- United Arab Emirates

- /

- Industrials

- /

- DFM:DIC

Dubai Investments PJSC Leads The List Of 3 Promising Penny Stocks

Reviewed by Simply Wall St

Global markets have recently been influenced by rising U.S. Treasury yields, which have put pressure on stocks and led to a mixed performance across major indices. For investors interested in exploring smaller or newer companies, penny stocks—despite their somewhat outdated name—remain a relevant investment area with potential for value and growth. This article will highlight several penny stocks that stand out due to their strong financial foundations, offering both stability and potential upside in today's market conditions.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.575 | MYR2.86B | ★★★★★★ |

| BP Plastics Holding Bhd (KLSE:BPPLAS) | MYR1.21 | MYR340.59M | ★★★★★★ |

| Rexit Berhad (KLSE:REXIT) | MYR0.72 | MYR124.72M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.78 | HK$495.14M | ★★★★★★ |

| Tristel (AIM:TSTL) | £3.50 | £173.92M | ★★★★★★ |

| Zhejiang Giuseppe Garment (SZSE:002687) | CN¥4.39 | CN¥2.15B | ★★★★★★ |

| Polar Capital Holdings (AIM:POLR) | £4.865 | £459.28M | ★★★★★★ |

| FRP Advisory Group (AIM:FRP) | £1.28 | £323.7M | ★★★★★★ |

| Seafco (SET:SEAFCO) | THB2.36 | THB1.91B | ★★★★★★ |

| Next 15 Group (AIM:NFG) | £4.235 | £409.76M | ★★★★☆☆ |

Click here to see the full list of 5,814 stocks from our Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Dubai Investments PJSC (DFM:DIC)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Dubai Investments PJSC operates in property, investment, manufacturing, contracting, and services sectors both in the United Arab Emirates and internationally, with a market cap of AED9.01 billion.

Operations: The company generates revenue from property (AED2.26 billion), investments (AED253.17 million), and manufacturing, contracting, and services (AED1.19 billion).

Market Cap: AED9.01B

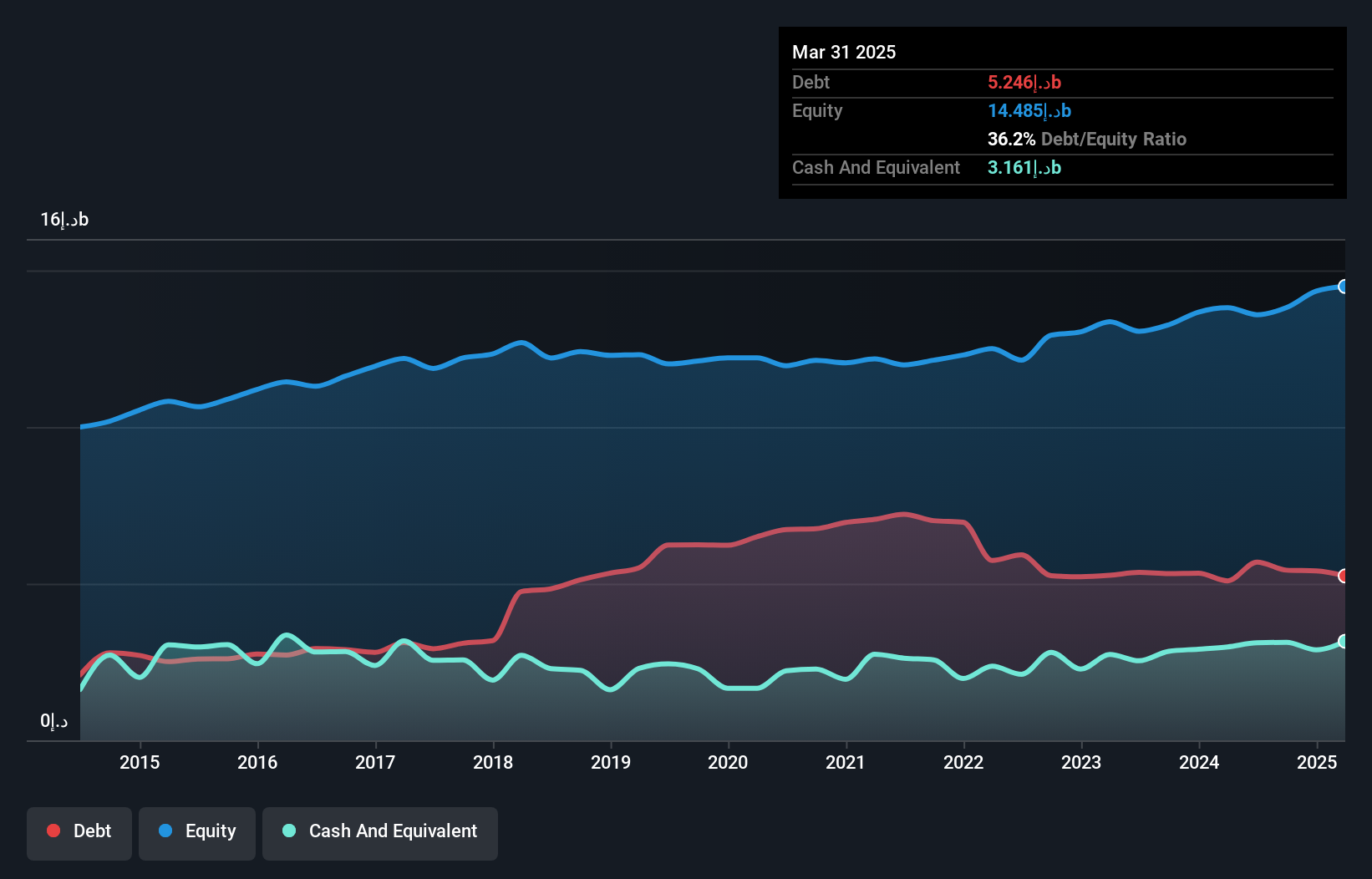

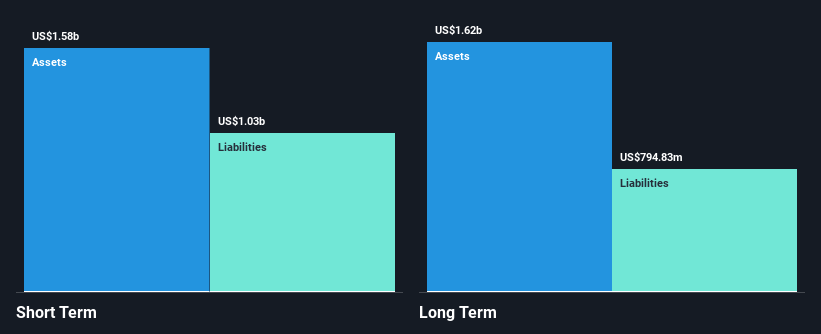

Dubai Investments PJSC, with a market cap of AED9.01 billion, operates across multiple sectors including property and manufacturing. Despite recent negative earnings growth and forecasted declines over the next three years, the company maintains a satisfactory net debt to equity ratio of 19% and covers its short-term liabilities with assets totaling AED7.1 billion. However, profit margins have decreased from 57.2% to 25.9%, partly due to large one-off gains impacting financial results. While dividends are unstable, the company's price-to-earnings ratio of 9.4x suggests it may be undervalued relative to the AE market average of 13.6x.

- Navigate through the intricacies of Dubai Investments PJSC with our comprehensive balance sheet health report here.

- Explore Dubai Investments PJSC's analyst forecasts in our growth report.

Meitu (SEHK:1357)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Meitu, Inc. is an investment holding company that develops products to enhance image, video, and design production with beauty-related solutions in China and internationally, with a market cap of HK$12.52 billion.

Operations: The company's revenue from its Internet Business segment is CN¥3.06 billion.

Market Cap: HK$12.52B

Meitu, Inc., with a market cap of HK$12.52 billion, has shown stable financial health despite recent challenges. The company's revenue from its Internet Business segment reached CN¥3.06 billion, reflecting growth in sales and net income for the first half of 2024 compared to the previous year. Meitu's debt is well covered by operating cash flow, and it holds more cash than total debt, indicating strong liquidity management. Although profit margins have decreased this year and insider selling has been significant recently, Meitu's stock trades significantly below its estimated fair value, suggesting potential undervaluation in the market.

- Click here and access our complete financial health analysis report to understand the dynamics of Meitu.

- Assess Meitu's future earnings estimates with our detailed growth reports.

Japfa (SGX:UD2)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Japfa Ltd. is an agri-food company that produces and sells protein staples and packaged food products in Indonesia, Vietnam, India, Myanmar, and internationally with a market cap of SGD804.63 million.

Operations: Japfa Ltd. does not report specific revenue segments.

Market Cap: SGD804.63M

Japfa Ltd., with a market cap of SGD804.63 million, has recently turned profitable, reporting a net income of US$87.54 million for the nine months ending September 2024, compared to a loss in the previous year. The company's revenue increased to US$3.42 billion from US$3.29 billion year-on-year, demonstrating growth despite high debt levels with a net debt to equity ratio of 70.4%. Japfa's short-term assets exceed both its short and long-term liabilities, indicating sound financial management. The company declared an interim dividend and is trading significantly below estimated fair value, suggesting potential undervaluation.

- Get an in-depth perspective on Japfa's performance by reading our balance sheet health report here.

- Gain insights into Japfa's outlook and expected performance with our report on the company's earnings estimates.

Next Steps

- Take a closer look at our Penny Stocks list of 5,814 companies by clicking here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About DFM:DIC

Dubai Investments PJSC

Engages in property, investment, manufacturing, contracting, and services businesses in the United Arab Emirates and internationally.

Excellent balance sheet average dividend payer.