- Hong Kong

- /

- Metals and Mining

- /

- SEHK:3993

Here's Why We Think CMOC Group (HKG:3993) Might Deserve Your Attention Today

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like CMOC Group (HKG:3993). Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

See our latest analysis for CMOC Group

How Fast Is CMOC Group Growing?

If a company can keep growing earnings per share (EPS) long enough, its share price should eventually follow. That makes EPS growth an attractive quality for any company. CMOC Group's shareholders have have plenty to be happy about as their annual EPS growth for the last 3 years was 51%. Growth that fast may well be fleeting, but it should be more than enough to pique the interest of the wary stock pickers.

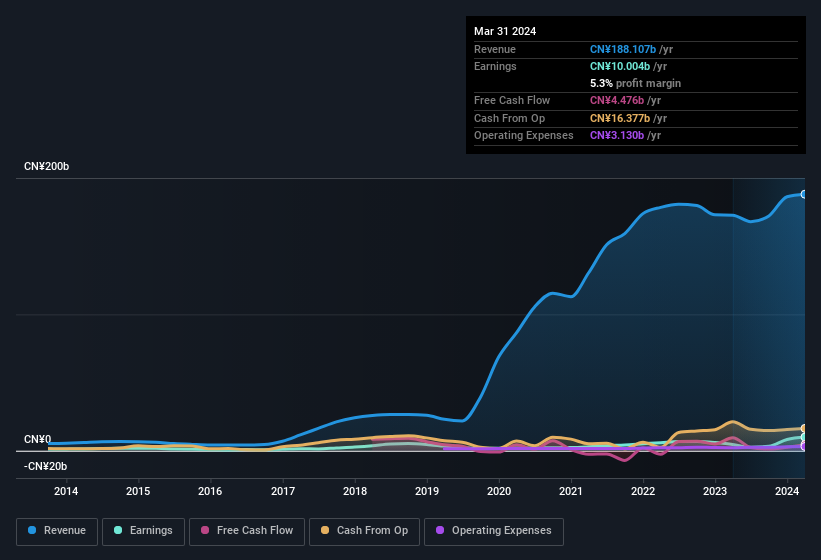

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. CMOC Group shareholders can take confidence from the fact that EBIT margins are up from 4.3% to 8.1%, and revenue is growing. Both of which are great metrics to check off for potential growth.

The chart below shows how the company's bottom and top lines have progressed over time. Click on the chart to see the exact numbers.

While we live in the present moment, there's little doubt that the future matters most in the investment decision process. So why not check this interactive chart depicting future EPS estimates, for CMOC Group?

Are CMOC Group Insiders Aligned With All Shareholders?

Since CMOC Group has a market capitalisation of HK$164b, we wouldn't expect insiders to hold a large percentage of shares. But thanks to their investment in the company, it's pleasing to see that there are still incentives to align their actions with the shareholders. Indeed, they hold CN¥100m worth of its stock. That shows significant buy-in, and may indicate conviction in the business strategy. While their ownership only accounts for 0.06%, this is still a considerable amount at stake to encourage the business to maintain a strategy that will deliver value to shareholders.

Does CMOC Group Deserve A Spot On Your Watchlist?

CMOC Group's earnings have taken off in quite an impressive fashion. This level of EPS growth does wonders for attracting investment, and the large insider investment in the company is just the cherry on top. The hope is, of course, that the strong growth marks a fundamental improvement in the business economics. So based on this quick analysis, we do think it's worth considering CMOC Group for a spot on your watchlist. Of course, identifying quality businesses is only half the battle; investors need to know whether the stock is undervalued. So you might want to consider this free discounted cashflow valuation of CMOC Group.

Although CMOC Group certainly looks good, it may appeal to more investors if insiders were buying up shares. If you like to see companies with more skin in the game, then check out this handpicked selection of Hong Kong companies that not only boast of strong growth but have strong insider backing.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:3993

CMOC Group

Engages in the mining, beneficiation, smelting, and refining of base and rare metals.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives