- Hong Kong

- /

- Interactive Media and Services

- /

- SEHK:3700

Inkeverse Group And 2 Other Promising Penny Stocks To Watch

Reviewed by Simply Wall St

As global markets continue to navigate the evolving landscape of trade policies and AI-driven enthusiasm, major indices have reached new heights, reflecting investor optimism. In this context, identifying promising stocks becomes crucial for those looking to capitalize on market trends. Penny stocks, often misunderstood as relics of past trading days, still offer intriguing opportunities when backed by robust financials. This article explores three penny stocks that demonstrate balance sheet strength and potential for growth, providing investors with a chance to uncover hidden value in lesser-known companies.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.525 | MYR2.59B | ★★★★★★ |

| Tristel (AIM:TSTL) | £3.70 | £176.46M | ★★★★★★ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.395 | MYR1.1B | ★★★★★★ |

| Bosideng International Holdings (SEHK:3998) | HK$3.75 | HK$43.09B | ★★★★★★ |

| Polar Capital Holdings (AIM:POLR) | £4.825 | £465.11M | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.88 | MYR285.47M | ★★★★★★ |

| MGB Berhad (KLSE:MGB) | MYR0.72 | MYR423.03M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.10 | £791.31M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$1.11 | HK$704.62M | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.77 | A$141.28M | ★★★★☆☆ |

Click here to see the full list of 5,718 stocks from our Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Inkeverse Group (SEHK:3700)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Inkeverse Group Limited is an investment holding company that operates mobile live streaming platforms in the People’s Republic of China, with a market capitalization of approximately HK$3.35 billion.

Operations: The company generates revenue primarily from its live streaming business, which amounted to CN¥7.25 billion.

Market Cap: HK$3.35B

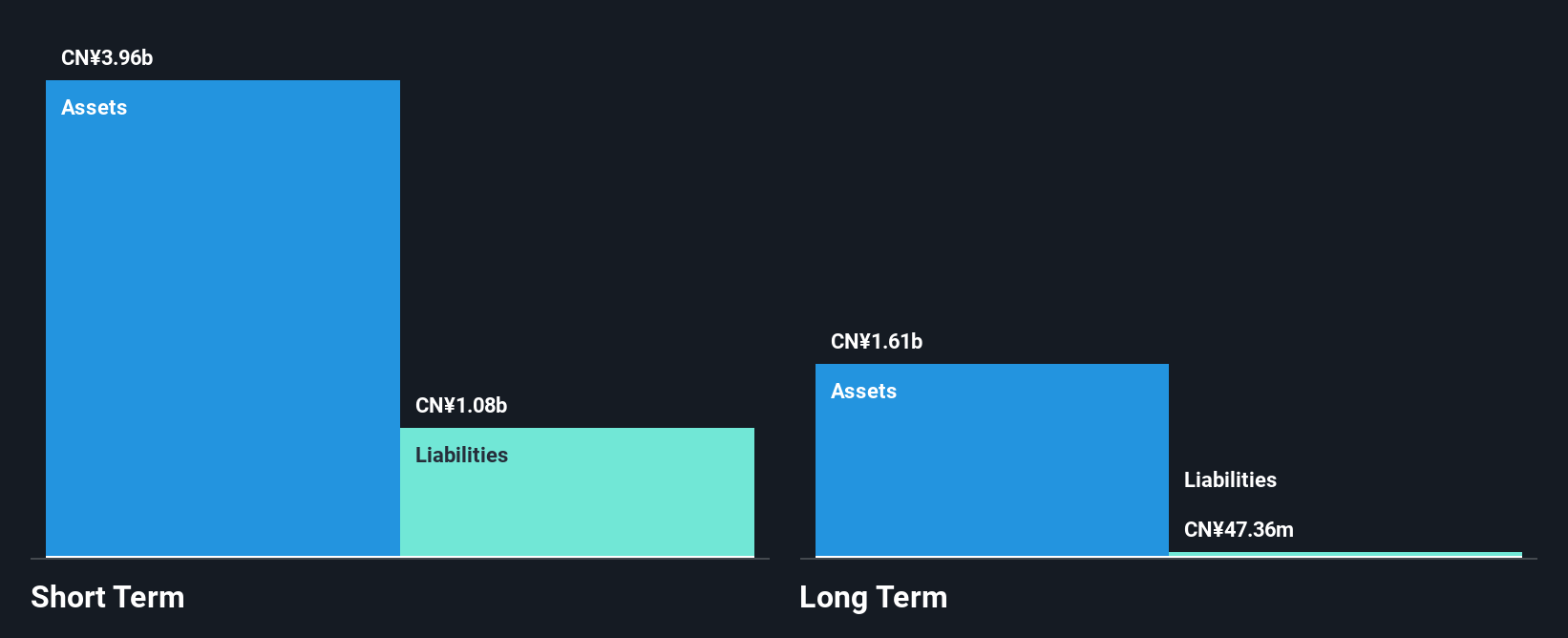

Inkeverse Group Limited, with a market cap of HK$3.35 billion, has demonstrated significant earnings growth of 136.1% over the past year, surpassing the industry average and its own five-year growth rate. The company is debt-free and boasts strong short-term asset coverage for both long-term (CN¥38.8M) and short-term liabilities (CN¥908.4M). However, its return on equity remains low at 7.9%, and its share price has been highly volatile recently. Recent board changes include the appointment of Ms. Zheng Congnan as an independent director, bringing extensive tech management expertise to the team.

- Take a closer look at Inkeverse Group's potential here in our financial health report.

- Learn about Inkeverse Group's historical performance here.

Japfa (SGX:UD2)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Japfa Ltd. is an agri-food company that produces and sells protein staples and packaged food products in Indonesia, Vietnam, India, Myanmar, and internationally, with a market cap of SGD1.16 billion.

Operations: The company's revenue is primarily derived from its Animal Protein PT Japfa Tbk segment, which includes consumer food and accounts for $3.46 billion, followed by the Animal Protein - Other segment at $1.07 billion.

Market Cap: SGD1.16B

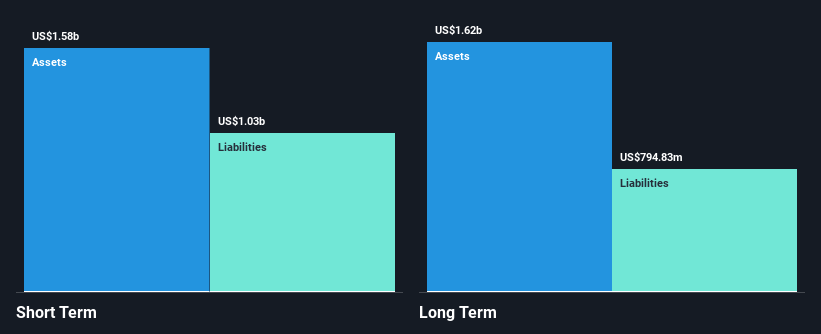

Japfa Ltd., with a market cap of SGD1.16 billion, has recently become profitable, marking a shift in its financial trajectory despite a 40.2% annual decline in earnings over the past five years. The company maintains strong short-term asset coverage for both short-term (SGD1 billion) and long-term liabilities (SGD794.8 million), although it carries high debt levels with a net debt to equity ratio of 69.9%. Japfa's shares are trading below estimated fair value, and recent privatisation offers at SGD0.62 per share could lead to delisting from the Singapore Exchange, reflecting strategic shifts by major shareholders owning 75% of shares.

- Unlock comprehensive insights into our analysis of Japfa stock in this financial health report.

- Review our growth performance report to gain insights into Japfa's future.

Quzhou Xin'an Development (SHSE:600208)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Quzhou Xin'an Development Co., Ltd. operates in real estate development, technology manufacturing, and financial services in China, with a market cap of CN¥24.51 billion.

Operations: The company's revenue from its operations in China amounts to CN¥27.61 billion.

Market Cap: CN¥24.51B

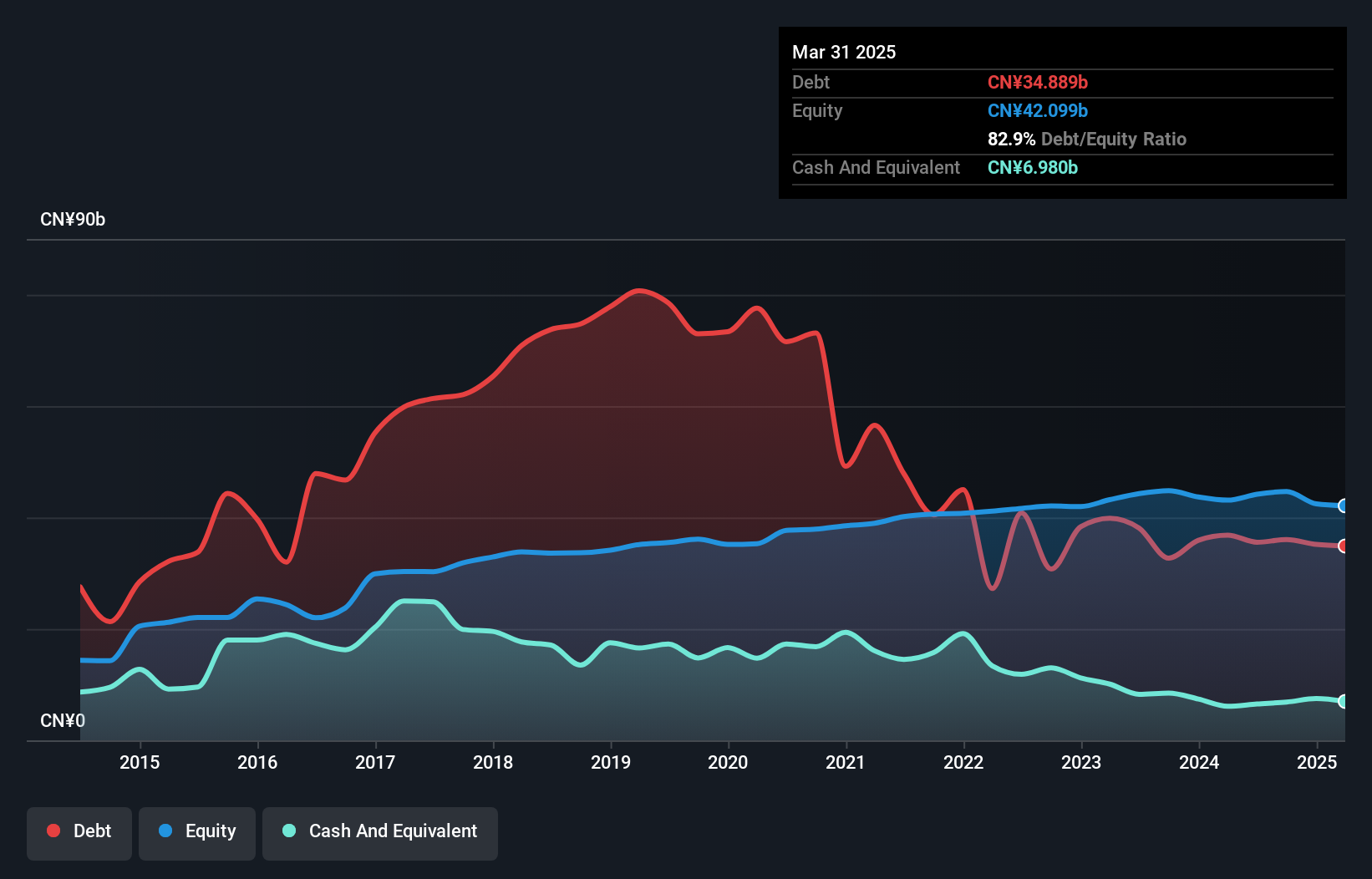

Quzhou Xin'an Development, with a market cap of CN¥24.51 billion, has faced challenges with negative earnings growth over the past year and declining profit margins from 22.3% to 6%. Despite this, it maintains strong short-term asset coverage exceeding both its short-term and long-term liabilities. The company's debt to equity ratio has improved significantly over five years, although operating cash flow still struggles to cover debt adequately. Its Price-To-Earnings ratio of 14.8x suggests good value compared to the Chinese market average. Recent earnings show substantial revenue growth but only slight net income improvement year-over-year.

- Dive into the specifics of Quzhou Xin'an Development here with our thorough balance sheet health report.

- Learn about Quzhou Xin'an Development's future growth trajectory here.

Key Takeaways

- Embark on your investment journey to our 5,718 Penny Stocks selection here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:3700

Inkeverse Group

An investment holding company, operates mobile live streaming platforms in the People’s Republic of China.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives