For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it completely lacks a track record of revenue and profit. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.'

If, on the other hand, you like companies that have revenue, and even earn profits, then you may well be interested in FriendTimes (HKG:6820). While that doesn't make the shares worth buying at any price, you can't deny that successful capitalism requires profit, eventually. Loss-making companies are always racing against time to reach financial sustainability, but time is often a friend of the profitable company, especially if it is growing.

See our latest analysis for FriendTimes

How Fast Is FriendTimes Growing?

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS). That means EPS growth is considered a real positive by most successful long-term investors. Who among us would not applaud FriendTimes's stratospheric annual EPS growth of 54%, compound, over the last three years? Growth that fast may well be fleeting, but like a lotus blooming from a murky pond, it sparks joy for the wary stock pickers.

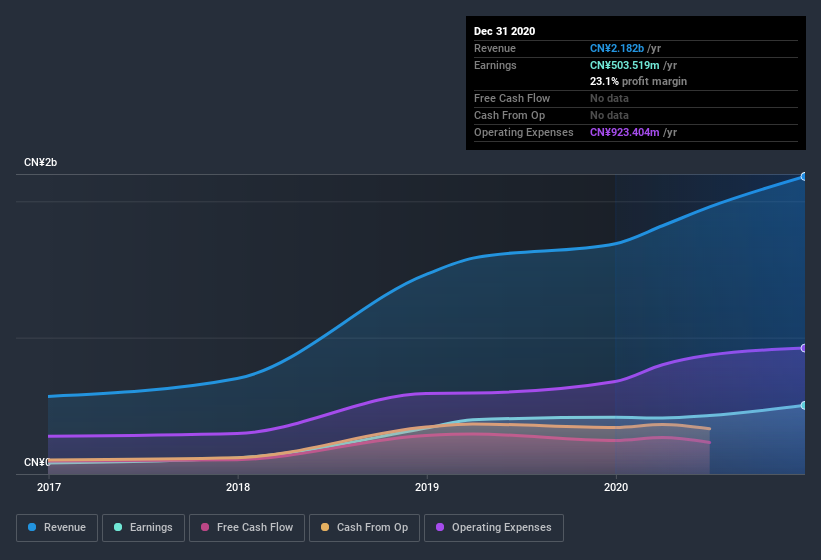

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. While we note FriendTimes's EBIT margins were flat over the last year, revenue grew by a solid 29% to CN¥2.2b. That's a real positive.

The chart below shows how the company's bottom and top lines have progressed over time. Click on the chart to see the exact numbers.

You don't drive with your eyes on the rear-view mirror, so you might be more interested in this free report showing analyst forecasts for FriendTimes's future profits.

Are FriendTimes Insiders Aligned With All Shareholders?

Like the kids in the streets standing up for their beliefs, insider share purchases give me reason to believe in a brighter future. Because oftentimes, the purchase of stock is a sign that the buyer views it as undervalued. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

The good news is that FriendTimes insiders spent a whopping CN¥8.4m on stock in just one year, and I didn't see any selling. As if for a flower bud approaching bloom, I become an expectant observer, anticipating with hope, that something splendid is coming. Zooming in, we can see that the biggest insider purchase was by Founder Xiaohuang Jiang for HK$5.8m worth of shares, at about HK$2.68 per share.

On top of the insider buying, we can also see that FriendTimes insiders own a large chunk of the company. In fact, they own 65% of the company, so they will share in the same delights and challenges experienced by the ordinary shareholders. This makes me think they will be incentivised to plan for the long term - something I like to see. And their holding is extremely valuable at the current share price, totalling CN¥3.9b. Now that's what I call some serious skin in the game!

Should You Add FriendTimes To Your Watchlist?

FriendTimes's earnings have taken off like any random crypto-currency did, back in 2017. What's more insiders own a significant stake in the company and have been buying more shares. This quick rundown suggests that the business may be of good quality, and also at an inflection point, so maybe FriendTimes deserves timely attention. You still need to take note of risks, for example - FriendTimes has 2 warning signs we think you should be aware of.

As a growth investor I do like to see insider buying. But FriendTimes isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

When trading FriendTimes or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:6820

FriendTimes

Through its subsidiaries, develops, publishes, distributes, and operates mobile games in the People’s Republic of China and internationally.

Mediocre balance sheet and slightly overvalued.

Market Insights

Community Narratives