How Does Huabao International Holdings Limited (HKG:336) Fare As A Dividend Stock?

Dividend paying stocks like Huabao International Holdings Limited (HKG:336) tend to be popular with investors, and for good reason - some research suggests a significant amount of all stock market returns come from reinvested dividends. If you are hoping to live on the income from dividends, it's important to be a lot more stringent with your investments than the average punter.

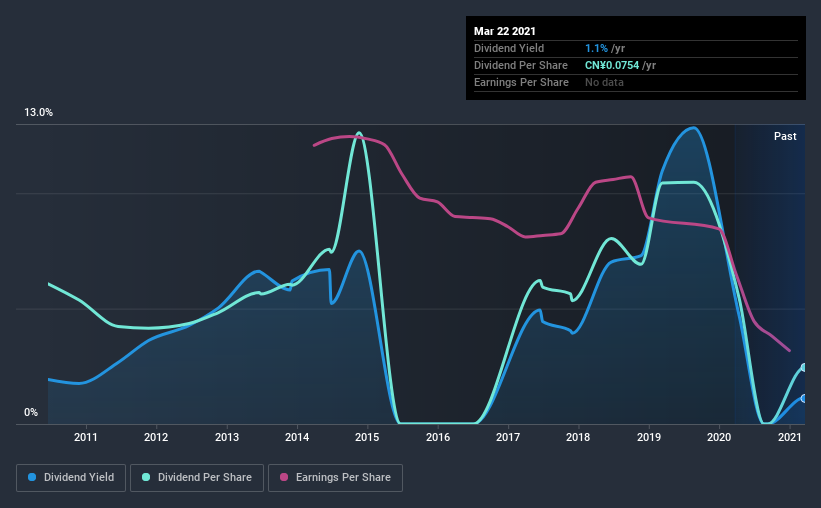

While Huabao International Holdings's 1.1% dividend yield is not the highest, we think its lengthy payment history is quite interesting. Some simple research can reduce the risk of buying Huabao International Holdings for its dividend - read on to learn more.

Click the interactive chart for our full dividend analysis

Payout ratios

Dividends are usually paid out of company earnings. If a company is paying more than it earns, then the dividend might become unsustainable - hardly an ideal situation. As a result, we should always investigate whether a company can afford its dividend, measured as a percentage of a company's net income after tax. Huabao International Holdings paid out 56% of its profit as dividends, over the trailing twelve month period. This is a fairly normal payout ratio among most businesses. It allows a higher dividend to be paid to shareholders, but does limit the capital retained in the business - which could be good or bad.

Another important check we do is to see if the free cash flow generated is sufficient to pay the dividend. Huabao International Holdings paid out 22% of its free cash flow as dividends last year, which is conservative and suggests the dividend is sustainable. It's positive to see that Huabao International Holdings' dividend is covered by both profits and cash flow, since this is generally a sign that the dividend is sustainable, and a lower payout ratio usually suggests a greater margin of safety before the dividend gets cut.

While the above analysis focuses on dividends relative to a company's earnings, we do note Huabao International Holdings' strong net cash position, which will let it pay larger dividends for a time, should it choose.

We update our data on Huabao International Holdings every 24 hours, so you can always get our latest analysis of its financial health, here.

Dividend Volatility

From the perspective of an income investor who wants to earn dividends for many years, there is not much point buying a stock if its dividend is regularly cut or is not reliable. For the purpose of this article, we only scrutinise the last decade of Huabao International Holdings' dividend payments. This dividend has been unstable, which we define as having been cut one or more times over this time. During the past 10-year period, the first annual payment was CN¥0.2 in 2011, compared to CN¥0.08 last year. The dividend has shrunk at around 8.7% a year during that period. Huabao International Holdings' dividend hasn't shrunk linearly at 8.7% per annum, but the CAGR is a useful estimate of the historical rate of change.

We struggle to make a case for buying Huabao International Holdings for its dividend, given that payments have shrunk over the past 10 years.

Dividend Growth Potential

With a relatively unstable dividend, and a poor history of shrinking dividends, it's even more important to see if EPS are growing. Huabao International Holdings' EPS have fallen by approximately 20% per year during the past five years. A sharp decline in earnings per share is not great from from a dividend perspective, as even conservative payout ratios can come under pressure if earnings fall far enough.

Conclusion

To summarise, shareholders should always check that Huabao International Holdings' dividends are affordable, that its dividend payments are relatively stable, and that it has decent prospects for growing its earnings and dividend. First, we think Huabao International Holdings has an acceptable payout ratio and its dividend is well covered by cashflow. Earnings per share are down, and Huabao International Holdings' dividend has been cut at least once in the past, which is disappointing. Ultimately, Huabao International Holdings comes up short on our dividend analysis. It's not that we think it is a bad company - just that there are likely more appealing dividend prospects out there on this analysis.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. Still, investors need to consider a host of other factors, apart from dividend payments, when analysing a company. As an example, we've identified 3 warning signs for Huabao International Holdings that you should be aware of before investing.

We have also put together a list of global stocks with a market capitalisation above $1bn and yielding more 3%.

If you’re looking to trade Huabao International Holdings, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

If you're looking to trade Huabao International Holdings, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Huabao International Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:336

Huabao International Holdings

An investment holding company, researches, develops, produces, distributes, and sells flavours, fragrances, food ingredients, tobacco and aroma raw materials, and condiment products primarily in the People’s Republic of China.

Flawless balance sheet low.

Market Insights

Community Narratives