- Hong Kong

- /

- Interactive Media and Services

- /

- SEHK:6100

Tongdao Liepin Group (HKG:6100) Stock Rockets 27% As Investors Are Less Pessimistic Than Expected

Despite an already strong run, Tongdao Liepin Group (HKG:6100) shares have been powering on, with a gain of 27% in the last thirty days. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 40% over that time.

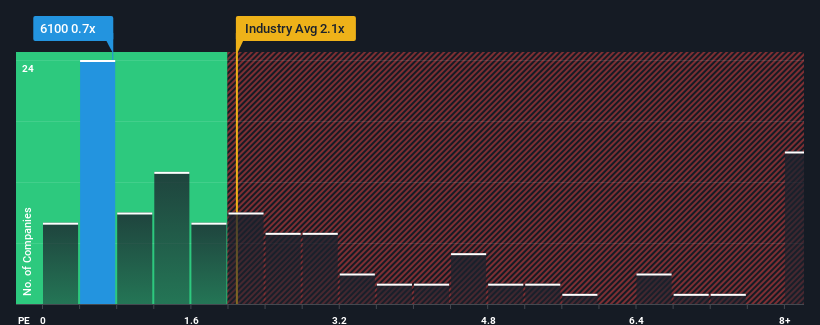

Although its price has surged higher, you could still be forgiven for feeling indifferent about Tongdao Liepin Group's P/S ratio of 0.7x, since the median price-to-sales (or "P/S") ratio for the Interactive Media and Services industry in Hong Kong is about the same. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

View our latest analysis for Tongdao Liepin Group

How Has Tongdao Liepin Group Performed Recently?

While the industry has experienced revenue growth lately, Tongdao Liepin Group's revenue has gone into reverse gear, which is not great. Perhaps the market is expecting its poor revenue performance to improve, keeping the P/S from dropping. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Tongdao Liepin Group.How Is Tongdao Liepin Group's Revenue Growth Trending?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Tongdao Liepin Group's to be considered reasonable.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 5.7%. This means it has also seen a slide in revenue over the longer-term as revenue is down 14% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Turning to the outlook, the next year should bring diminished returns, with revenue decreasing 5.3% as estimated by the three analysts watching the company. That's not great when the rest of the industry is expected to grow by 9.4%.

With this in consideration, we think it doesn't make sense that Tongdao Liepin Group's P/S is closely matching its industry peers. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. Only the boldest would assume these prices are sustainable as these declining revenues are likely to weigh on the share price eventually.

What We Can Learn From Tongdao Liepin Group's P/S?

Its shares have lifted substantially and now Tongdao Liepin Group's P/S is back within range of the industry median. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

It appears that Tongdao Liepin Group currently trades on a higher than expected P/S for a company whose revenues are forecast to decline. With this in mind, we don't feel the current P/S is justified as declining revenues are unlikely to support a more positive sentiment for long. If we consider the revenue outlook, the P/S seems to indicate that potential investors may be paying a premium for the stock.

Plus, you should also learn about these 2 warning signs we've spotted with Tongdao Liepin Group (including 1 which shouldn't be ignored).

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Tongdao Liepin Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:6100

Tongdao Liepin Group

An investment holding company, provides talent acquisition services in the People’s Republic of China.

Flawless balance sheet and good value.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026