- China

- /

- Electronic Equipment and Components

- /

- SHSE:601138

3 Asian Stocks That May Be Trading Below Their Estimated Intrinsic Value

Reviewed by Simply Wall St

As global markets experience fluctuations driven by geopolitical tensions and economic data releases, Asian stock markets have shown resilience, with key indices in Japan and China posting notable gains. In this environment, identifying stocks that may be trading below their estimated intrinsic value can offer potential opportunities for investors seeking to capitalize on market inefficiencies.

Top 10 Undervalued Stocks Based On Cash Flows In Asia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Xi'an International Medical Investment (SZSE:000516) | CN¥4.76 | CN¥9.37 | 49.2% |

| Teikoku Sen-i (TSE:3302) | ¥3410.00 | ¥6673.15 | 48.9% |

| Takara Bio (TSE:4974) | ¥923.00 | ¥1802.98 | 48.8% |

| TaewoongLtd (KOSDAQ:A044490) | ₩31350.00 | ₩61413.35 | 49% |

| Ningxia Building Materials GroupLtd (SHSE:600449) | CN¥13.32 | CN¥26.43 | 49.6% |

| IbidenLtd (TSE:4062) | ¥13595.00 | ¥26769.99 | 49.2% |

| HD Hyundai Construction Equipment (KOSE:A267270) | ₩103300.00 | ₩199784.82 | 48.3% |

| DuChemBIOLtd (KOSDAQ:A176750) | ₩9160.00 | ₩17685.75 | 48.2% |

| CICT Mobile Communication Technology (SHSE:688387) | CN¥6.75 | CN¥13.37 | 49.5% |

| Alibaba Health Information Technology (SEHK:241) | HK$5.79 | HK$11.30 | 48.8% |

Underneath we present a selection of stocks filtered out by our screen.

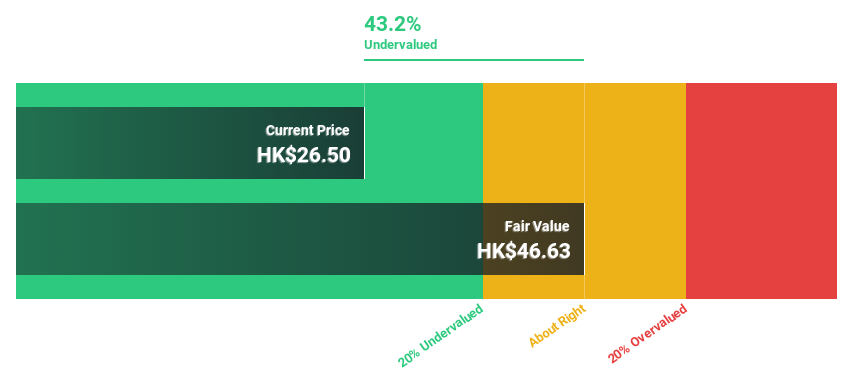

China Ruyi Holdings (SEHK:136)

Overview: China Ruyi Holdings Limited is an investment holding company involved in content production and online streaming across Mainland China, Hong Kong, Europe, and internationally, with a market cap of HK$45.43 billion.

Operations: The company generates revenue from its content production business, which accounts for CN¥648.86 million, and its online streaming and gaming businesses, contributing CN¥3.44 billion.

Estimated Discount To Fair Value: 42.7%

China Ruyi Holdings is trading at HK$2.77, significantly below its estimated fair value of HK$4.83, suggesting it is undervalued based on cash flows. Despite a recent follow-on equity offering of HKD 3.9 billion diluting shareholders, the company reported robust earnings growth with net income reaching CNY 1,235.1 million for the first half of 2025 compared to a loss last year. Earnings are forecast to grow significantly at 25.54% annually over the next three years.

- According our earnings growth report, there's an indication that China Ruyi Holdings might be ready to expand.

- Unlock comprehensive insights into our analysis of China Ruyi Holdings stock in this financial health report.

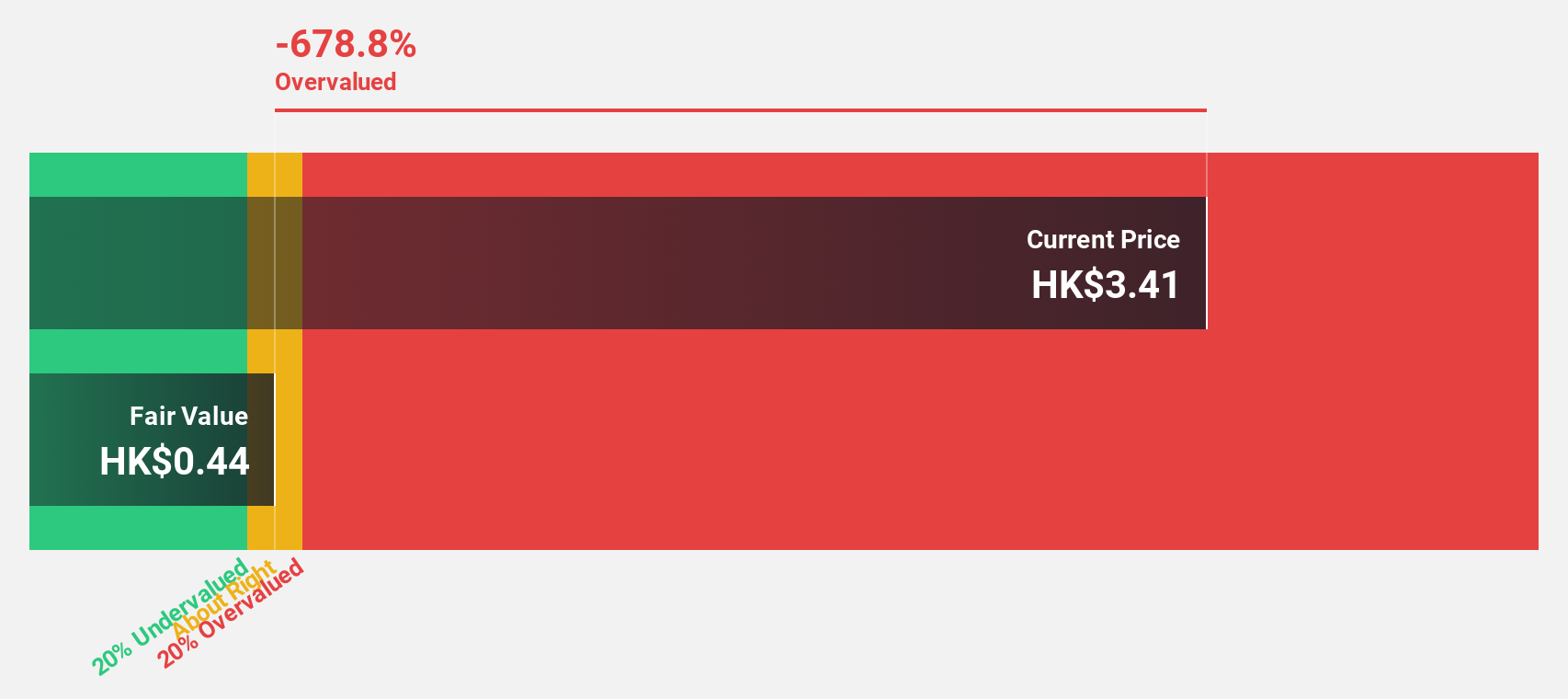

RemeGen (SEHK:9995)

Overview: RemeGen Co., Ltd. is a biopharmaceutical company focused on discovering, developing, producing, and commercializing biological drugs for autoimmune, oncology, and ophthalmic diseases in Mainland China and the United States with a market cap of approximately HK$51.43 billion.

Operations: RemeGen's revenue primarily comes from its biopharmaceutical research, service, production, and sales segment, generating approximately CN¥2.07 billion.

Estimated Discount To Fair Value: 20.2%

RemeGen is trading at HK$84.5, more than 20% below its fair value of HK$105.88, indicating undervaluation based on cash flows. The company reported a reduction in net loss to CNY 550.7 million for the first nine months of 2025 from CNY 1,071.43 million a year prior, reflecting improved financial performance. Despite volatile share prices and significant insider selling recently, RemeGen's revenue and earnings are projected to grow substantially in the coming years.

- Our expertly prepared growth report on RemeGen implies its future financial outlook may be stronger than recent results.

- Click to explore a detailed breakdown of our findings in RemeGen's balance sheet health report.

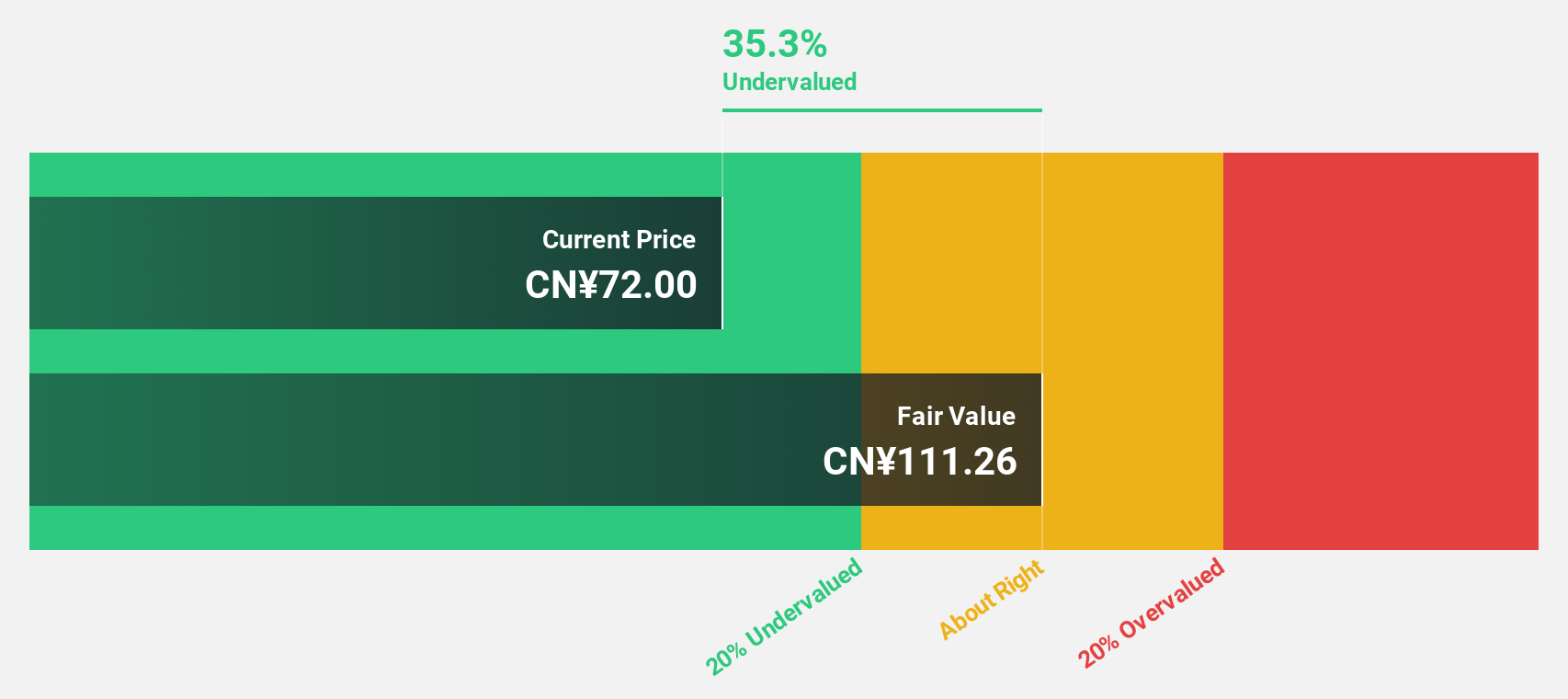

Foxconn Industrial Internet (SHSE:601138)

Overview: Foxconn Industrial Internet Co., Ltd. specializes in designing and manufacturing communication network and cloud service equipment, precision tools, and industrial solutions, with a market cap of approximately CN¥1.55 trillion.

Operations: The company's revenue segments include communication network equipment, cloud service equipment, precision tools, and industrial solutions.

Estimated Discount To Fair Value: 16.6%

Foxconn Industrial Internet's stock is trading at CN¥77.97, approximately 16.6% below its estimated fair value of CN¥93.5, reflecting potential undervaluation based on cash flows. The company reported strong financial performance with net income rising to CN¥22.49 billion for the first nine months of 2025 from CN¥15.14 billion a year ago, despite recent share price volatility and high non-cash earnings levels. Revenue growth outpaces the Chinese market significantly at 31.4% annually.

- In light of our recent growth report, it seems possible that Foxconn Industrial Internet's financial performance will exceed current levels.

- Navigate through the intricacies of Foxconn Industrial Internet with our comprehensive financial health report here.

Key Takeaways

- Gain an insight into the universe of 265 Undervalued Asian Stocks Based On Cash Flows by clicking here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:601138

Foxconn Industrial Internet

Designs and manufactures communication network and cloud service equipment, precision tools, and industrial solutions.

Exceptional growth potential and good value.

Similar Companies

Market Insights

Community Narratives