- Hong Kong

- /

- Entertainment

- /

- SEHK:136

3 Asian Growth Stocks With Insider Ownership Up To 34%

Reviewed by Simply Wall St

As global markets react to recent economic shifts, including a rate cut by the Federal Reserve and ongoing trade discussions between the U.S. and China, Asian markets are navigating their own set of challenges and opportunities. In this environment, growth companies with significant insider ownership can be particularly appealing to investors seeking alignment of interests between management and shareholders.

Top 10 Growth Companies With High Insider Ownership In Asia

| Name | Insider Ownership | Earnings Growth |

| Zhejiang Leapmotor Technology (SEHK:9863) | 14.6% | 57.1% |

| Techwing (KOSDAQ:A089030) | 19.1% | 122.3% |

| Seers Technology (KOSDAQ:A458870) | 33.9% | 84.6% |

| Samyang Foods (KOSE:A003230) | 11.7% | 28.6% |

| Oscotec (KOSDAQ:A039200) | 12.7% | 104.1% |

| Novoray (SHSE:688300) | 23.6% | 30.3% |

| Laopu Gold (SEHK:6181) | 35.5% | 33.9% |

| Gold Circuit Electronics (TWSE:2368) | 31.4% | 35.2% |

| Fulin Precision (SZSE:300432) | 11.8% | 50.7% |

| Ascentage Pharma Group International (SEHK:6855) | 12.8% | 91.9% |

Let's explore several standout options from the results in the screener.

China Ruyi Holdings (SEHK:136)

Simply Wall St Growth Rating: ★★★★★☆

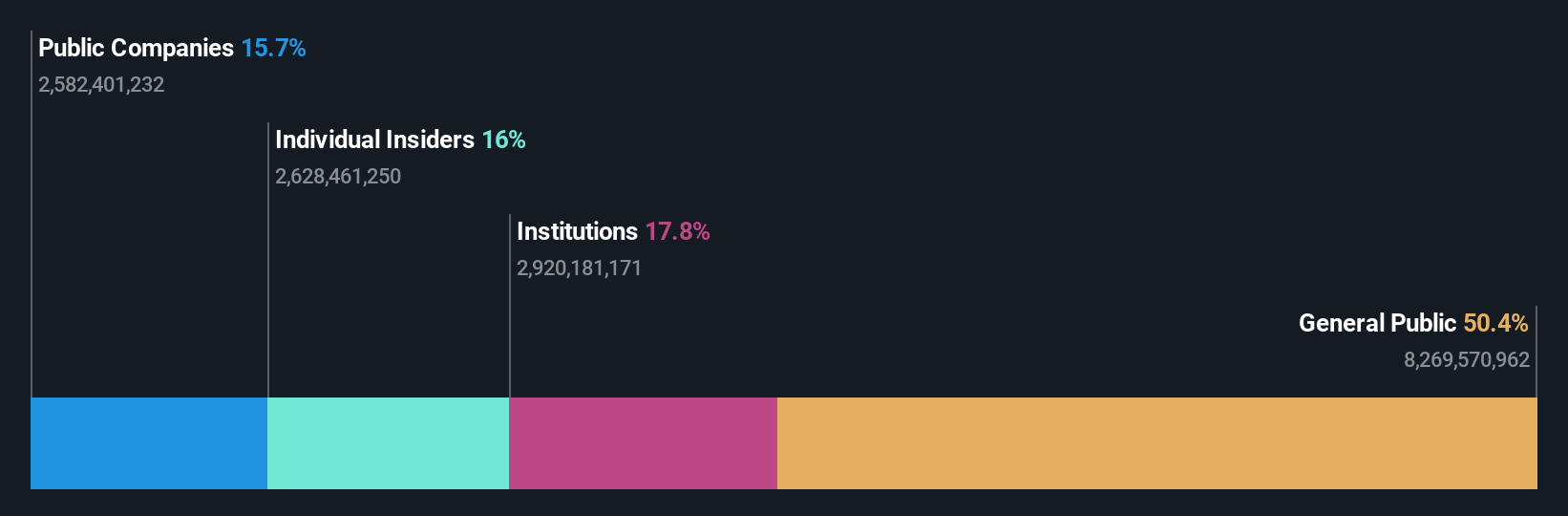

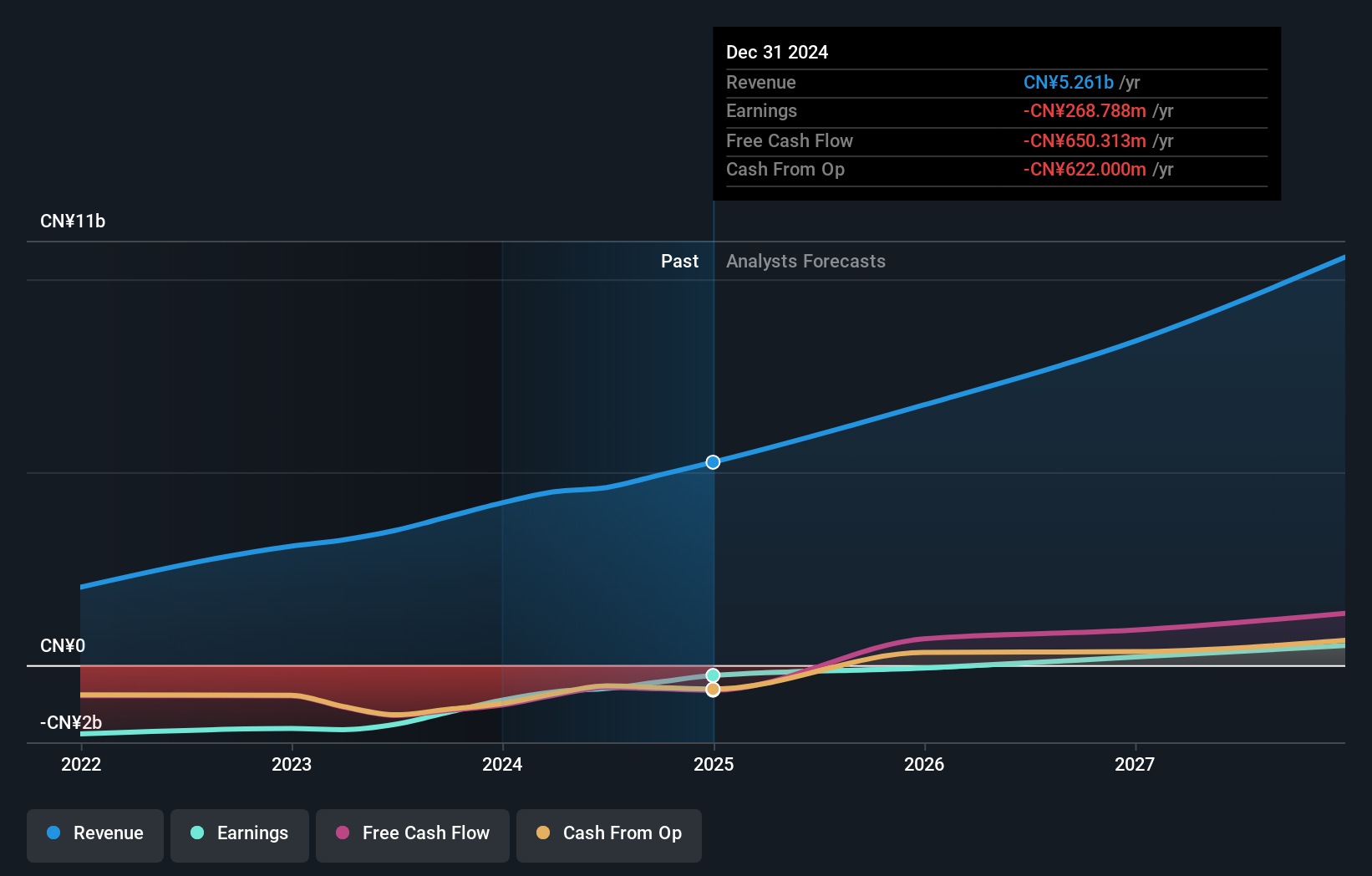

Overview: China Ruyi Holdings Limited is an investment holding company involved in content production and online streaming across Mainland China, Hong Kong, Europe, and internationally, with a market cap of HK$47.40 billion.

Operations: The company's revenue is primarily derived from its content production business, which generated CN¥648.86 million, and its online streaming and gaming businesses, which contributed CN¥3.44 billion.

Insider Ownership: 16%

China Ruyi Holdings has shown substantial growth, with recent earnings reporting CNY 1,235.1 million in net income for H1 2025, a significant turnaround from a loss the previous year. Despite substantial shareholder dilution due to equity offerings totaling HKD 5.07 billion, the company's revenue and earnings are forecast to grow significantly above market averages at rates of over 20% annually. Analysts expect further stock price appreciation while insider ownership remains high, indicating strong internal confidence in its strategic direction.

- Unlock comprehensive insights into our analysis of China Ruyi Holdings stock in this growth report.

- Our expertly prepared valuation report China Ruyi Holdings implies its share price may be lower than expected.

Beijing Fourth Paradigm Technology (SEHK:6682)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Beijing Fourth Paradigm Technology Co., Ltd. is an investment holding company that offers platform-centric artificial intelligence solutions in the People's Republic of China, with a market capitalization of HK$33.34 billion.

Operations: The company generates revenue through its Sagegpt Aigs Services (CN¥505.70 million), 4ParadigmSage AI Platform (CN¥4.57 billion), and Shift Intelligent Solutions (CN¥940.30 million).

Insider Ownership: 20.5%

Beijing Fourth Paradigm Technology's recent earnings report shows sales of CNY 2.63 billion, a notable increase from the previous year, while net losses narrowed significantly. The company's revenue is expected to grow at 26.7% annually, outpacing the Hong Kong market average. Recent strategic alliances in AI and energy sectors highlight its innovative approach, though profitability remains a future goal. Despite no significant insider trading activity recently, high insider ownership suggests confidence in long-term growth prospects.

- Click here to discover the nuances of Beijing Fourth Paradigm Technology with our detailed analytical future growth report.

- Insights from our recent valuation report point to the potential overvaluation of Beijing Fourth Paradigm Technology shares in the market.

Guangzhou Hexin InstrumentLtd (SHSE:688622)

Simply Wall St Growth Rating: ★★★★☆☆

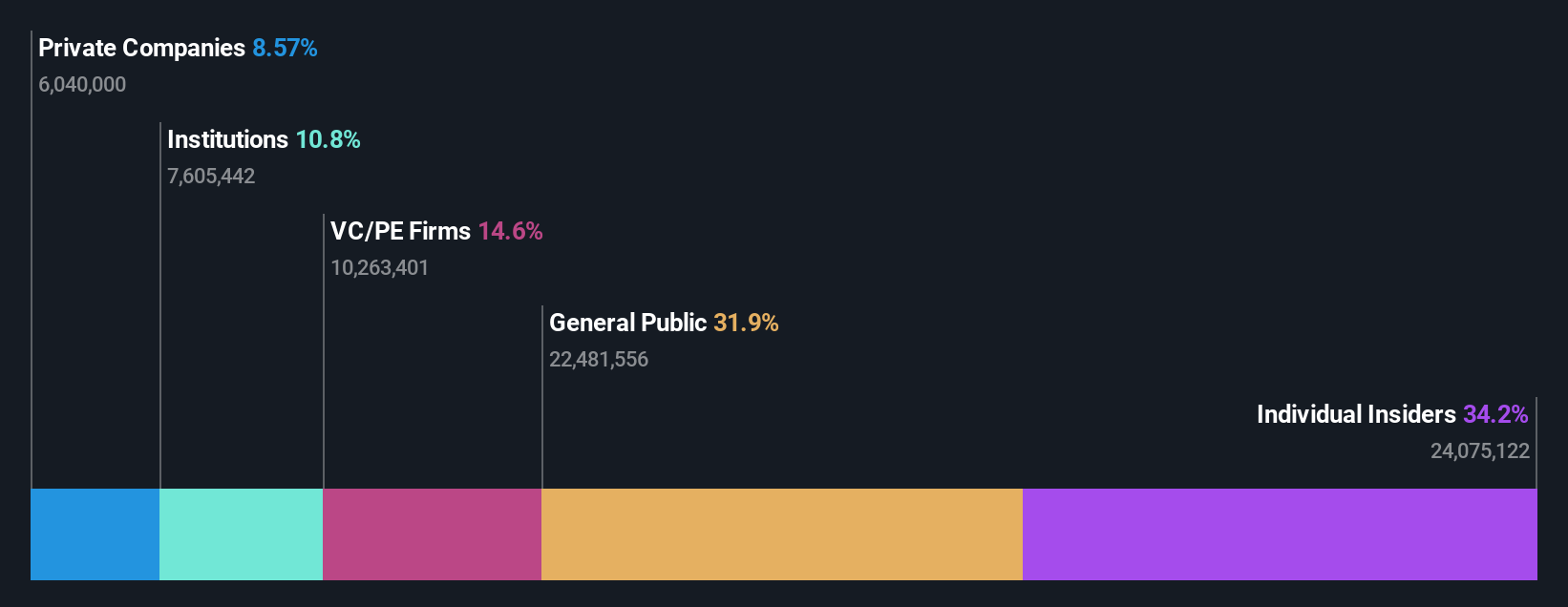

Overview: Guangzhou Hexin Instrument Co., Ltd. focuses on the research, development, production, sale, and technical services of mass spectrometry products in China and has a market cap of CN¥8.21 billion.

Operations: The company's revenue is derived entirely from its Mass Spectrometer Business, amounting to CN¥152 million.

Insider Ownership: 34.2%

Guangzhou Hexin Instrument's addition to the S&P Global BMI Index underscores its growing prominence. Despite a challenging first half of 2025 with sales and revenue halving from the previous year and a net loss of CNY 17.46 million, forecasts suggest profitability within three years, outpacing market averages. Revenue is expected to grow annually by 15.1%, slightly above China's market rate, yet insider ownership remains stable without recent trading activity.

- Delve into the full analysis future growth report here for a deeper understanding of Guangzhou Hexin InstrumentLtd.

- Our valuation report unveils the possibility Guangzhou Hexin InstrumentLtd's shares may be trading at a premium.

Turning Ideas Into Actions

- Click through to start exploring the rest of the 616 Fast Growing Asian Companies With High Insider Ownership now.

- Curious About Other Options? Uncover 11 companies that survived and thrived after COVID and have the right ingredients to survive Trump's tariffs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:136

China Ruyi Holdings

An investment holding company, engages in content production and online streaming business in the People's Republic of Mainland China, Hong Kong, Europe, and internationally.

Solid track record and good value.

Market Insights

Community Narratives