- Hong Kong

- /

- Entertainment

- /

- SEHK:302

CMGE Technology Group (HKG:302) shareholders are up 13% this past week, but still in the red over the last three years

While not a mind-blowing move, it is good to see that the CMGE Technology Group Limited (HKG:302) share price has gained 24% in the last three months. But that doesn't change the fact that the returns over the last three years have been stomach churning. Indeed, the share price is down a whopping 72% in the last three years. So it's about time shareholders saw some gains. The thing to think about is whether the business has really turned around.

On a more encouraging note the company has added HK$300m to its market cap in just the last 7 days, so let's see if we can determine what's driven the three-year loss for shareholders.

See our latest analysis for CMGE Technology Group

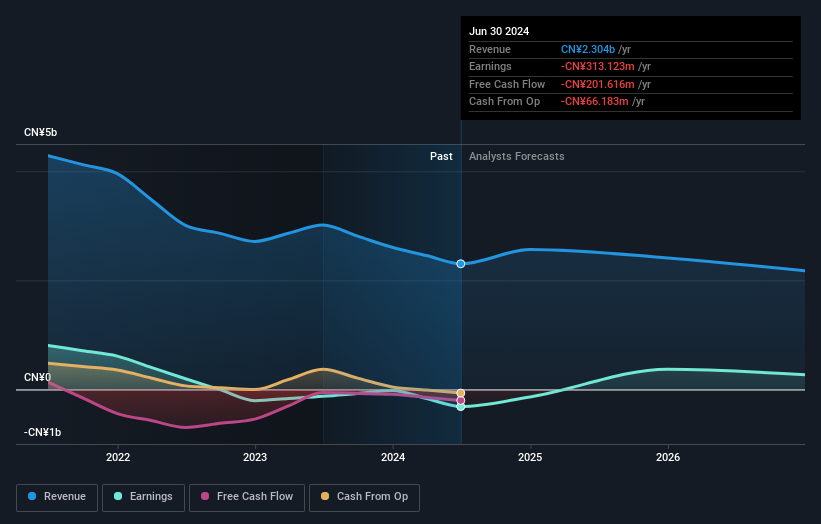

Given that CMGE Technology Group didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

In the last three years CMGE Technology Group saw its revenue shrink by 19% per year. That's definitely a weaker result than most pre-profit companies report. The swift share price decline at an annual compound rate of 20%, reflects this weak fundamental performance. Never forget that loss making companies with falling revenue can and do cause losses for everyday investors. It's worth remembering that investors call buying a steeply falling share price 'catching a falling knife' because it is a dangerous pass time.

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

We consider it positive that insiders have made significant purchases in the last year. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. If you are thinking of buying or selling CMGE Technology Group stock, you should check out this free report showing analyst profit forecasts.

A Different Perspective

Investors in CMGE Technology Group had a tough year, with a total loss of 41%, against a market gain of about 18%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 11% over the last half decade. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For example, we've discovered 1 warning sign for CMGE Technology Group that you should be aware of before investing here.

There are plenty of other companies that have insiders buying up shares. You probably do not want to miss this free list of undervalued small cap companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Hong Kong exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:302

CMGE Technology Group

An investment holding company, develops and publishes intellectual property (IP)-based games in Mainland China and internationally.

Moderate growth potential with mediocre balance sheet.