As global markets grapple with tariff uncertainties and fluctuating economic indicators, investors are increasingly cautious, leading to significant declines in major U.S. indices and mixed performances across Europe and Asia. Amidst this backdrop, growth companies with high insider ownership can offer a unique appeal; such firms often demonstrate strong alignment between management and shareholder interests, potentially providing resilience during volatile market conditions.

Top 10 Growth Companies With High Insider Ownership Globally

| Name | Insider Ownership | Earnings Growth |

| Vow (OB:VOW) | 13.1% | 120.9% |

| Pharma Mar (BME:PHM) | 11.9% | 40.8% |

| Laopu Gold (SEHK:6181) | 36.4% | 43.7% |

| CD Projekt (WSE:CDR) | 29.7% | 41.3% |

| Nordic Halibut (OB:NOHAL) | 29.8% | 56.3% |

| Elliptic Laboratories (OB:ELABS) | 22.6% | 88.2% |

| HANA Micron (KOSDAQ:A067310) | 18.3% | 125.9% |

| Fulin Precision (SZSE:300432) | 13.6% | 78.6% |

| Ascentage Pharma Group International (SEHK:6855) | 17.9% | 60.9% |

| Synspective (TSE:290A) | 13.2% | 37.4% |

Let's review some notable picks from our screened stocks.

Meitu (SEHK:1357)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Meitu, Inc. is an investment holding company that creates products for enhancing image, video, and design production to support digitalization in beauty-related industries both in the People's Republic of China and internationally, with a market cap of HK$26.39 billion.

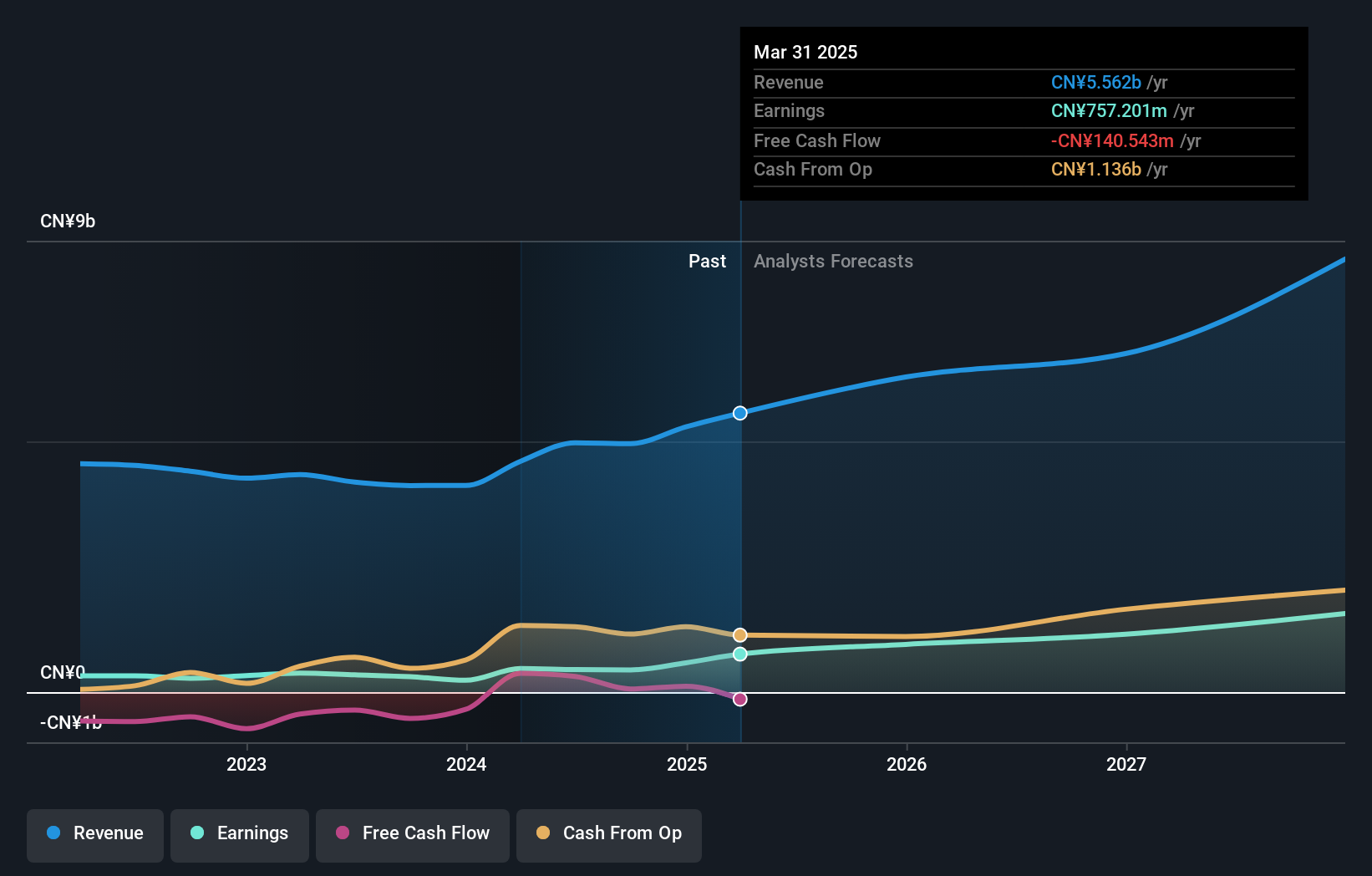

Operations: Meitu's revenue is primarily derived from its Internet Business segment, which generated CN¥3.06 billion.

Insider Ownership: 33.2%

Meitu's earnings are projected to grow at 26.8% annually, outpacing the Hong Kong market, while revenue is forecasted to increase by 19.5%. Despite high volatility in its share price and a decrease in profit margins from last year, insider transactions have shown more buying than selling recently. A special dividend of HK$0.109 per share was approved at the recent extraordinary general meeting, reflecting potential shareholder value return amidst growth prospects.

- Dive into the specifics of Meitu here with our thorough growth forecast report.

- Our valuation report unveils the possibility Meitu's shares may be trading at a premium.

Shenzhen Noposion Crop Science (SZSE:002215)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Shenzhen Noposion Crop Science Co., Ltd. engages in the research, development, production, and sale of agricultural inputs both in China and internationally, with a market cap of CN¥9.67 billion.

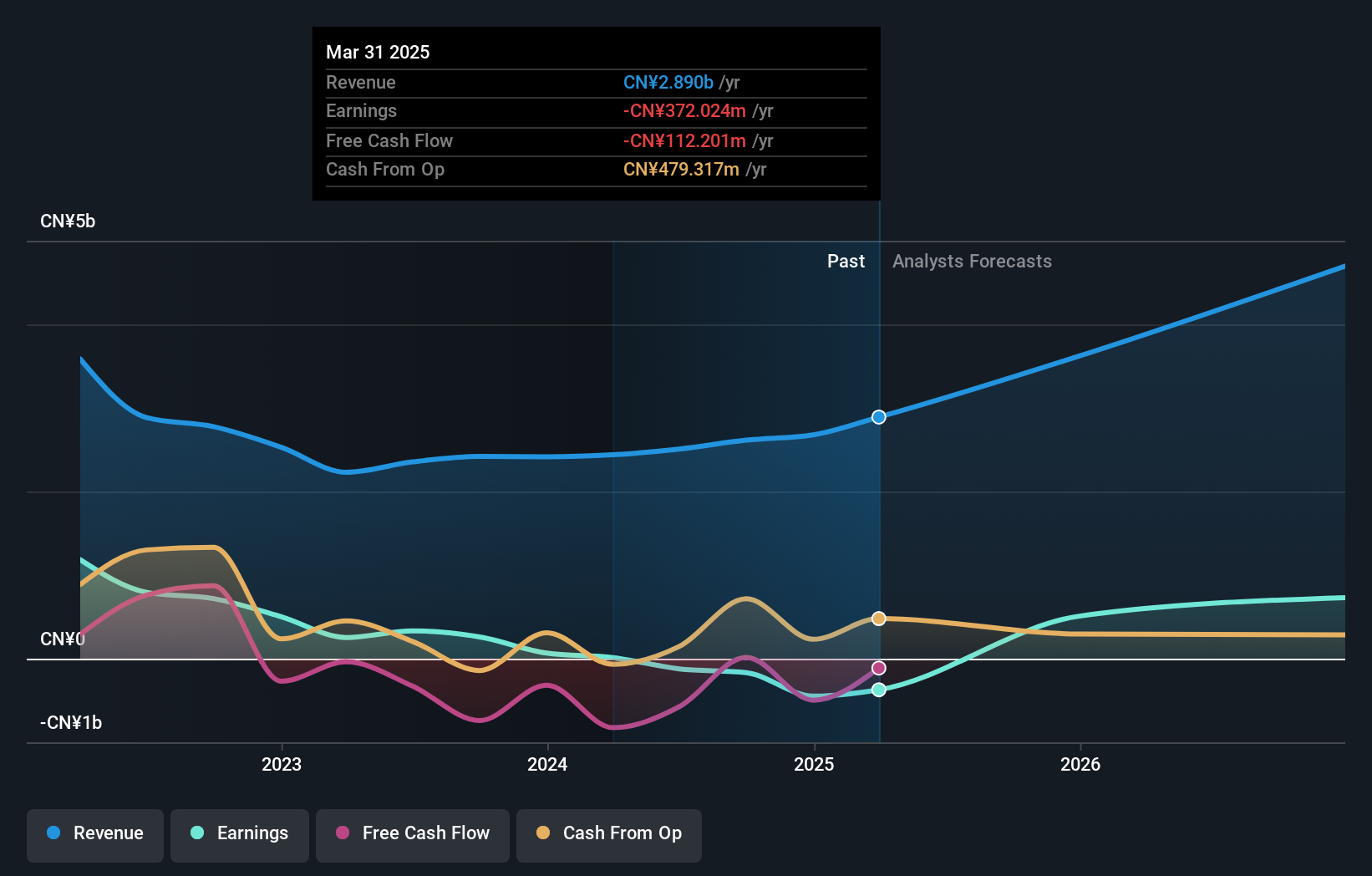

Operations: Shenzhen Noposion Crop Science Co., Ltd. generates revenue through its research, development, production, and sale of agricultural inputs across domestic and international markets.

Insider Ownership: 29.6%

Shenzhen Noposion Crop Science's earnings are forecast to grow significantly at 36.97% annually, surpassing the Chinese market average. Despite its high debt levels, it trades at a favorable price-to-earnings ratio of 22.1x compared to the broader market's 38.9x, suggesting good relative value. However, revenue growth is expected to lag behind both the industry and broader market rates, potentially impacting long-term growth prospects despite substantial insider ownership stability recently observed.

- Click here to discover the nuances of Shenzhen Noposion Crop Science with our detailed analytical future growth report.

- The analysis detailed in our Shenzhen Noposion Crop Science valuation report hints at an deflated share price compared to its estimated value.

Wuhan Guide Infrared (SZSE:002414)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Wuhan Guide Infrared Co., Ltd. focuses on the research, development, production, and sale of infrared thermal imaging technology in Asia with a market cap of CN¥37.16 billion.

Operations: Revenue segments for SZSE:002414 are not provided in the given text.

Insider Ownership: 27.2%

Wuhan Guide Infrared is forecast to achieve significant growth, with earnings expected to increase by 79.07% annually and revenue projected to grow at 26.3% per year, outpacing the Chinese market's average. Despite this robust growth outlook, the company's return on equity is anticipated to remain low at 8.9% in three years. There have been no significant insider trading activities over the past three months, indicating stable insider sentiment towards the company's prospects.

- Get an in-depth perspective on Wuhan Guide Infrared's performance by reading our analyst estimates report here.

- Insights from our recent valuation report point to the potential overvaluation of Wuhan Guide Infrared shares in the market.

Where To Now?

- Access the full spectrum of 874 Fast Growing Global Companies With High Insider Ownership by clicking on this link.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002215

Shenzhen Noposion Crop Science

Researches and develops, produces, and sells agricultural inputs in China and internationally.

High growth potential with solid track record and pays a dividend.

Market Insights

Community Narratives