiment is building around NetDragon Websoft Holdings and its long-term prospects.

If this kind of surge has you wondering what else is gaining steam in the market, now is a smart time to widen your search and discover fast growing stocks with high insider ownership

The real question now is whether NetDragon Websoft Holdings is trading below its true value after such a rapid climb, or if the recent rally means markets are already factoring in all the future upside.

Most Popular Narrative: 5.5% Undervalued

With NetDragon Websoft Holdings last closing at HK$14.07, the most popular narrative estimates a fair value slightly higher. This sets up the possibility of further upside according to widely-followed forecasts grounded in future earnings assumptions.

The strategic shift towards AI integration in both gaming and education sectors is expected to cut costs significantly, which should positively impact net margins. Expansion into international markets via partnerships, such as with Wenge, leveraging AI and IP assets, is anticipated to drive revenue growth.

There is a high-stakes growth lever behind this target price, combining a bold cost-slashing strategy with ambitious global expansion. Wondering what pivotal financial leaps and profit projections could justify this valuation? Unpack the narrative to see which expectations are fueling that fair value call.

Result: Fair Value of $14.88 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, uncertainties in international education markets and declining revenue in some AI segments could challenge this growth outlook. These factors may potentially impact future performance.

Find out about the key risks to this NetDragon Websoft Holdings narrative.

Another View: Testing the Numbers With a Different Lens

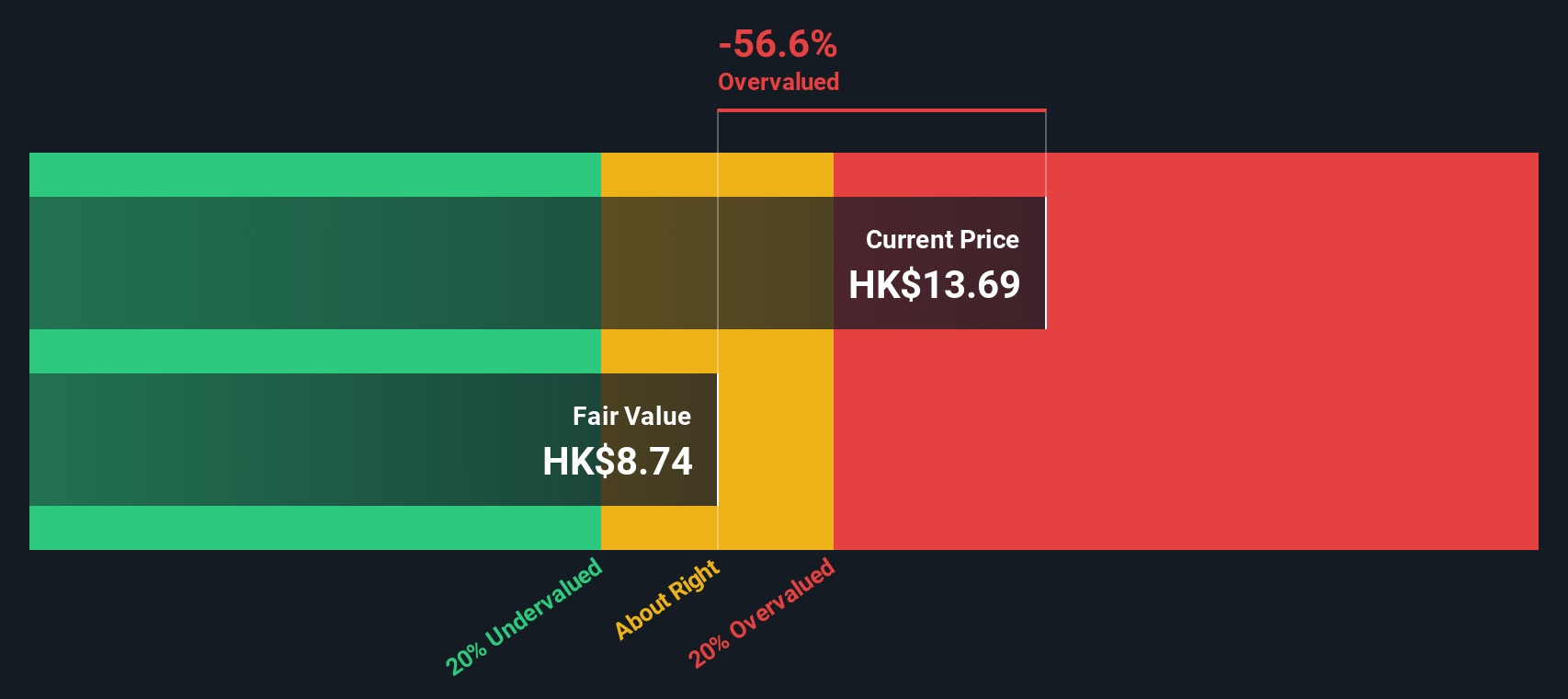

While analyst forecasts paint an optimistic story, our DCF model takes a different approach by projecting future cash flows and discounting them to today's values. By this calculation, NetDragon Websoft Holdings appears overvalued compared to our estimate of fair value. Which scenario lines up with your own expectations?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out NetDragon Websoft Holdings for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own NetDragon Websoft Holdings Narrative

If you see the numbers differently or want to test your own assumptions, you can quickly build your own view in just a few minutes using the tools provided. So why not Do it your way

A great starting point for your NetDragon Websoft Holdings research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

You’re never limited to a single opportunity. Make your next smart move by uncovering fresh stocks across the hottest edges of the market with these powerful screeners.

- Access powerful growth potential by reviewing these 24 AI penny stocks, which highlight advancements in machine intelligence and disruptive automation.

- Maximize yield with these 19 dividend stocks with yields > 3%, focusing on companies that deliver strong and consistent returns above 3%.

- Get ahead of the mainstream by scanning these 78 cryptocurrency and blockchain stocks, featuring the forefront of blockchain and digital innovation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NetDragon Websoft Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:777

NetDragon Websoft Holdings

Provides online and mobile games the People’s Republic of China, the United States, the United Kingdom, and internationally.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives