- Hong Kong

- /

- Entertainment

- /

- SEHK:2660

Top SEHK Dividend Stocks For September 2024

Reviewed by Simply Wall St

As global markets navigate a period of mixed performances and economic recalibrations, the Hong Kong market has shown resilience with the Hang Seng Index gaining 2.14% recently. In this environment, dividend stocks have become increasingly attractive for investors seeking steady income streams amidst fluctuating market conditions. A good dividend stock typically offers consistent payouts, strong financial health, and a sustainable business model—qualities that are particularly valuable in today's uncertain economic landscape.

Top 10 Dividend Stocks In Hong Kong

| Name | Dividend Yield | Dividend Rating |

| Chongqing Rural Commercial Bank (SEHK:3618) | 8.15% | ★★★★★☆ |

| Chow Tai Fook Jewellery Group (SEHK:1929) | 8.62% | ★★★★★☆ |

| China Construction Bank (SEHK:939) | 7.95% | ★★★★★☆ |

| Sinopharm Group (SEHK:1099) | 5.33% | ★★★★★☆ |

| S.A.S. Dragon Holdings (SEHK:1184) | 8.84% | ★★★★★☆ |

| Zhongsheng Group Holdings (SEHK:881) | 8.65% | ★★★★★☆ |

| Bank of China (SEHK:3988) | 7.40% | ★★★★★☆ |

| PC Partner Group (SEHK:1263) | 9.17% | ★★★★★☆ |

| Zhejiang Expressway (SEHK:576) | 6.96% | ★★★★★☆ |

| Tian An China Investments (SEHK:28) | 5.13% | ★★★★★☆ |

Click here to see the full list of 77 stocks from our Top SEHK Dividend Stocks screener.

We'll examine a selection from our screener results.

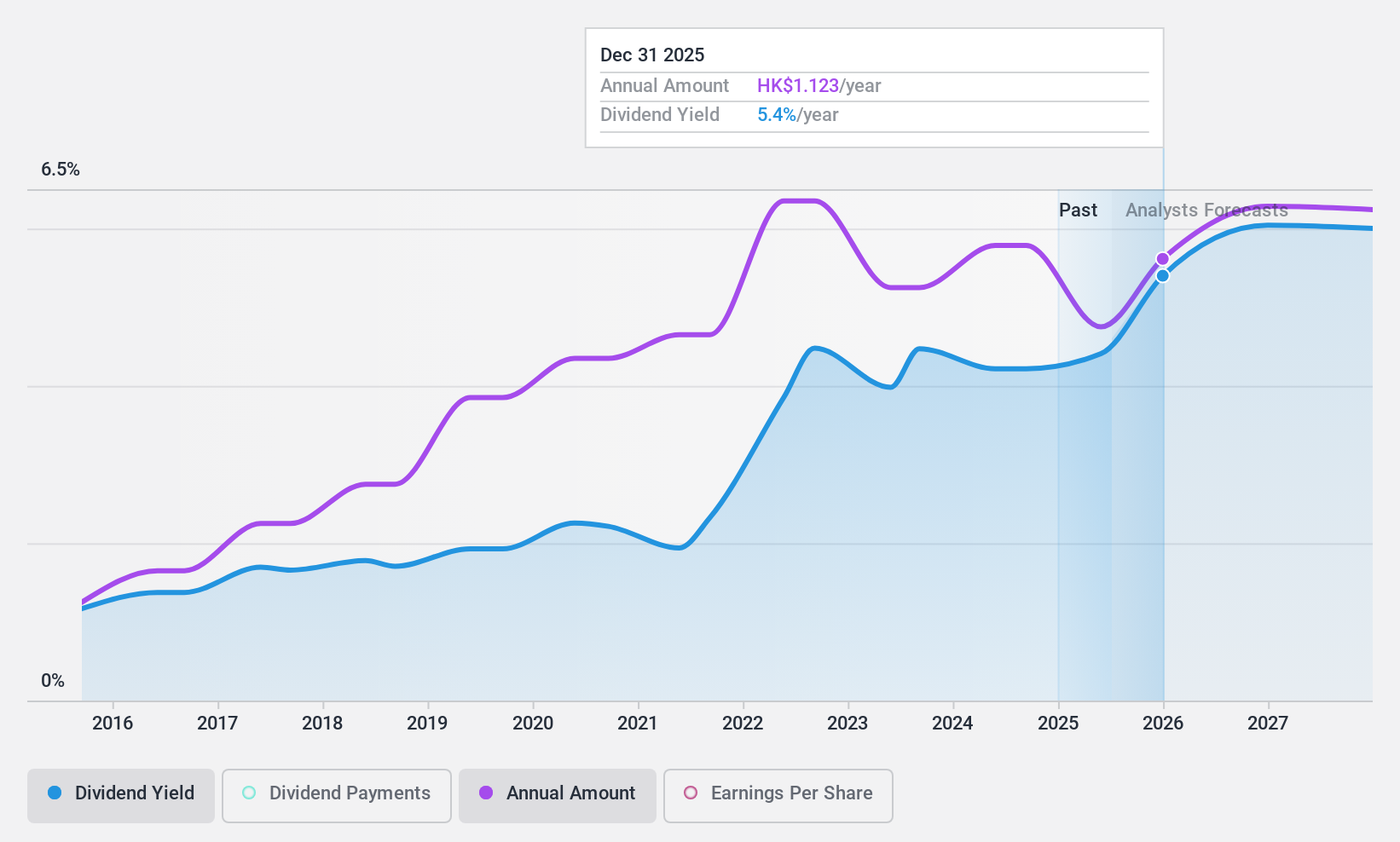

China Resources Gas Group (SEHK:1193)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: China Resources Gas Group Limited, with a market cap of HK$65.60 billion, engages in the sale of natural and liquefied gas and the connection of gas pipelines.

Operations: China Resources Gas Group Limited generates revenue from several segments, including HK$3.23 billion from gas stations, HK$9.65 billion from gas connections, HK$4.34 billion from comprehensive services, HK$444.11 million from design and construction services, and HK$87.31 billion from the sale and distribution of gas fuel and related products (excluding gas stations).

Dividend Yield: 4.1%

China Resources Gas Group Limited announced an interim dividend of HKD 0.25 per share for the first half of 2024, with a payout ratio of 55.5%, indicating dividends are covered by earnings and cash flows. Despite reporting higher sales at HKD 52.08 billion, net income slightly decreased to HKD 3.46 billion from last year’s HKD 3.55 billion. Recent executive changes may impact future stability, but the current dividend yield remains lower compared to top-tier Hong Kong dividend payers.

- Unlock comprehensive insights into our analysis of China Resources Gas Group stock in this dividend report.

- Our comprehensive valuation report raises the possibility that China Resources Gas Group is priced lower than what may be justified by its financials.

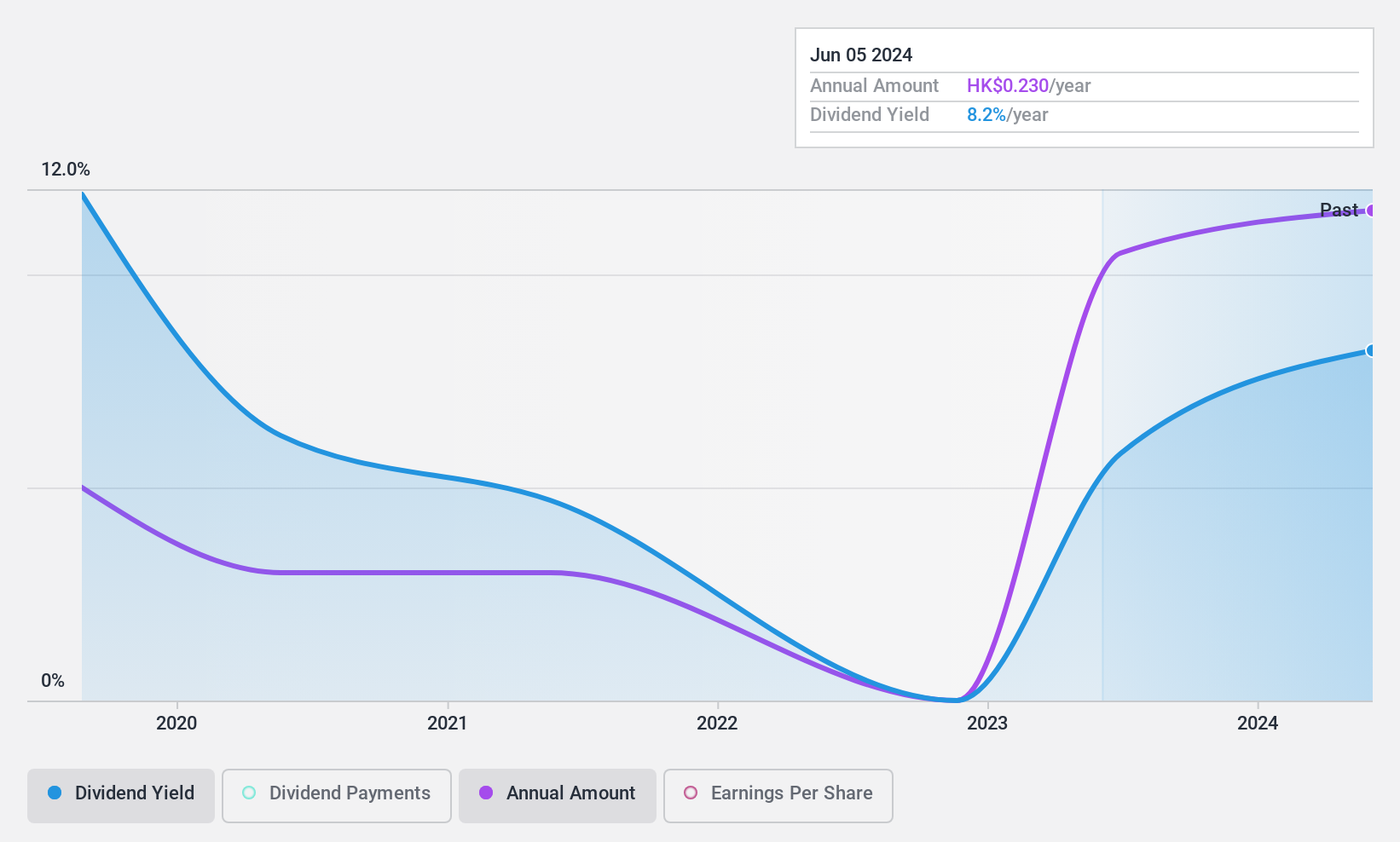

Zengame Technology Holding (SEHK:2660)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Zengame Technology Holding Limited, with a market cap of HK$2.75 billion, is an investment holding company that develops and operates mobile games primarily in the People’s Republic of China.

Operations: Zengame Technology Holding Limited generates CN¥1.98 billion from developing and operating mobile games in the People’s Republic of China.

Dividend Yield: 8.4%

Zengame Technology Holding Limited reported a decline in sales and net income for the first half of 2024, with sales at CNY 934.32 million and net income at CNY 309.84 million. Despite this, the company's dividend payout ratio remains low at around 30%, indicating dividends are well covered by both earnings and cash flows. However, its dividend track record is unstable, having only paid dividends for five years with some volatility in payments.

- Get an in-depth perspective on Zengame Technology Holding's performance by reading our dividend report here.

- Our valuation report here indicates Zengame Technology Holding may be undervalued.

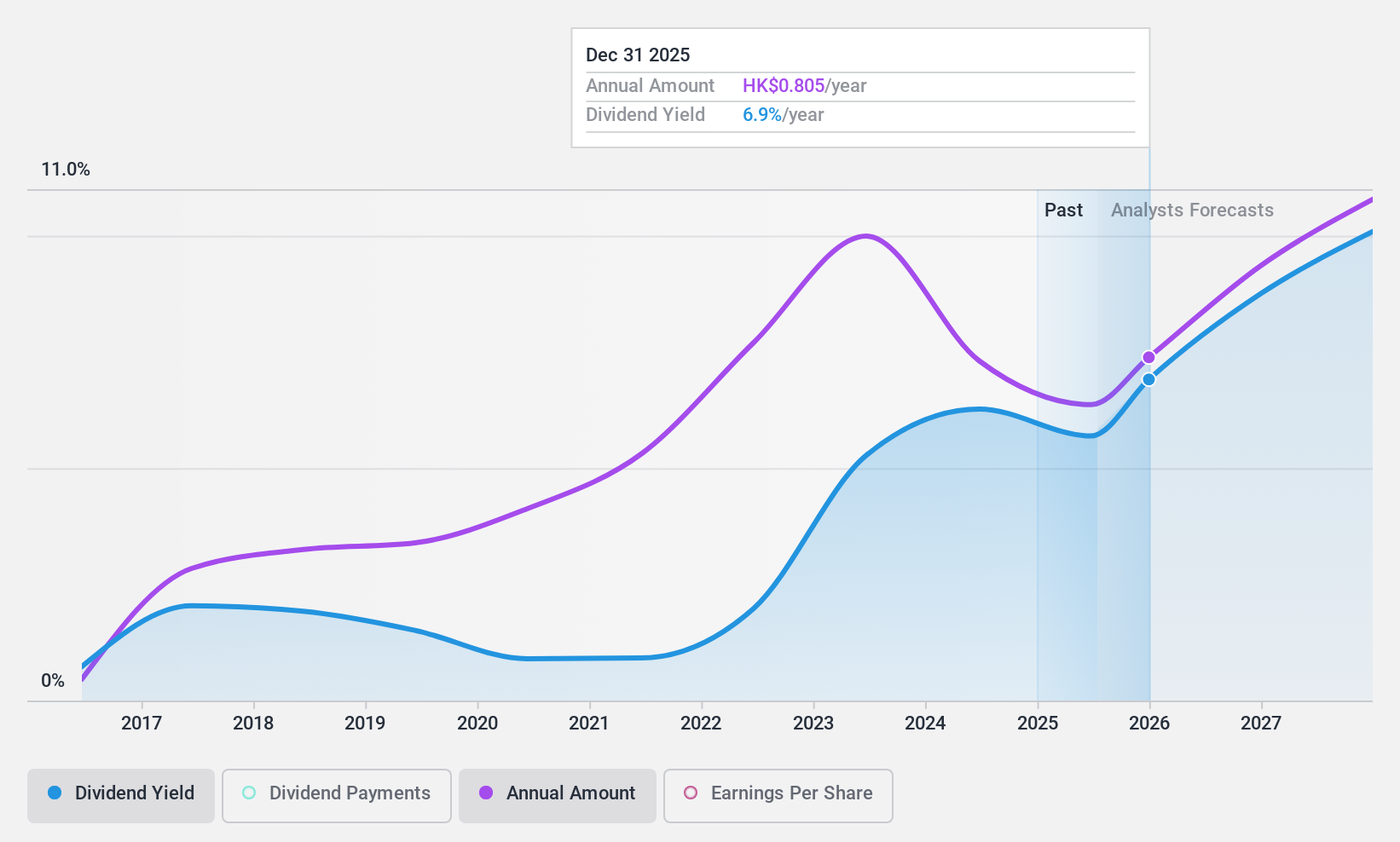

Zhongsheng Group Holdings (SEHK:881)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Zhongsheng Group Holdings Limited is an investment holding company that operates in the sale and service of motor vehicles in the People’s Republic of China, with a market cap of HK$21.20 billion.

Operations: Zhongsheng Group Holdings Limited generates CN¥179.81 billion from the sale of motor vehicles and the provision of related services in the People’s Republic of China.

Dividend Yield: 8.6%

Zhongsheng Group Holdings' dividend payments have been volatile over the past decade, although they are well covered by earnings (payout ratio: 49%) and cash flows (cash payout ratio: 52.1%). The recent half-year financial results showed a decline in net income to CNY 1.58 billion from CNY 3 billion a year ago. Despite this, the company continues to trade at good value compared to peers and has undertaken significant debt financing initiatives to manage costs and extend loan maturities.

- Click here to discover the nuances of Zhongsheng Group Holdings with our detailed analytical dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Zhongsheng Group Holdings shares in the market.

Where To Now?

- Gain an insight into the universe of 77 Top SEHK Dividend Stocks by clicking here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zengame Technology Holding might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:2660

Zengame Technology Holding

An investment holding company, develops and operates mobile games primarily in the People’s Republic of China.

Flawless balance sheet and good value.

Market Insights

Community Narratives