- Hong Kong

- /

- Interactive Media and Services

- /

- SEHK:1357

It Looks Like Shareholders Would Probably Approve Meitu, Inc.'s (HKG:1357) CEO Compensation Package

Key Insights

- Meitu's Annual General Meeting to take place on 5th of June

- Total pay for CEO Xinhong Wu includes CN¥752.0k salary

- The overall pay is comparable to the industry average

- Meitu's total shareholder return over the past three years was 37% while its EPS grew by 108% over the past three years

It would be hard to discount the role that CEO Xinhong Wu has played in delivering the impressive results at Meitu, Inc. (HKG:1357) recently. Coming up to the next AGM on 5th of June, shareholders would be keeping this in mind. This would also be a chance for them to hear the board review the financial results, discuss future company strategy and vote on any resolutions such as executive remuneration. In light of the great performance, we discuss the case why we think CEO compensation is not excessive.

See our latest analysis for Meitu

How Does Total Compensation For Xinhong Wu Compare With Other Companies In The Industry?

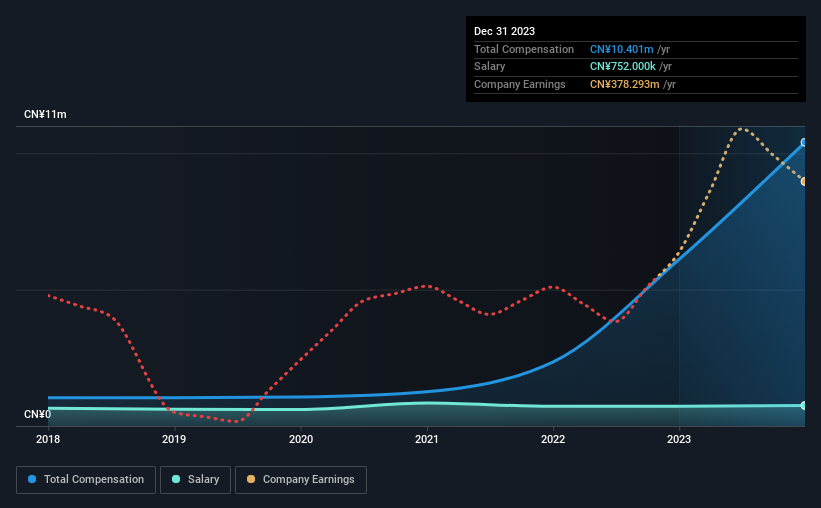

Our data indicates that Meitu, Inc. has a market capitalization of HK$12b, and total annual CEO compensation was reported as CN¥10m for the year to December 2023. We note that's an increase of 70% above last year. We think total compensation is more important but our data shows that the CEO salary is lower, at CN¥752k.

For comparison, other companies in the Hong Kong Interactive Media and Services industry with market capitalizations ranging between HK$7.8b and HK$25b had a median total CEO compensation of CN¥14m. So it looks like Meitu compensates Xinhong Wu in line with the median for the industry. What's more, Xinhong Wu holds HK$1.6b worth of shares in the company in their own name, indicating that they have a lot of skin in the game.

| Component | 2023 | 2022 | Proportion (2023) |

| Salary | CN¥752k | CN¥722k | 7% |

| Other | CN¥9.6m | CN¥5.4m | 93% |

| Total Compensation | CN¥10m | CN¥6.1m | 100% |

On an industry level, roughly 33% of total compensation represents salary and 67% is other remuneration. It's interesting to note that Meitu allocates a smaller portion of compensation to salary in comparison to the broader industry. If total compensation is slanted towards non-salary benefits, it indicates that CEO pay is linked to company performance.

Meitu, Inc.'s Growth

Meitu, Inc.'s earnings per share (EPS) grew 108% per year over the last three years. Its revenue is up 29% over the last year.

This demonstrates that the company has been improving recently and is good news for the shareholders. The combination of strong revenue growth with medium-term EPS improvement certainly points to the kind of growth we like to see. Historical performance can sometimes be a good indicator on what's coming up next but if you want to peer into the company's future you might be interested in this free visualization of analyst forecasts.

Has Meitu, Inc. Been A Good Investment?

Most shareholders would probably be pleased with Meitu, Inc. for providing a total return of 37% over three years. This strong performance might mean some shareholders don't mind if the CEO were to be paid more than is normal for a company of its size.

To Conclude...

The company's solid performance might have made most shareholders happy, possibly making CEO remuneration the least of the matters to be discussed in the AGM. In fact, strategic decisions that could impact the future of the business might be a far more interesting topic for investors as it would help them set their longer-term expectations.

CEO compensation can have a massive impact on performance, but it's just one element. We've identified 3 warning signs for Meitu that investors should be aware of in a dynamic business environment.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1357

Meitu

An investment holding company, engages in the development and provision of products that streamline the production of photo, video, and design with other AI-powered products in Mainland China and internationally.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Salesforce Stock: AI-Fueled Growth Is Real — But Can Margins Stay This Strong?

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)