- Hong Kong

- /

- Interactive Media and Services

- /

- SEHK:1762

Wanka Online Inc.'s (HKG:1762) Shares Leap 54% Yet They're Still Not Telling The Full Story

Despite an already strong run, Wanka Online Inc. (HKG:1762) shares have been powering on, with a gain of 54% in the last thirty days. The annual gain comes to 200% following the latest surge, making investors sit up and take notice.

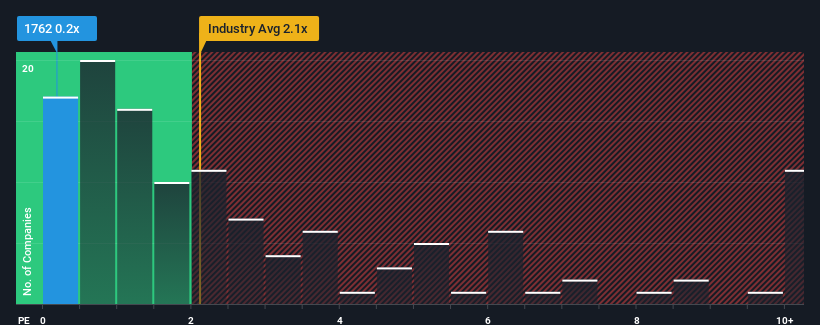

Even after such a large jump in price, considering around half the companies operating in Hong Kong's Interactive Media and Services industry have price-to-sales ratios (or "P/S") above 1x, you may still consider Wanka Online as an solid investment opportunity with its 0.2x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

See our latest analysis for Wanka Online

How Has Wanka Online Performed Recently?

Revenue has risen at a steady rate over the last year for Wanka Online, which is generally not a bad outcome. Perhaps the market believes the recent revenue performance might fall short of industry figures in the near future, leading to a reduced P/S. If that doesn't eventuate, then existing shareholders may have reason to be optimistic about the future direction of the share price.

Although there are no analyst estimates available for Wanka Online, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.Is There Any Revenue Growth Forecasted For Wanka Online?

Wanka Online's P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

Retrospectively, the last year delivered a decent 5.5% gain to the company's revenues. The solid recent performance means it was also able to grow revenue by 29% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been respectable for the company.

Weighing that recent medium-term revenue trajectory against the broader industry's one-year forecast for expansion of 9.0% shows it's about the same on an annualised basis.

With this information, we find it odd that Wanka Online is trading at a P/S lower than the industry. It may be that most investors are not convinced the company can maintain recent growth rates.

What We Can Learn From Wanka Online's P/S?

Despite Wanka Online's share price climbing recently, its P/S still lags most other companies. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

The fact that Wanka Online currently trades at a low P/S relative to the industry is unexpected considering its recent three-year growth is in line with the wider industry forecast. There could be some unobserved threats to revenue preventing the P/S ratio from matching the company's performance. revenue trends suggest that the risk of a price decline is low, investors appear to perceive a possibility of revenue volatility in the future.

We don't want to rain on the parade too much, but we did also find 2 warning signs for Wanka Online (1 can't be ignored!) that you need to be mindful of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Wanka Online might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1762

Wanka Online

Provides android-based content distribution services in Mainland China.

Adequate balance sheet with acceptable track record.