- Hong Kong

- /

- Entertainment

- /

- SEHK:1981

High Growth Tech Stocks And 2 More Exciting Picks For Your Portfolio

Reviewed by Simply Wall St

In recent weeks, global markets have been navigating a landscape marked by policy uncertainties and fluctuating economic indicators, with the S&P 500 giving back some of its earlier gains amid concerns over potential changes in U.S. administration policies. As investors assess the implications of these developments, identifying high growth tech stocks becomes crucial for those looking to capitalize on innovation-driven sectors that may offer resilience and potential upside in a dynamic market environment.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Material Group | 20.45% | 24.01% | ★★★★★★ |

| Yggdrazil Group | 24.66% | 85.53% | ★★★★★★ |

| eWeLLLtd | 26.52% | 27.53% | ★★★★★★ |

| Seojin SystemLtd | 33.54% | 52.43% | ★★★★★★ |

| Medley | 25.57% | 31.67% | ★★★★★★ |

| Pharma Mar | 26.94% | 56.39% | ★★★★★★ |

| Mental Health TechnologiesLtd | 27.88% | 79.61% | ★★★★★★ |

| Elliptic Laboratories | 65.73% | 103.55% | ★★★★★★ |

| Alkami Technology | 21.89% | 98.60% | ★★★★★★ |

| UTI | 114.97% | 134.60% | ★★★★★★ |

Click here to see the full list of 1297 stocks from our High Growth Tech and AI Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Syrma SGS Technology (NSEI:SYRMA)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Syrma SGS Technology Limited offers comprehensive electronic manufacturing services across India, the United States, Germany, and other international markets with a market capitalization of ₹99.66 billion.

Operations: Syrma SGS Technology generates revenue primarily through its electronic manufacturing services, amounting to ₹38.33 billion.

Syrma SGS Technology is actively expanding its footprint, as evidenced by the recent inauguration of a major electronics manufacturing facility in Ranjangaon, which will enhance its PCB assembly capabilities crucial for automotive and industrial sectors. This move aligns with the company's strategy to meet burgeoning domestic demand and underscores its commitment to operational excellence. Financially, Syrma is poised for robust growth with revenue expected to surge by 22.8% annually, outpacing the Indian market's 10.5%. However, it faces challenges in earnings growth which declined by 19.9% over the past year against an industry average of 30.1%. Despite this, future earnings are projected to grow significantly at a rate of 34.8% per year, suggesting potential recovery and adaptation in its business operations.

- Take a closer look at Syrma SGS Technology's potential here in our health report.

Explore historical data to track Syrma SGS Technology's performance over time in our Past section.

Cathay Group Holdings (SEHK:1981)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Cathay Group Holdings Inc. is an investment holding company involved in entertainment production and higher education businesses in China and internationally, with a market cap of approximately HK$2.03 billion.

Operations: Cathay Group Holdings generates revenue primarily from higher and vocational education, contributing CN¥606.66 million, and entertainment and livestreaming e-commerce, which adds CN¥162.17 million to its financials. The company operates within China and internationally, focusing on these two key business segments.

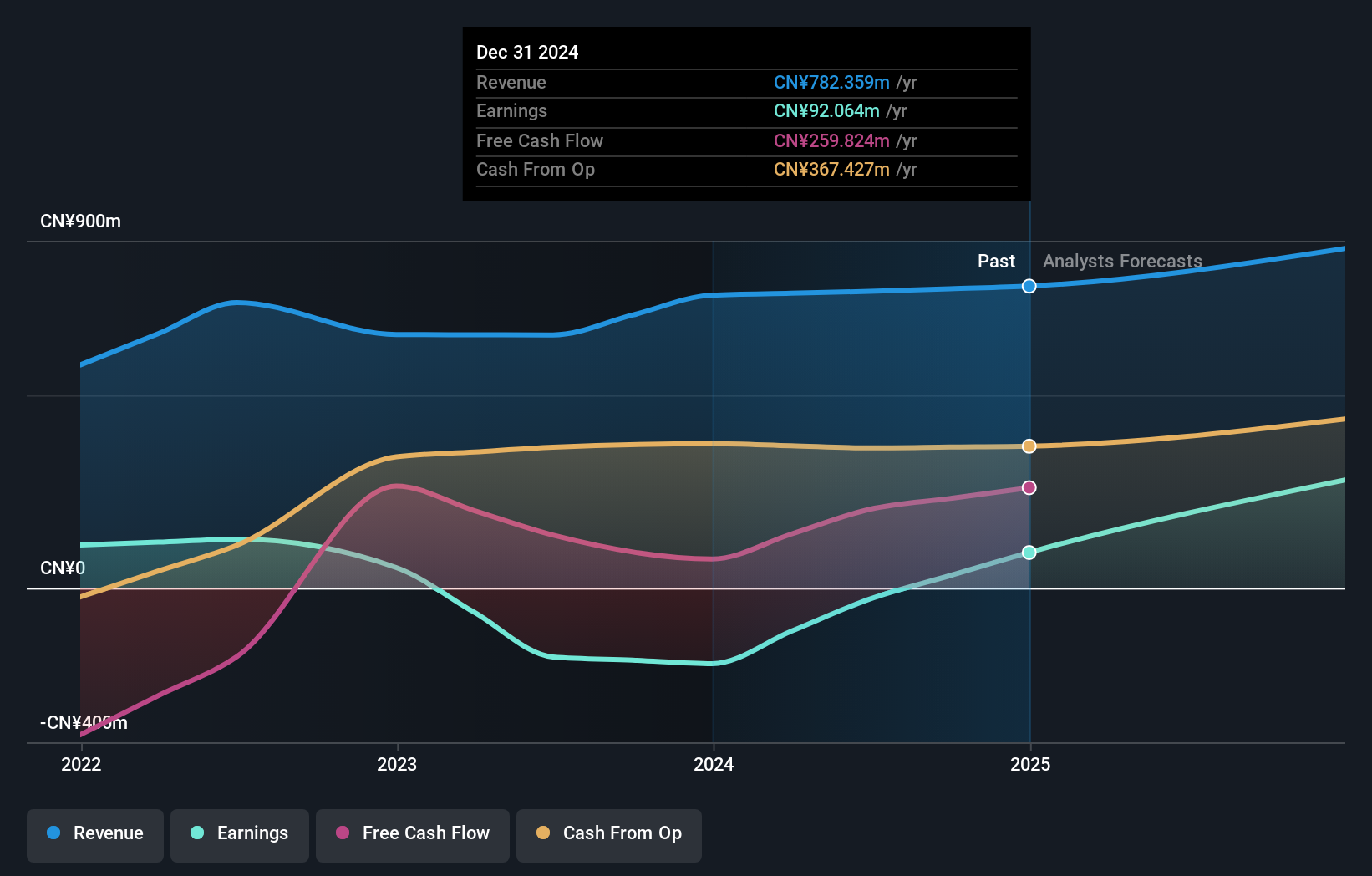

Cathay Group Holdings has demonstrated a notable turnaround, with its half-year earnings showing a swing from a net loss of CNY 119.06 million to a profit of CNY 48.55 million year-over-year. This recovery is underpinned by significant reductions in impairment losses and inventory write-downs in its TV/film production segment, alongside burgeoning revenues from its newly established livestreaming e-commerce and artist management services, which began operations in May 2023. The firm's strategic pivot towards digital media and entertainment platforms is expected to fuel future growth, evidenced by an anticipated revenue increase of 13.4% annually, outperforming the Hong Kong market's average growth rate of 7.8%. Additionally, earnings are projected to surge by an impressive 62.37% per year, positioning Cathay Group Holdings for sustained profitability and sector leadership within the dynamic tech landscape.

- Delve into the full analysis health report here for a deeper understanding of Cathay Group Holdings.

RemeGen (SEHK:9995)

Simply Wall St Growth Rating: ★★★★★☆

Overview: RemeGen Co., Ltd. is a biopharmaceutical company focused on discovering, developing, and commercializing biologics for autoimmune, oncology, and ophthalmic diseases in Mainland China and the United States with a market cap of HK$16.78 billion.

Operations: RemeGen generates revenue primarily from biopharmaceutical research, service, production, and sales, amounting to CN¥1.52 billion. The company focuses on biologics addressing unmet medical needs in autoimmune, oncology, and ophthalmic diseases across Mainland China and the United States.

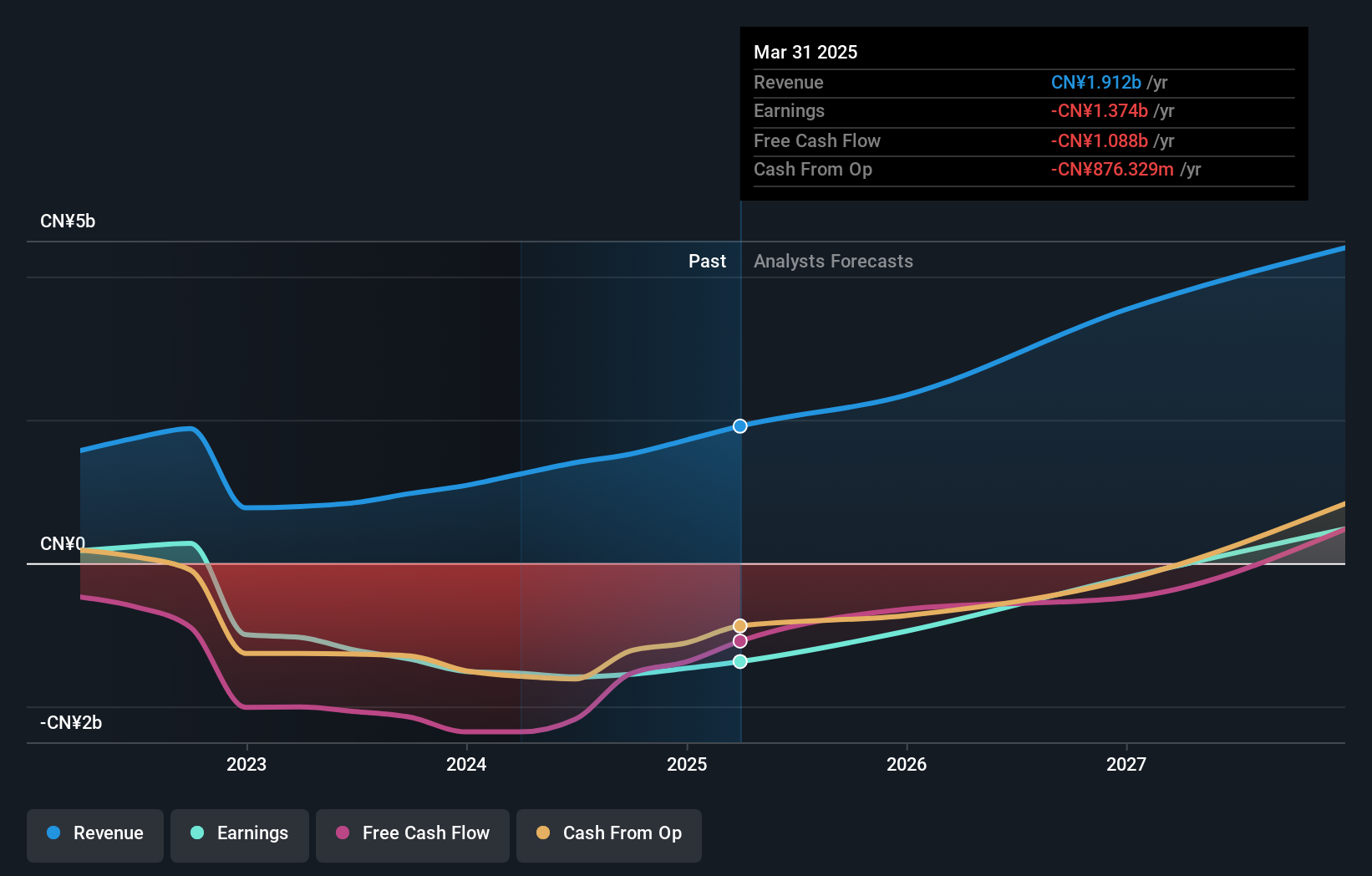

Despite recent leadership changes and ongoing losses, RemeGen remains a dynamic participant in the biotech sector, with significant investments in innovation signaling potential future gains. In the first nine months of 2024, RemeGen reported a substantial revenue increase to CNY 1.21 billion, up from CNY 769.47 million year-over-year—a growth rate of 26%. However, net losses also widened slightly to CNY 1.07 billion from CNY 1.03 billion. This financial trajectory is underpinned by aggressive R&D spending aimed at fueling advancements and capturing market share within the competitive biotechnology landscape where annual earnings are expected to surge by an impressive 54.5%. As RemeGen navigates these challenges and opportunities, its heavy investment in research may well be the linchpin for its long-term positioning in high-growth tech sectors.

- Navigate through the intricacies of RemeGen with our comprehensive health report here.

Assess RemeGen's past performance with our detailed historical performance reports.

Where To Now?

- Explore the 1297 names from our High Growth Tech and AI Stocks screener here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1981

Cathay Group Holdings

An investment holding company, engages in the entertainment production and higher education businesses in the People’s Republic of China and internationally.

Flawless balance sheet with reasonable growth potential.