China Singyes New Materials Holdings Limited's (HKG:8073) 296% Share Price Surge Not Quite Adding Up

Despite an already strong run, China Singyes New Materials Holdings Limited (HKG:8073) shares have been powering on, with a gain of 296% in the last thirty days. Looking back a bit further, it's encouraging to see the stock is up 69% in the last year.

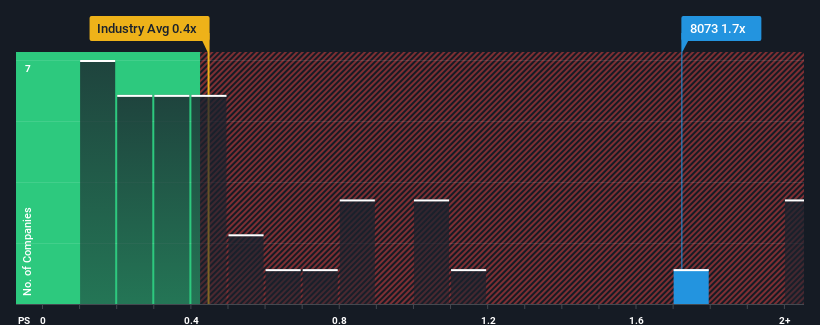

Since its price has surged higher, you could be forgiven for thinking China Singyes New Materials Holdings is a stock not worth researching with a price-to-sales ratios (or "P/S") of 1.7x, considering almost half the companies in Hong Kong's Chemicals industry have P/S ratios below 0.4x. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for China Singyes New Materials Holdings

How Has China Singyes New Materials Holdings Performed Recently?

The revenue growth achieved at China Singyes New Materials Holdings over the last year would be more than acceptable for most companies. It might be that many expect the respectable revenue performance to beat most other companies over the coming period, which has increased investors’ willingness to pay up for the stock. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on China Singyes New Materials Holdings will help you shine a light on its historical performance.Is There Enough Revenue Growth Forecasted For China Singyes New Materials Holdings?

There's an inherent assumption that a company should outperform the industry for P/S ratios like China Singyes New Materials Holdings' to be considered reasonable.

Taking a look back first, we see that the company managed to grow revenues by a handy 9.3% last year. Still, lamentably revenue has fallen 15% in aggregate from three years ago, which is disappointing. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Comparing that to the industry, which is predicted to deliver 35% growth in the next 12 months, the company's downward momentum based on recent medium-term revenue results is a sobering picture.

In light of this, it's alarming that China Singyes New Materials Holdings' P/S sits above the majority of other companies. It seems most investors are ignoring the recent poor growth rate and are hoping for a turnaround in the company's business prospects. There's a very good chance existing shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the recent negative growth rates.

What We Can Learn From China Singyes New Materials Holdings' P/S?

The large bounce in China Singyes New Materials Holdings' shares has lifted the company's P/S handsomely. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Our examination of China Singyes New Materials Holdings revealed its shrinking revenue over the medium-term isn't resulting in a P/S as low as we expected, given the industry is set to grow. Right now we aren't comfortable with the high P/S as this revenue performance is highly unlikely to support such positive sentiment for long. Should recent medium-term revenue trends persist, it would pose a significant risk to existing shareholders' investments and prospective investors will have a hard time accepting the current value of the stock.

There are also other vital risk factors to consider and we've discovered 3 warning signs for China Singyes New Materials Holdings (2 don't sit too well with us!) that you should be aware of before investing here.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:8073

China Shuifa Singyes New Materials Holdings

An investment holding company, engages in the research and development, manufacture, sale, and installation of indium tin oxide films and related downstream products in Mainland China and internationally.

Mediocre balance sheet low.

Market Insights

Community Narratives