Shaky Earnings May Not Tell The Whole Story For Rego Interactive (HKG:2422)

Rego Interactive Co., Ltd's (HKG:2422) stock wasn't much affected by its recent lackluster earnings numbers. We did some analysis and found some concerning details beneath the statutory profit number.

View our latest analysis for Rego Interactive

Zooming In On Rego Interactive's Earnings

One key financial ratio used to measure how well a company converts its profit to free cash flow (FCF) is the accrual ratio. To get the accrual ratio we first subtract FCF from profit for a period, and then divide that number by the average operating assets for the period. You could think of the accrual ratio from cashflow as the 'non-FCF profit ratio'.

That means a negative accrual ratio is a good thing, because it shows that the company is bringing in more free cash flow than its profit would suggest. While having an accrual ratio above zero is of little concern, we do think it's worth noting when a company has a relatively high accrual ratio. That's because some academic studies have suggested that high accruals ratios tend to lead to lower profit or less profit growth.

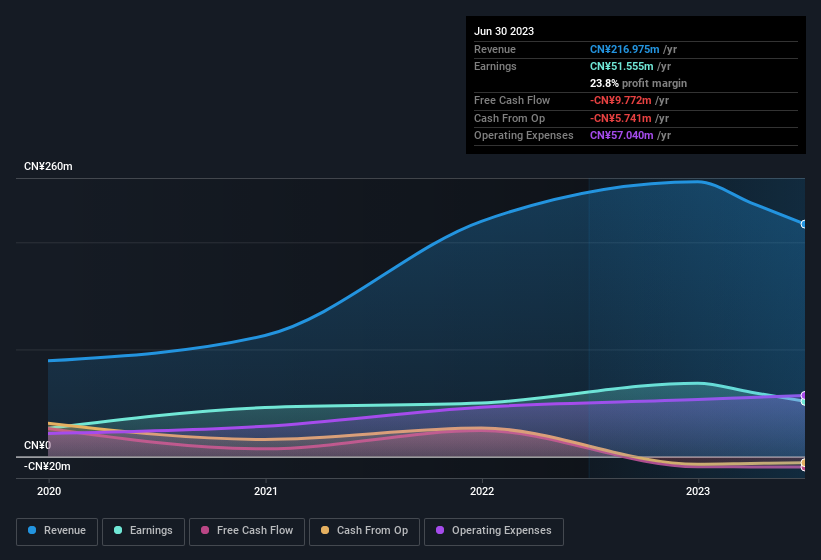

Over the twelve months to June 2023, Rego Interactive recorded an accrual ratio of 0.35. We can therefore deduce that its free cash flow fell well short of covering its statutory profit, suggesting we might want to think twice before putting a lot of weight on the latter. In the last twelve months it actually had negative free cash flow, with an outflow of CN¥9.8m despite its profit of CN¥51.6m, mentioned above. We saw that FCF was CN¥7.5m a year ago though, so Rego Interactive has at least been able to generate positive FCF in the past. However, that's not all there is to consider. The accrual ratio is reflecting the impact of unusual items on statutory profit, at least in part.

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of Rego Interactive.

How Do Unusual Items Influence Profit?

The fact that the company had unusual items boosting profit by CN¥10m, in the last year, probably goes some way to explain why its accrual ratio was so weak. While it's always nice to have higher profit, a large contribution from unusual items sometimes dampens our enthusiasm. When we analysed the vast majority of listed companies worldwide, we found that significant unusual items are often not repeated. And, after all, that's exactly what the accounting terminology implies. If Rego Interactive doesn't see that contribution repeat, then all else being equal we'd expect its profit to drop over the current year.

Our Take On Rego Interactive's Profit Performance

Summing up, Rego Interactive received a nice boost to profit from unusual items, but could not match its paper profit with free cash flow. For the reasons mentioned above, we think that a perfunctory glance at Rego Interactive's statutory profits might make it look better than it really is on an underlying level. If you'd like to know more about Rego Interactive as a business, it's important to be aware of any risks it's facing. When we did our research, we found 3 warning signs for Rego Interactive (1 is a bit unpleasant!) that we believe deserve your full attention.

In this article we've looked at a number of factors that can impair the utility of profit numbers, and we've come away cautious. But there are plenty of other ways to inform your opinion of a company. Some people consider a high return on equity to be a good sign of a quality business. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying to be useful.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:2422

Rego Interactive

An investment holding company, provides marketing and promotion, IT solutions, and other services in Mainland China.

Adequate balance sheet with very low risk.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

The Hidden Gem of AI Hardware – Solving the Data Center Bottleneck

Moving from "Science Fiction" to "Science Fact" – A Bullish Valuation Case

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026