Changmao Biochemical Engineering's (HKG:954) Dividend Will Be Reduced To HK$0.024

Changmao Biochemical Engineering Company Limited (HKG:954) has announced it will be reducing its dividend payable on the 30th of July to HK$0.024. Despite the cut, the dividend yield of 3.1% will still be comparable to other companies in the industry.

View our latest analysis for Changmao Biochemical Engineering

Changmao Biochemical Engineering Is Paying Out More Than It Is Earning

Unless the payments are sustainable, the dividend yield doesn't mean too much. Prior to this announcement, Changmao Biochemical Engineering's earnings easily covered the dividend, but free cash flows were negative. No cash flows could definitely make returning cash to shareholders difficult, or at least mean the balance sheet will come under pressure.

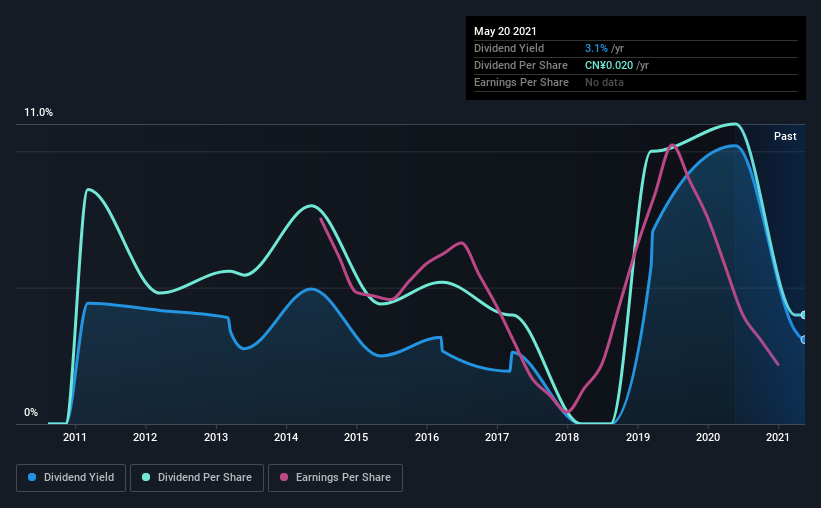

EPS is set to fall by 18.0% over the next 12 months if recent trends continue. Assuming the dividend continues along recent trends, we believe the payout ratio could reach 104%, which could put the dividend under pressure if earnings don't start to improve.

Dividend Volatility

The company has a long dividend track record, but it doesn't look great with cuts in the past. The first annual payment during the last 10 years was CN¥0.043 in 2011, and the most recent fiscal year payment was CN¥0.02. The dividend has shrunk at around 7.4% a year during that period. A company that decreases its dividend over time generally isn't what we are looking for.

The Dividend Has Limited Growth Potential

Given that dividend payments have been shrinking like a glacier in a warming world, we need to check if there are some bright spots on the horizon. Changmao Biochemical Engineering's earnings per share has shrunk at 18% a year over the past five years. Such rapid declines definitely have the potential to constrain dividend payments if the trend continues into the future.

The Dividend Could Prove To Be Unreliable

Overall, it's not great to see that the dividend has been cut, but this might be explained by the payments being a bit high previously. With cash flows lacking, it is difficult to see how the company can sustain a dividend payment. This company is not in the top tier of income providing stocks.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. Still, investors need to consider a host of other factors, apart from dividend payments, when analysing a company. For example, we've picked out 3 warning signs for Changmao Biochemical Engineering that investors should know about before committing capital to this stock. If you are a dividend investor, you might also want to look at our curated list of high performing dividend stock.

When trading stocks or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:954

Changmao Biochemical Engineering

Produces and sells organic acids for food additive, chemical, and pharmaceutical industries in Mainland China, Europe, the Asia Pacific, the United States, and internationally.

Low risk and slightly overvalued.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026