- China

- /

- Semiconductors

- /

- SHSE:688719

Asian Growth Companies With High Insider Ownership In November 2025

Reviewed by Simply Wall St

In November 2025, Asian markets are navigating a landscape marked by concerns over inflated AI stock valuations and broader economic uncertainties, mirroring similar sentiments seen in global indices. Amidst this backdrop, growth companies with high insider ownership can be particularly appealing to investors seeking stability and confidence in management's commitment to the company's long-term success.

Top 10 Growth Companies With High Insider Ownership In Asia

| Name | Insider Ownership | Earnings Growth |

| UTI (KOSDAQ:A179900) | 25.2% | 110.4% |

| Suzhou Sunmun Technology (SZSE:300522) | 33.2% | 93.1% |

| Streamax Technology (SZSE:002970) | 32.5% | 33.1% |

| Seers Technology (KOSDAQ:A458870) | 33.9% | 78.8% |

| Novoray (SHSE:688300) | 23.6% | 31.4% |

| Loadstar Capital K.K (TSE:3482) | 31% | 23.6% |

| Laopu Gold (SEHK:6181) | 34.8% | 34.3% |

| J&V Energy Technology (TWSE:6869) | 17.5% | 31.6% |

| Gold Circuit Electronics (TWSE:2368) | 31.4% | 33.6% |

| Fulin Precision (SZSE:300432) | 11.6% | 55.2% |

Let's uncover some gems from our specialized screener.

China Ruyi Holdings (SEHK:136)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: China Ruyi Holdings Limited is an investment holding company involved in content production and online streaming across Mainland China, Hong Kong, Europe, and other international markets, with a market cap of HK$39.69 billion.

Operations: The company generates revenue from its content production business, which accounts for CN¥648.86 million, and its online streaming and online gaming businesses, contributing CN¥3.44 billion.

Insider Ownership: 16%

Revenue Growth Forecast: 18.5% p.a.

China Ruyi Holdings is trading at 49.7% below its estimated fair value, suggesting potential upside. Analysts agree the stock price could rise by 72.5%. While revenue growth of 18.5% per year is slower than the desired 20%, it still outpaces the Hong Kong market's 8.5%. Earnings are projected to grow significantly at 25.54% annually, surpassing market expectations of 11.6%, despite past shareholder dilution and a forecasted low return on equity of 11.9%.

- Get an in-depth perspective on China Ruyi Holdings' performance by reading our analyst estimates report here.

- According our valuation report, there's an indication that China Ruyi Holdings' share price might be on the cheaper side.

MIXUE Group (SEHK:2097)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: MIXUE Group operates in the production and sale of fruit drinks, tea drinks, ice cream, and coffee products both in Mainland China and internationally, with a market cap of HK$156.78 billion.

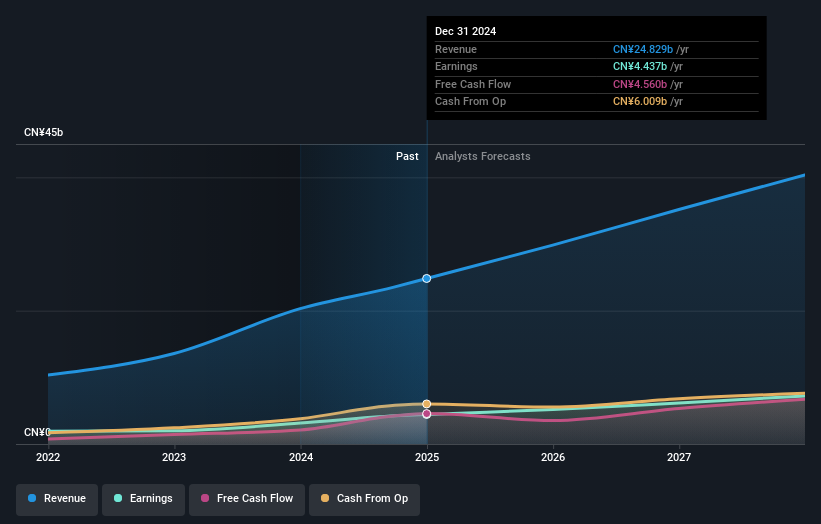

Operations: MIXUE Group's revenue is primarily derived from franchise and related services (CN¥707.31 million), sales of goods (CN¥27.37 billion), and sales of equipment (CN¥949.98 million).

Insider Ownership: 28.8%

Revenue Growth Forecast: 14.3% p.a.

MIXUE Group, recently added to the S&P Global BMI Index, stands out with its earnings projected to grow at 14.9% annually, exceeding the Hong Kong market's 11.6%. Revenue growth is also expected at 14.3%, faster than the market's 8.5%, though not reaching a significant threshold of 20%. The company's return on equity is forecasted to be robust at 24.1% in three years, indicating strong potential despite no substantial insider trading activity recently reported.

- Dive into the specifics of MIXUE Group here with our thorough growth forecast report.

- Our comprehensive valuation report raises the possibility that MIXUE Group is priced higher than what may be justified by its financials.

Xi'an Actionpower Electric (SHSE:688719)

Simply Wall St Growth Rating: ★★★★★☆

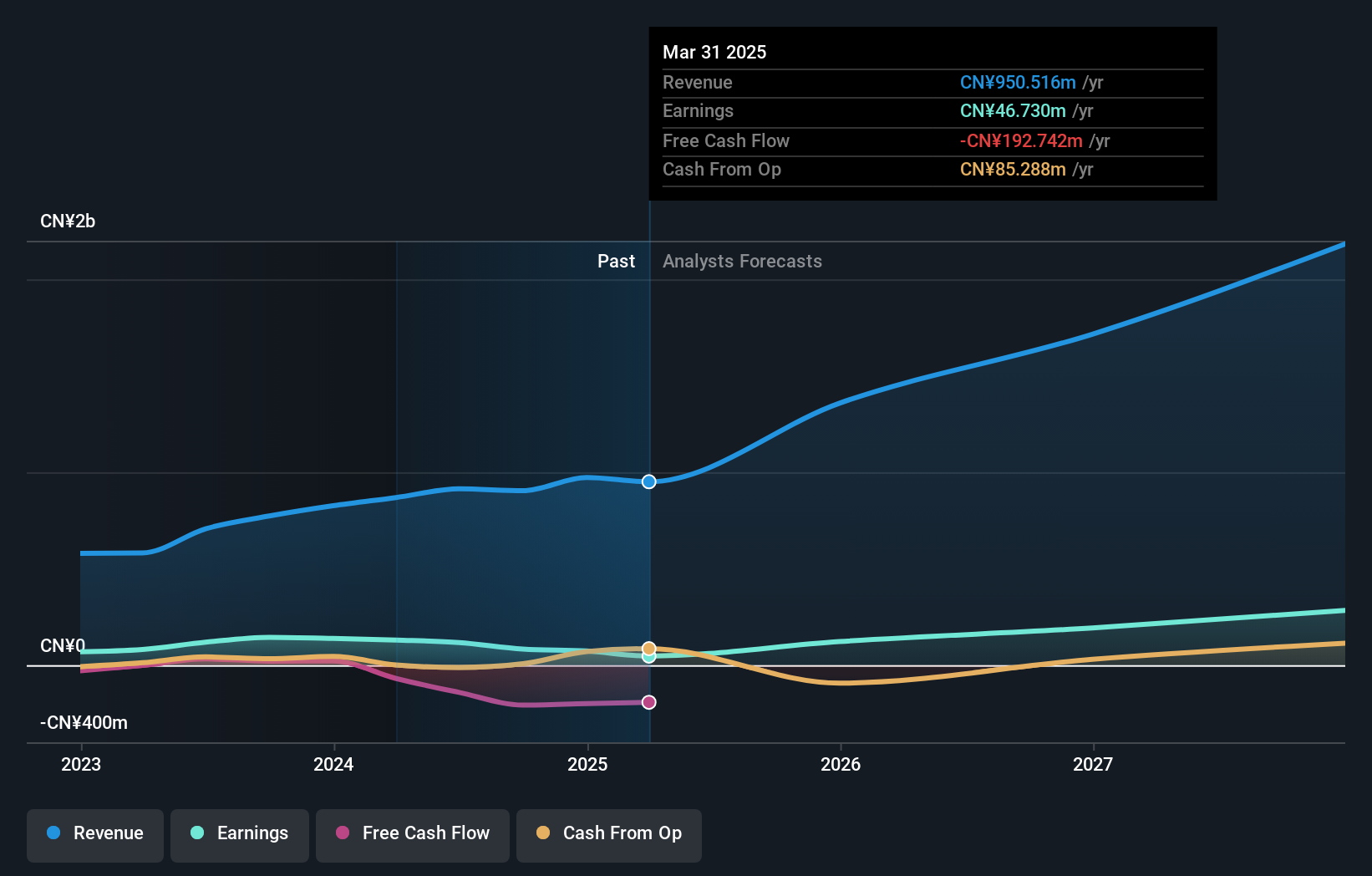

Overview: Xi'an Actionpower Electric Co., Ltd. focuses on the research, development, production, and sale of power supply and quality control equipment in China with a market cap of CN¥5.47 billion.

Operations: Xi'an Actionpower Electric Co., Ltd. generates revenue through its activities in research, development, production, and sales of power supply and quality control equipment within the Chinese market.

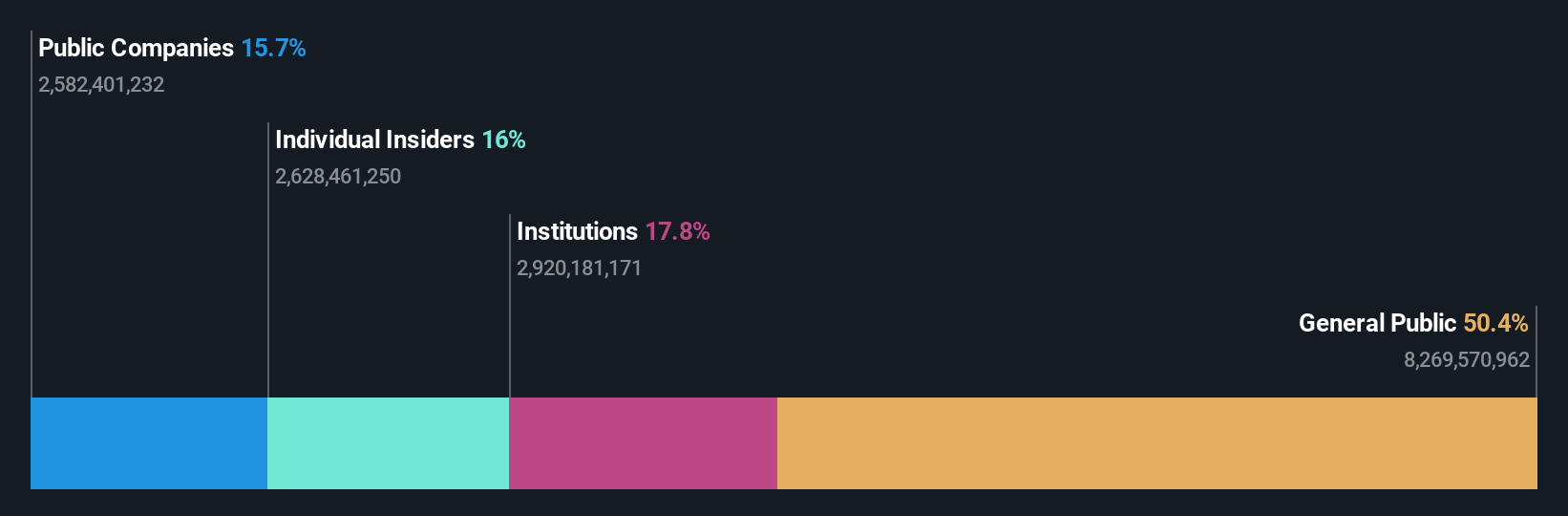

Insider Ownership: 28.2%

Revenue Growth Forecast: 32.2% p.a.

Xi'an Actionpower Electric is positioned for significant growth, with revenue expected to rise 32.2% annually, surpassing the Chinese market's 14.5%. Despite a recent net loss of CNY 44.62 million for the first nine months of 2025, earnings are projected to grow by 76.55% per year and achieve profitability within three years. While insider trading activity has been minimal over the past three months, share price volatility remains high.

- Click here and access our complete growth analysis report to understand the dynamics of Xi'an Actionpower Electric.

- The analysis detailed in our Xi'an Actionpower Electric valuation report hints at an deflated share price compared to its estimated value.

Taking Advantage

- Navigate through the entire inventory of 640 Fast Growing Asian Companies With High Insider Ownership here.

- Contemplating Other Strategies? Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688719

Xi'an Actionpower Electric

Engages in the research and development, production, and sale of power supply and quality control equipment in China.

High growth potential with excellent balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.