- Hong Kong

- /

- Metals and Mining

- /

- SEHK:323

Maanshan Iron & Steel Company Limited's (HKG:323) Shares Climb 62% But Its Business Is Yet to Catch Up

Maanshan Iron & Steel Company Limited (HKG:323) shares have had a really impressive month, gaining 62% after a shaky period beforehand. Taking a wider view, although not as strong as the last month, the full year gain of 21% is also fairly reasonable.

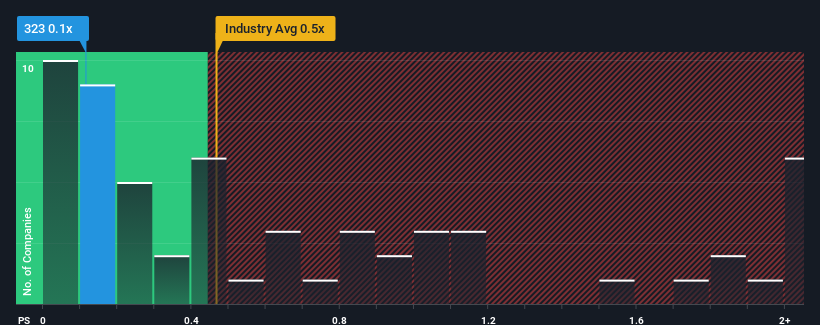

Although its price has surged higher, you could still be forgiven for feeling indifferent about Maanshan Iron & Steel's P/S ratio of 0.1x, since the median price-to-sales (or "P/S") ratio for the Metals and Mining industry in Hong Kong is also close to 0.5x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

View our latest analysis for Maanshan Iron & Steel

How Has Maanshan Iron & Steel Performed Recently?

While the industry has experienced revenue growth lately, Maanshan Iron & Steel's revenue has gone into reverse gear, which is not great. One possibility is that the P/S ratio is moderate because investors think this poor revenue performance will turn around. If not, then existing shareholders may be a little nervous about the viability of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Maanshan Iron & Steel will help you uncover what's on the horizon.Is There Some Revenue Growth Forecasted For Maanshan Iron & Steel?

In order to justify its P/S ratio, Maanshan Iron & Steel would need to produce growth that's similar to the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 1.9%. This means it has also seen a slide in revenue over the longer-term as revenue is down 8.0% in total over the last three years. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Looking ahead now, revenue is anticipated to slump, contracting by 5.0% during the coming year according to the six analysts following the company. Meanwhile, the broader industry is forecast to expand by 14%, which paints a poor picture.

With this in consideration, we think it doesn't make sense that Maanshan Iron & Steel's P/S is closely matching its industry peers. Apparently many investors in the company reject the analyst cohort's pessimism and aren't willing to let go of their stock right now. There's a good chance these shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the negative growth outlook.

The Bottom Line On Maanshan Iron & Steel's P/S

Its shares have lifted substantially and now Maanshan Iron & Steel's P/S is back within range of the industry median. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

While Maanshan Iron & Steel's P/S isn't anything out of the ordinary for companies in the industry, we didn't expect it given forecasts of revenue decline. With this in mind, we don't feel the current P/S is justified as declining revenues are unlikely to support a more positive sentiment for long. If we consider the revenue outlook, the P/S seems to indicate that potential investors may be paying a premium for the stock.

And what about other risks? Every company has them, and we've spotted 1 warning sign for Maanshan Iron & Steel you should know about.

If you're unsure about the strength of Maanshan Iron & Steel's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:323

Maanshan Iron & Steel

Manufactures and sells iron and steel products, and related by-products in Mainland China, Hong Kong, and internationally.

Fair value with moderate growth potential.

Market Insights

Community Narratives