- United Arab Emirates

- /

- Consumer Services

- /

- ADX:DRIVE

Unveiling None And 2 Other Promising Small Caps With Strong Potential

Reviewed by Simply Wall St

As global markets wrap up the year, major indices have shown moderate gains despite a dip in U.S. consumer confidence and mixed economic indicators, particularly affecting small-cap stocks. Amidst this backdrop, identifying promising small-cap companies requires a keen eye for those with robust fundamentals and growth potential that can weather fluctuating market sentiments.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| SALUS Ljubljana d. d | 13.55% | 13.11% | 9.95% | ★★★★★★ |

| Morris State Bancshares | 10.20% | -0.28% | 6.97% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Natural Food International Holding | NA | 2.49% | 20.35% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Arab Insurance Group (B.S.C.) | NA | -59.20% | 20.33% | ★★★★★☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Invest Bank | 135.69% | 11.07% | 18.67% | ★★★★☆☆ |

| Central Cooperative Bank AD | 4.88% | 37.94% | 537.05% | ★★★★☆☆ |

We'll examine a selection from our screener results.

Emirates Driving Company P.J.S.C (ADX:DRIVE)

Simply Wall St Value Rating: ★★★★★★

Overview: Emirates Driving Company P.J.S.C., along with its subsidiaries, focuses on managing and developing motor vehicle driving training, with a market capitalization of AED3.02 billion.

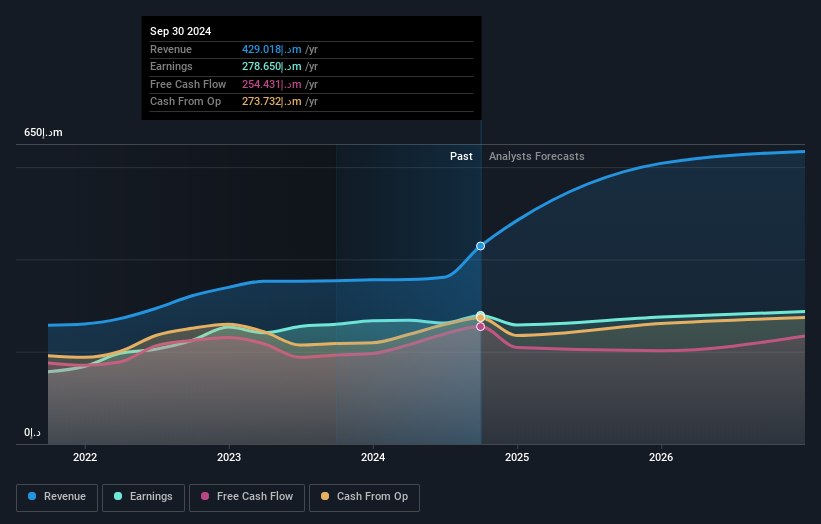

Operations: Emirates Driving Company P.J.S.C. generates revenue primarily from car and other related services, amounting to AED429.02 million. The company's financial performance is reflected in its market capitalization of AED3.02 billion.

Emirates Driving Company, a modestly sized entity in the market, showcases a solid financial footing with no debt over the past five years and high-quality earnings. The company's recent performance is noteworthy, with third-quarter sales reaching AED 161.69 million compared to AED 94.1 million last year, and net income at AED 85.26 million against AED 68.79 million previously reported. Although its annual earnings growth of 7.4% trails behind the industry average of 9.6%, it trades at an attractive value, estimated at 15% below fair value, suggesting potential for future appreciation as revenue is forecasted to grow by nearly 17% annually.

Bahnhof (OM:BAHN B)

Simply Wall St Value Rating: ★★★★★★

Overview: Bahnhof AB (publ) operates in the Internet and telecommunications sector across Sweden and Europe, with a market cap of SEK5.63 billion.

Operations: Bahnhof generates revenue primarily from its Internet and telecommunications services across Sweden and Europe. The company focuses on delivering these services, which contribute significantly to its financial performance.

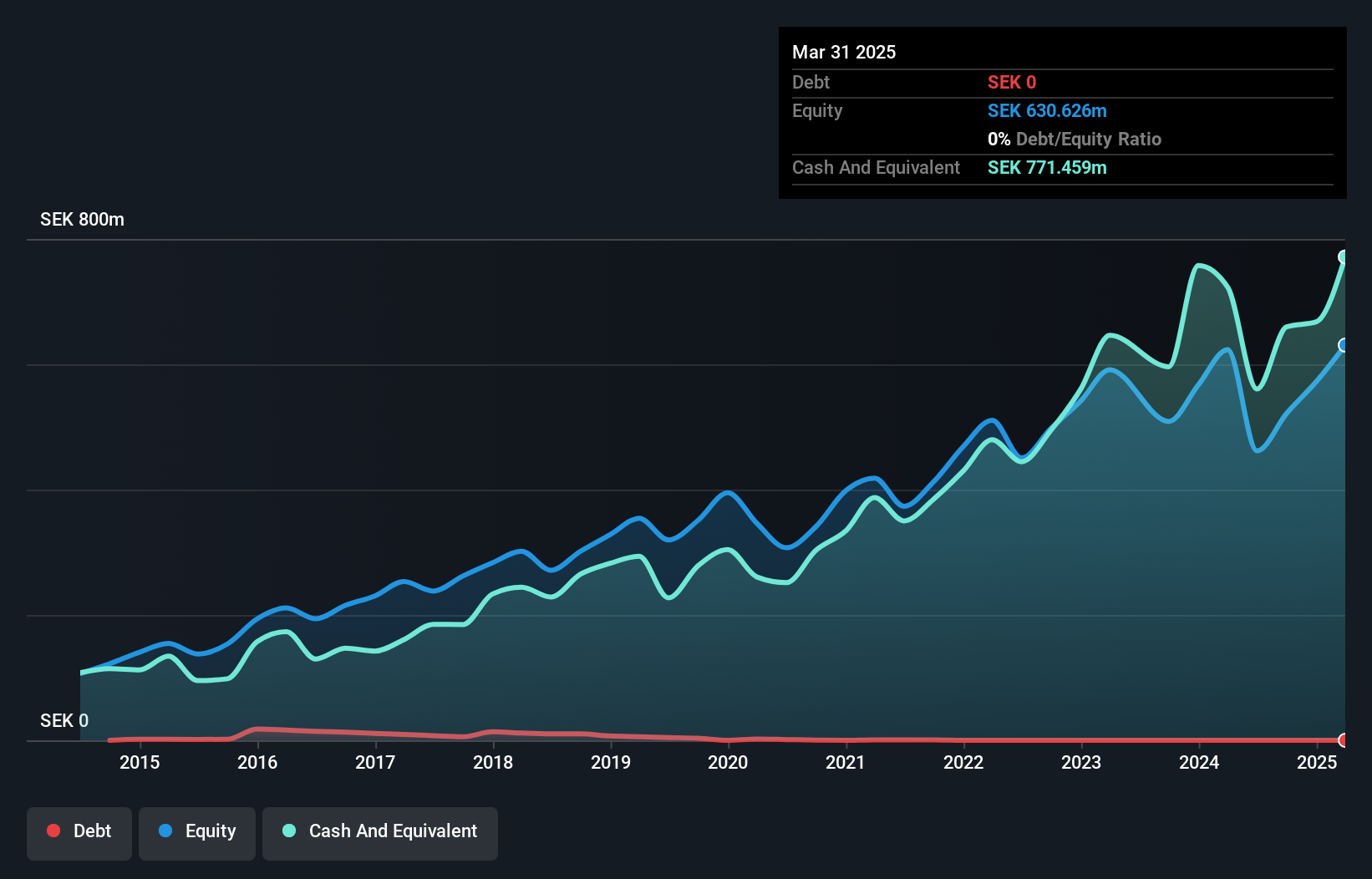

Bahnhof, a nimble player in the telecom sector, showcases a strong financial footing with no debt compared to five years ago when its debt to equity ratio stood at 0.9%. Trading at 46.4% below its estimated fair value, it offers potential for value seekers. The company reported earnings growth of 14.6% over the past year, outpacing the industry average of 4.4%. Recent quarterly results showed sales climbing to SEK 511 million from SEK 475 million last year and net income rising slightly to SEK 60 million from SEK 58 million, reflecting steady performance amid market challenges.

- Dive into the specifics of Bahnhof here with our thorough health report.

Understand Bahnhof's track record by examining our Past report.

JM HoldingsLtd (TSE:3539)

Simply Wall St Value Rating: ★★★★★★

Overview: JM Holdings Co., Ltd. operates in the supermarket sector across Japan, with a market capitalization of approximately ¥64.54 billion.

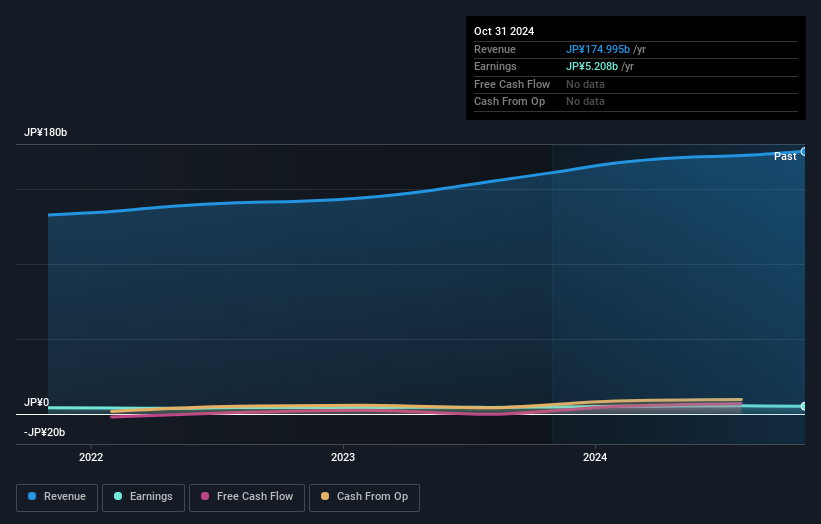

Operations: JM Holdings Co., Ltd. generates revenue primarily through its supermarket operations in Japan, contributing significantly to its market presence. The company's financial performance is characterized by a focus on cost management and efficiency, impacting its profitability metrics such as the net profit margin.

JM Holdings Ltd. presents a compelling case with its current valuation trading at 55.8% below estimated fair value, suggesting potential undervaluation. Over the past five years, earnings have grown annually by 9.7%, indicating consistent performance despite not outpacing the Consumer Retailing industry's growth of 11.8%. The company's debt management is noteworthy, with a reduction in the debt-to-equity ratio from 21.2 to 19.7 over five years and interest payments well covered by EBIT at a robust coverage of 198 times. Additionally, JM Holdings' free cash flow remains positive, which supports its financial stability moving forward.

- Delve into the full analysis health report here for a deeper understanding of JM HoldingsLtd.

Review our historical performance report to gain insights into JM HoldingsLtd's's past performance.

Turning Ideas Into Actions

- Embark on your investment journey to our 4637 Undiscovered Gems With Strong Fundamentals selection here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Emirates Driving Company P.J.S.C might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ADX:DRIVE

Emirates Driving Company P.J.S.C

Manages and develops motor vehicles driving training in the United Arab Emirates.

Flawless balance sheet established dividend payer.

Market Insights

Community Narratives