- South Korea

- /

- Personal Products

- /

- KOSE:A278470

3 Stocks Estimated To Be Trading Below Their Intrinsic Values

Reviewed by Simply Wall St

As global markets navigate the uncertainties surrounding policy changes and economic indicators, investors are closely watching sectors that may benefit from deregulation while being cautious of those facing potential headwinds. Amid this environment, identifying stocks trading below their intrinsic values can offer opportunities for value-oriented investors seeking to capitalize on market inefficiencies. Understanding a stock's true worth relative to its current market price is crucial in such volatile conditions, as it allows investors to make informed decisions based on fundamental analysis rather than short-term market fluctuations.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Taiwan Union Technology (TPEX:6274) | NT$156.50 | NT$311.70 | 49.8% |

| Tibet Rhodiola Pharmaceutical Holding (SHSE:600211) | CN¥38.67 | CN¥76.93 | 49.7% |

| Giant Biogene Holding (SEHK:2367) | HK$48.90 | HK$97.74 | 50% |

| Wistron (TWSE:3231) | NT$114.00 | NT$227.50 | 49.9% |

| SISB (SET:SISB) | THB31.75 | THB63.42 | 49.9% |

| ConvaTec Group (LSE:CTEC) | £2.43 | £4.85 | 49.9% |

| Shoei (TSE:7839) | ¥2360.00 | ¥4718.51 | 50% |

| EnomotoLtd (TSE:6928) | ¥1475.00 | ¥2946.42 | 49.9% |

| TF Bank (OM:TFBANK) | SEK312.00 | SEK621.04 | 49.8% |

| Credit Clear (ASX:CCR) | A$0.355 | A$0.71 | 50% |

Let's explore several standout options from the results in the screener.

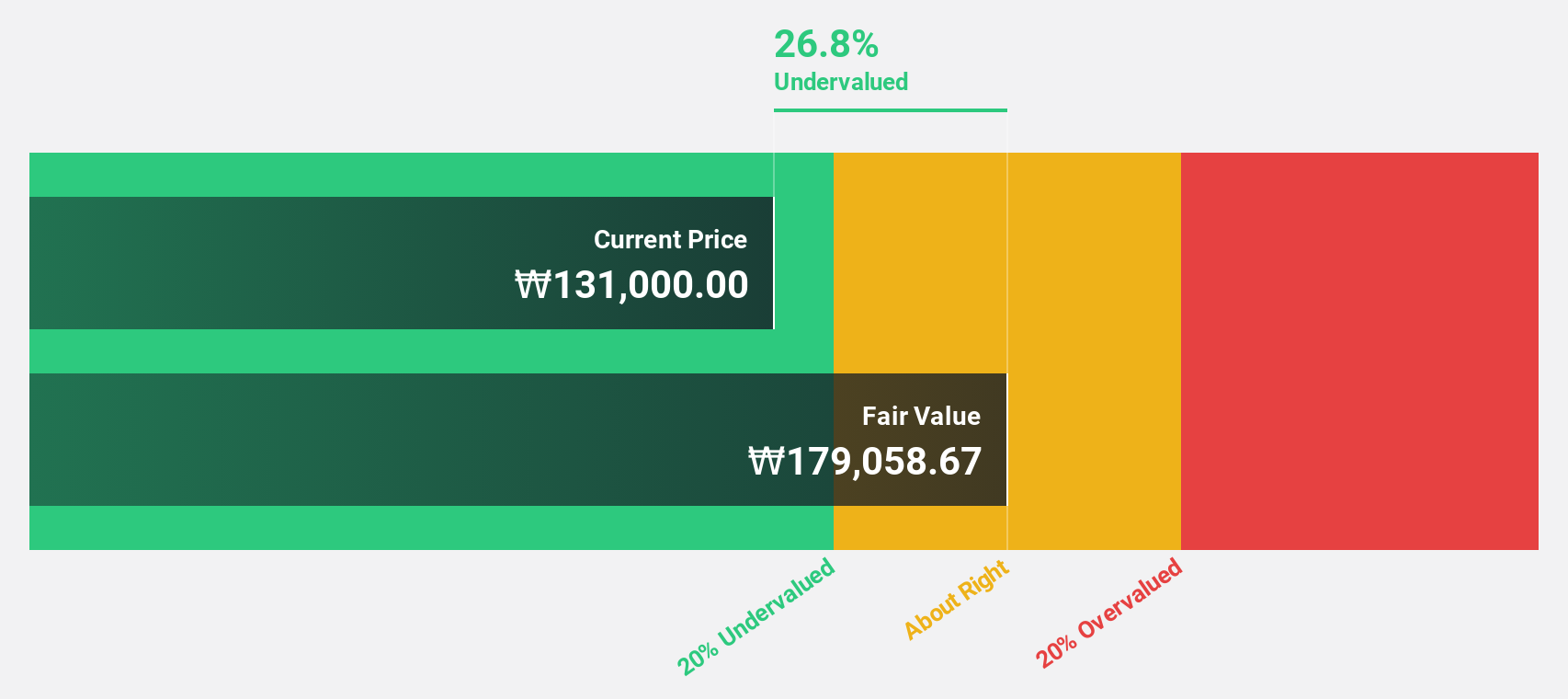

APR (KOSE:A278470)

Overview: APR Co., Ltd is a company that manufactures and sells cosmetic products for both men and women, with a market cap of ₩1.89 billion.

Operations: The company's revenue segments include ₩614.77 billion from cosmetics and ₩64.46 billion from apparel fashion.

Estimated Discount To Fair Value: 49.4%

APR Co., Ltd. is trading at ₩51,500, significantly below its estimated fair value of ₩101,857.52, highlighting its undervaluation based on discounted cash flows. Despite high share price volatility recently, the company's earnings are projected to grow substantially at 25.69% annually over the next three years and faster than the market average in revenue terms. Recent buyback activity and index inclusion may further support investor confidence in APR's growth trajectory amidst strong analyst consensus for price appreciation.

- According our earnings growth report, there's an indication that APR might be ready to expand.

- Get an in-depth perspective on APR's balance sheet by reading our health report here.

Mobvista (SEHK:1860)

Overview: Mobvista Inc. provides advertising and marketing technology services to support the mobile internet ecosystem globally, with a market cap of approximately HK$9.20 billion.

Operations: The company's revenue is primarily derived from its advertising and marketing technology services, which are essential for the development of the global mobile internet ecosystem.

Estimated Discount To Fair Value: 45.1%

Mobvista, trading at HK$8.37, is significantly undervalued compared to its estimated fair value of HK$15.24 based on discounted cash flows. Recent earnings reports show strong performance with Q3 sales increasing to US$416.46 million from US$269.37 million year-over-year and net income rising to US$9.9 million from US$3.78 million, indicating robust growth potential despite high share price volatility and large one-off items impacting results. Revenue is forecasted to grow 21.7% annually, outpacing the Hong Kong market average of 7.8%.

- Insights from our recent growth report point to a promising forecast for Mobvista's business outlook.

- Navigate through the intricacies of Mobvista with our comprehensive financial health report here.

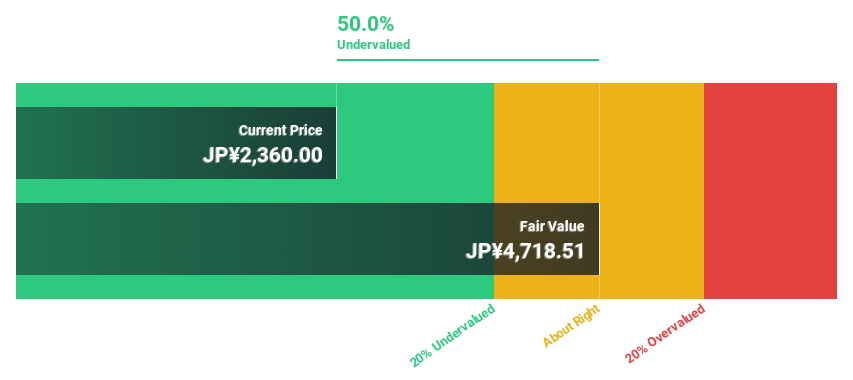

Shoei (TSE:7839)

Overview: Shoei Co., Ltd. manufactures and sells motorcycle helmets under the SHOEI brand to both the general public and government agencies worldwide, with a market cap of ¥111.56 billion.

Operations: The company's revenue primarily comes from the manufacture and sale of riding helmets, totaling ¥34.52 billion.

Estimated Discount To Fair Value: 50%

Shoei is trading at ¥2360, significantly below its estimated fair value of ¥4718.51, indicating it may be undervalued based on discounted cash flows. Although the dividend yield of 2.67% isn't well covered by free cash flows, earnings are forecasted to grow at 10.86% annually, surpassing the Japanese market average of 7.8%. Revenue growth is expected to outpace the market at 8% per year despite being slower than high-growth benchmarks.

- Upon reviewing our latest growth report, Shoei's projected financial performance appears quite optimistic.

- Click to explore a detailed breakdown of our findings in Shoei's balance sheet health report.

Seize The Opportunity

- Get an in-depth perspective on all 935 Undervalued Stocks Based On Cash Flows by using our screener here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A278470

APR

APR Co.,Ltd manufactures and sells cosmetic products for men and women.

Flawless balance sheet and good value.