Should You Be Adding Mobvista (HKG:1860) To Your Watchlist Today?

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it completely lacks a track record of revenue and profit. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses.

So if you're like me, you might be more interested in profitable, growing companies, like Mobvista (HKG:1860). While that doesn't make the shares worth buying at any price, you can't deny that successful capitalism requires profit, eventually. While a well funded company may sustain losses for years, unless its owners have an endless appetite for subsidizing the customer, it will need to generate a profit eventually, or else breathe its last breath.

View our latest analysis for Mobvista

Mobvista's Improving Profits

Even with very modest growth rates, a company will usually do well if it improves earnings per share (EPS) year after year. So it's no surprise that some investors are more inclined to invest in profitable businesses. Like a falcon taking flight, Mobvista's EPS soared from US$0.015 to US$0.019, over the last year. That's a impressive gain of 26%.

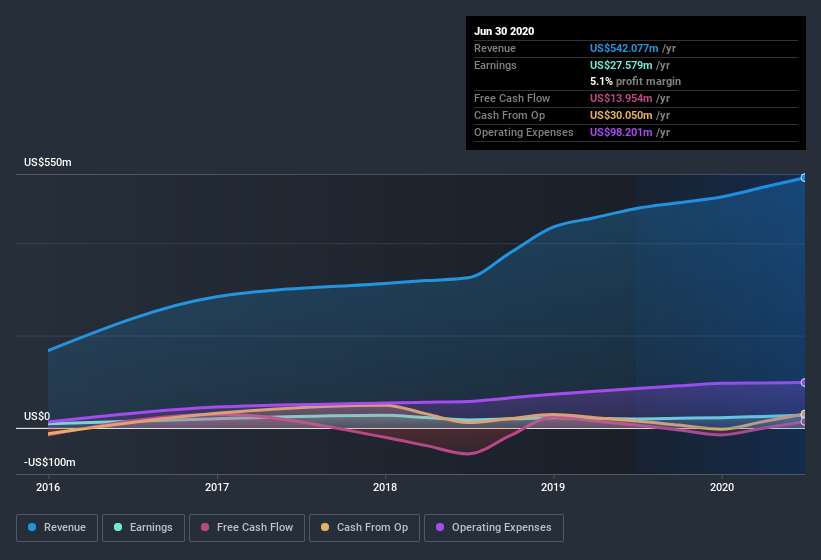

I like to take a look at earnings before interest and (EBIT) tax margins, as well as revenue growth, to get another take on the quality of the company's growth. Mobvista maintained stable EBIT margins over the last year, all while growing revenue 14% to US$542m. That's a real positive.

The chart below shows how the company's bottom and top lines have progressed over time. Click on the chart to see the exact numbers.

You don't drive with your eyes on the rear-view mirror, so you might be more interested in this free report showing analyst forecasts for Mobvista's future profits.

Are Mobvista Insiders Aligned With All Shareholders?

Like the kids in the streets standing up for their beliefs, insider share purchases give me reason to believe in a brighter future. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

The good news is that Mobvista insiders spent a whopping US$17m on stock in just one year, and I didn't see any selling. As if for a flower bud approaching bloom, I become an expectant observer, anticipating with hope, that something splendid is coming. We also note that it was the Co-Founder, Xiaohuan Cao, who made the biggest single acquisition, paying HK$10.0m for shares at about HK$3.47 each.

I do like that insiders have been buying shares in Mobvista, but there is more evidence of shareholder friendly management. I refer to the very reasonable level of CEO pay. I discovered that the median total compensation for the CEOs of companies like Mobvista with market caps between US$400m and US$1.6b is about US$458k.

The Mobvista CEO received total compensation of only US$103k in the year to . This could be considered a token amount, and indicates that the company does not need to use payment to motivate the CEO - that is often a good sign. While the level of CEO compensation isn't a huge factor in my view of the company, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. It can also be a sign of a culture of integrity, in a broader sense.

Is Mobvista Worth Keeping An Eye On?

For growth investors like me, Mobvista's raw rate of earnings growth is a beacon in the night. But wait, it gets better. We have seen insider buying and the executive pay seems on the modest side of things. The message I'd take from this quick rundown is that, yes, this stock is worth investigating further. However, before you get too excited we've discovered 1 warning sign for Mobvista that you should be aware of.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Mobvista, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

When trading Mobvista or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:1860

Mobvista

Engages in the provision of advertising and marketing technology services required to develop the mobile internet ecosystem to customers worldwide.

Exceptional growth potential with proven track record.

Similar Companies

Market Insights

Community Narratives