- Hong Kong

- /

- Interactive Media and Services

- /

- SEHK:1024

What Kuaishou Technology's (HKG:1024) 29% Share Price Gain Is Not Telling You

Kuaishou Technology (HKG:1024) shareholders would be excited to see that the share price has had a great month, posting a 29% gain and recovering from prior weakness. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 21% in the last twelve months.

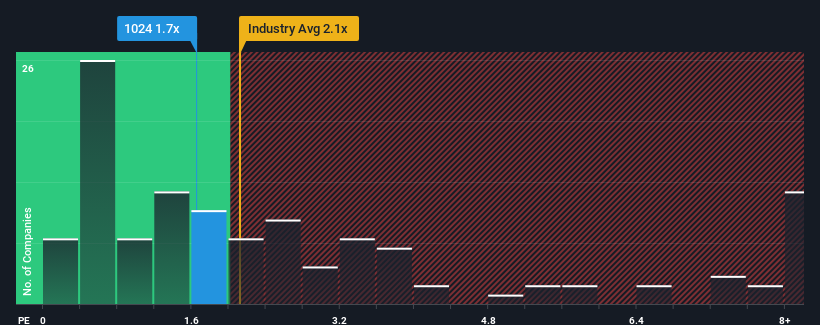

After such a large jump in price, when almost half of the companies in Hong Kong's Interactive Media and Services industry have price-to-sales ratios (or "P/S") below 0.6x, you may consider Kuaishou Technology as a stock probably not worth researching with its 1.7x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

See our latest analysis for Kuaishou Technology

How Kuaishou Technology Has Been Performing

With revenue growth that's superior to most other companies of late, Kuaishou Technology has been doing relatively well. The P/S is probably high because investors think this strong revenue performance will continue. If not, then existing shareholders might be a little nervous about the viability of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Kuaishou Technology will help you uncover what's on the horizon.Is There Enough Revenue Growth Forecasted For Kuaishou Technology?

There's an inherent assumption that a company should outperform the industry for P/S ratios like Kuaishou Technology's to be considered reasonable.

Retrospectively, the last year delivered an exceptional 16% gain to the company's top line. The latest three year period has also seen an excellent 74% overall rise in revenue, aided by its short-term performance. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Shifting to the future, estimates from the analysts covering the company suggest revenue should grow by 9.7% per year over the next three years. That's shaping up to be similar to the 9.3% per annum growth forecast for the broader industry.

With this in consideration, we find it intriguing that Kuaishou Technology's P/S is higher than its industry peers. It seems most investors are ignoring the fairly average growth expectations and are willing to pay up for exposure to the stock. These shareholders may be setting themselves up for disappointment if the P/S falls to levels more in line with the growth outlook.

What We Can Learn From Kuaishou Technology's P/S?

The large bounce in Kuaishou Technology's shares has lifted the company's P/S handsomely. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Analysts are forecasting Kuaishou Technology's revenues to only grow on par with the rest of the industry, which has lead to the high P/S ratio being unexpected. The fact that the revenue figures aren't setting the world alight has us doubtful that the company's elevated P/S can be sustainable for the long term. A positive change is needed in order to justify the current price-to-sales ratio.

The company's balance sheet is another key area for risk analysis. You can assess many of the main risks through our free balance sheet analysis for Kuaishou Technology with six simple checks.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Kuaishou Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1024

Kuaishou Technology

An investment holding company, provides live streaming, online marketing, and other services in the People’s Republic of China.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives