- Hong Kong

- /

- Metals and Mining

- /

- SEHK:3993

CMOC Group Limited (HKG:3993) Stock Rockets 26% As Investors Are Less Pessimistic Than Expected

Despite an already strong run, CMOC Group Limited (HKG:3993) shares have been powering on, with a gain of 26% in the last thirty days. The last 30 days bring the annual gain to a very sharp 34%.

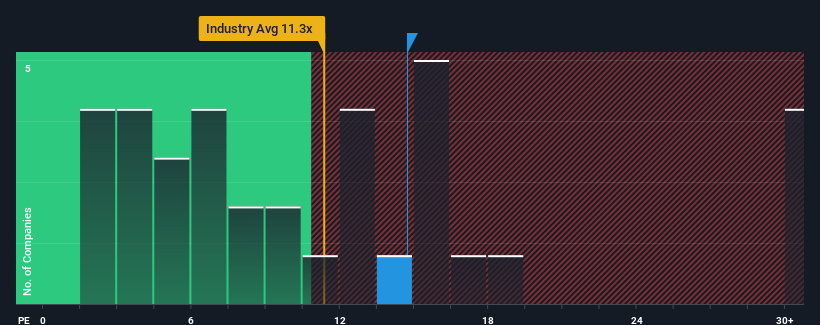

Since its price has surged higher, given close to half the companies in Hong Kong have price-to-earnings ratios (or "P/E's") below 8x, you may consider CMOC Group as a stock to avoid entirely with its 14.7x P/E ratio. However, the P/E might be quite high for a reason and it requires further investigation to determine if it's justified.

Recent times have been pleasing for CMOC Group as its earnings have risen in spite of the market's earnings going into reverse. The P/E is probably high because investors think the company will continue to navigate the broader market headwinds better than most. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

See our latest analysis for CMOC Group

Does Growth Match The High P/E?

There's an inherent assumption that a company should far outperform the market for P/E ratios like CMOC Group's to be considered reasonable.

Taking a look back first, we see that the company grew earnings per share by an impressive 36% last year. Pleasingly, EPS has also lifted 251% in aggregate from three years ago, thanks to the last 12 months of growth. Therefore, it's fair to say the earnings growth recently has been superb for the company.

Turning to the outlook, the next three years should generate growth of 9.6% per year as estimated by the analysts watching the company. Meanwhile, the rest of the market is forecast to expand by 16% per annum, which is noticeably more attractive.

With this information, we find it concerning that CMOC Group is trading at a P/E higher than the market. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. Only the boldest would assume these prices are sustainable as this level of earnings growth is likely to weigh heavily on the share price eventually.

The Final Word

The strong share price surge has got CMOC Group's P/E rushing to great heights as well. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our examination of CMOC Group's analyst forecasts revealed that its inferior earnings outlook isn't impacting its high P/E anywhere near as much as we would have predicted. Right now we are increasingly uncomfortable with the high P/E as the predicted future earnings aren't likely to support such positive sentiment for long. This places shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

Many other vital risk factors can be found on the company's balance sheet. Our free balance sheet analysis for CMOC Group with six simple checks will allow you to discover any risks that could be an issue.

Of course, you might also be able to find a better stock than CMOC Group. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:3993

CMOC Group

Engages in the mining, beneficiation, smelting, and refining of base and rare metals.

Very undervalued with outstanding track record.

Similar Companies

Market Insights

Community Narratives