After Leaping 65% SANVO Fine Chemicals Group Limited (HKG:301) Shares Are Not Flying Under The Radar

SANVO Fine Chemicals Group Limited (HKG:301) shareholders would be excited to see that the share price has had a great month, posting a 65% gain and recovering from prior weakness. While recent buyers may be laughing, long-term holders might not be as pleased since the recent gain only brings the stock back to where it started a year ago.

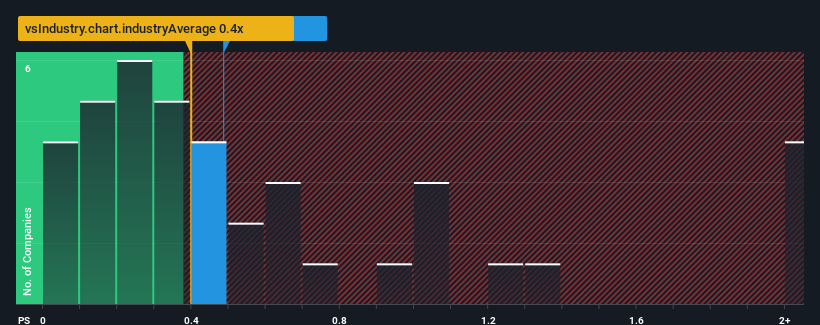

Even after such a large jump in price, there still wouldn't be many who think SANVO Fine Chemicals Group's price-to-sales (or "P/S") ratio of 0.5x is worth a mention when the median P/S in Hong Kong's Chemicals industry is similar at about 0.4x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

View our latest analysis for SANVO Fine Chemicals Group

How Has SANVO Fine Chemicals Group Performed Recently?

For example, consider that SANVO Fine Chemicals Group's financial performance has been poor lately as its revenue has been in decline. One possibility is that the P/S is moderate because investors think the company might still do enough to be in line with the broader industry in the near future. If you like the company, you'd at least be hoping this is the case so that you could potentially pick up some stock while it's not quite in favour.

Although there are no analyst estimates available for SANVO Fine Chemicals Group, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.How Is SANVO Fine Chemicals Group's Revenue Growth Trending?

There's an inherent assumption that a company should be matching the industry for P/S ratios like SANVO Fine Chemicals Group's to be considered reasonable.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 1.3%. That put a dampener on the good run it was having over the longer-term as its three-year revenue growth is still a noteworthy 8.2% in total. Accordingly, while they would have preferred to keep the run going, shareholders would be roughly satisfied with the medium-term rates of revenue growth.

Weighing that recent medium-term revenue trajectory against the broader industry's one-year forecast for expansion of 3.9% shows it's about the same on an annualised basis.

With this information, we can see why SANVO Fine Chemicals Group is trading at a fairly similar P/S to the industry. Apparently shareholders are comfortable to simply hold on assuming the company will continue keeping a low profile.

What We Can Learn From SANVO Fine Chemicals Group's P/S?

SANVO Fine Chemicals Group's stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

As we've seen, SANVO Fine Chemicals Group's three-year revenue trends seem to be contributing to its P/S, given they look similar to current industry expectations. With previous revenue trends that keep up with the current industry outlook, it's hard to justify the company's P/S ratio deviating much from it's current point. Unless the recent medium-term conditions change, they will continue to support the share price at these levels.

It is also worth noting that we have found 5 warning signs for SANVO Fine Chemicals Group (1 is potentially serious!) that you need to take into consideration.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

If you're looking to trade SANVO Fine Chemicals Group, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:301

SANVO Fine Chemicals Group

An investment holding company, engages in the research and development, manufacture, and sale of fine industrial chemical products in the People's Republic of China, Australia, and internationally.

Moderate with mediocre balance sheet.

Market Insights

Community Narratives