- Hong Kong

- /

- Metals and Mining

- /

- SEHK:486

Investors three-year losses continue as United Company RUSAL International (HKG:486) dips a further 3.1% this week, earnings continue to decline

It is a pleasure to report that the United Company RUSAL, International Public Joint-Stock Company (HKG:486) is up 35% in the last quarter. Meanwhile over the last three years the stock has dropped hard. Indeed, the share price is down a tragic 55% in the last three years. So it is really good to see an improvement. The rise has some hopeful, but turnarounds are often precarious.

Since United Company RUSAL International has shed HK$1.5b from its value in the past 7 days, let's see if the longer term decline has been driven by the business' economics.

Check out our latest analysis for United Company RUSAL International

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

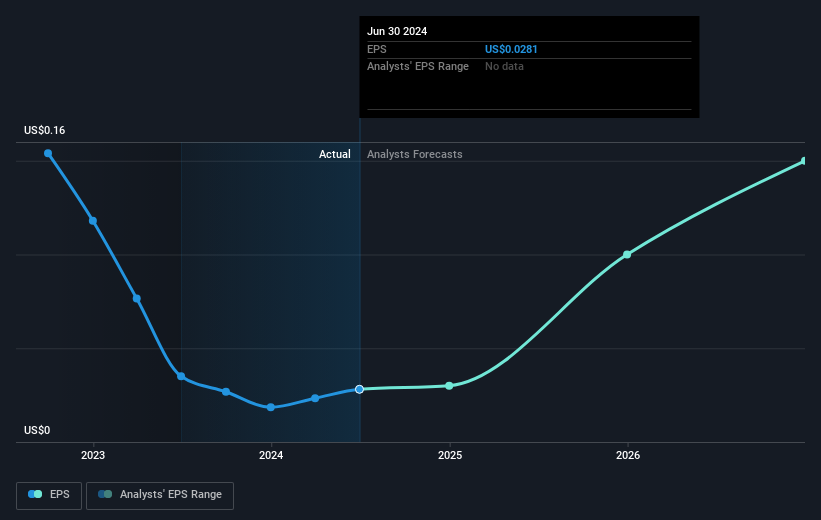

United Company RUSAL International saw its EPS decline at a compound rate of 47% per year, over the last three years. In comparison the 23% compound annual share price decline isn't as bad as the EPS drop-off. This suggests that the market retains some optimism around long term earnings stability, despite past EPS declines.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

Dive deeper into United Company RUSAL International's key metrics by checking this interactive graph of United Company RUSAL International's earnings, revenue and cash flow.

What About The Total Shareholder Return (TSR)?

Investors should note that there's a difference between United Company RUSAL International's total shareholder return (TSR) and its share price change, which we've covered above. Arguably the TSR is a more complete return calculation because it accounts for the value of dividends (as if they were reinvested), along with the hypothetical value of any discounted capital that have been offered to shareholders. Dividends have been really beneficial for United Company RUSAL International shareholders, and that cash payout explains why its total shareholder loss of 52%, over the last 3 years, isn't as bad as the share price return.

A Different Perspective

United Company RUSAL International's TSR for the year was broadly in line with the market average, at 24%. The silver lining is that the share price is up in the short term, which flies in the face of the annualised loss of 2% over the last five years. While 'turnarounds seldom turn' there are green shoots for United Company RUSAL International. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Consider for instance, the ever-present spectre of investment risk. We've identified 2 warning signs with United Company RUSAL International (at least 1 which shouldn't be ignored) , and understanding them should be part of your investment process.

We will like United Company RUSAL International better if we see some big insider buys. While we wait, check out this free list of undervalued stocks (mostly small caps) with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Hong Kong exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:486

United Company RUSAL International

Engages in production and sale of aluminium and related products in Russia.

Excellent balance sheet with acceptable track record.

Similar Companies

Market Insights

Community Narratives