- Hong Kong

- /

- Metals and Mining

- /

- SEHK:893

Would Shareholders Who Purchased China Vanadium Titano-Magnetite Mining's (HKG:893) Stock Three Years Be Happy With The Share price Today?

China Vanadium Titano-Magnetite Mining Company Limited (HKG:893) shareholders will doubtless be very grateful to see the share price up 42% in the last quarter. But that doesn't help the fact that the three year return is less impressive. After all, the share price is down 26% in the last three years, significantly under-performing the market.

View our latest analysis for China Vanadium Titano-Magnetite Mining

Because China Vanadium Titano-Magnetite Mining made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

In the last three years China Vanadium Titano-Magnetite Mining saw its revenue shrink by 30% per year. That means its revenue trend is very weak compared to other loss making companies. On the face of it we'd posit the share price fall of 8% compound, over three years is well justified by the fundamental deterioration. It would probably be worth asking whether the company can fund itself to profitability. The company will need to return to revenue growth as quickly as possible, if it wants to see some enthusiasm from investors.

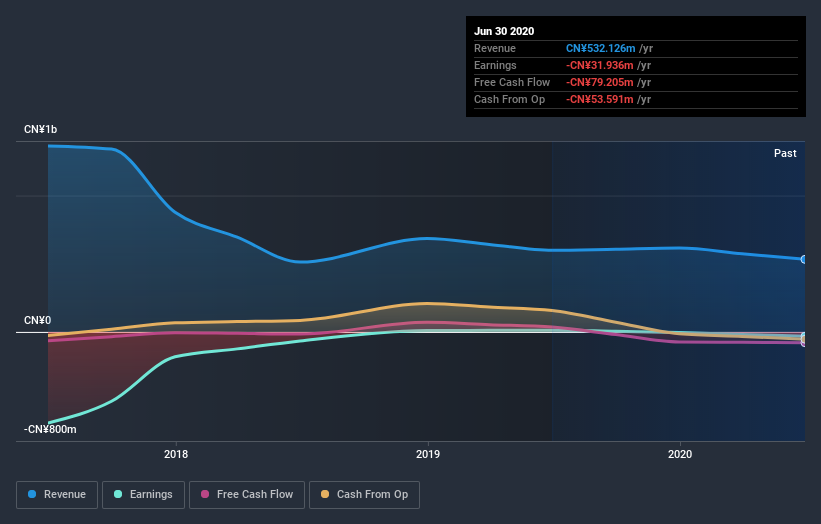

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. Dive deeper into the earnings by checking this interactive graph of China Vanadium Titano-Magnetite Mining's earnings, revenue and cash flow.

A Different Perspective

China Vanadium Titano-Magnetite Mining shareholders gained a total return of 5.9% during the year. Unfortunately this falls short of the market return. On the bright side, that's still a gain, and it is certainly better than the yearly loss of about 5% endured over half a decade. It could well be that the business is stabilizing. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Case in point: We've spotted 3 warning signs for China Vanadium Titano-Magnetite Mining you should be aware of, and 1 of them can't be ignored.

We will like China Vanadium Titano-Magnetite Mining better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

When trading China Vanadium Titano-Magnetite Mining or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:893

China Vanadium Titano-Magnetite Mining

An investment holding company, engages in mining and ore processing activities in the People’s Republic of China.

Flawless balance sheet with low risk.

Similar Companies

Market Insights

Community Narratives