- Hong Kong

- /

- Metals and Mining

- /

- SEHK:2899

Does Zijin Mining's Over-Allotment Success in Zijin Gold Spin-Off Alter Its Capital Flexibility Narrative (SEHK:2899)?

Reviewed by Sasha Jovanovic

- Zijin Mining Group Co., Ltd. announced that it has completed the full exercise of the over-allotment option in its spin-off of Zijin Gold International Company Limited on the Hong Kong Stock Exchange, raising approximately HK$3.70 billion through the sale of 52,348,600 shares and reducing its indirect stake from 86.70% to 85.00%.

- This move provides Zijin Mining with additional capital for future plans while signalling continued progress in restructuring and refining its corporate structure.

- To assess how Zijin Mining’s successful fundraising in the Zijin Gold International spin-off influences its growth narrative, let’s consider key impacts.

Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Zijin Mining Group Investment Narrative Recap

To be a shareholder in Zijin Mining Group, you need to believe in the company’s ability to monetize major project expansions and navigate international growth challenges. The recent Zijin Gold International spin-off and capital raise may add near-term flexibility, but does not materially alter the fact that Zijin’s largest short-term catalyst remains new mine ramp-ups, while overseas operational risks and cost pressures remain significant concerns.

Of recent announcements, Zijin’s start of production at the Tres Quebradas lithium project stands out as most relevant. This launch ties directly into the company’s push for output growth in fast-evolving commodity markets, while also underscoring persistent risks from volatile demand and pricing in the lithium sector.

By contrast, investors should be aware of how overseas risks can impact profits across Zijin’s expanding footprint if...

Read the full narrative on Zijin Mining Group (it's free!)

Zijin Mining Group's projections indicate CN¥409.3 billion in revenue and CN¥58.4 billion in earnings by 2028. This outlook is based on an expected annual revenue growth rate of 8.4% and a rise in earnings of CN¥18.2 billion from the current CN¥40.2 billion.

Uncover how Zijin Mining Group's forecasts yield a HK$29.36 fair value, a 13% downside to its current price.

Exploring Other Perspectives

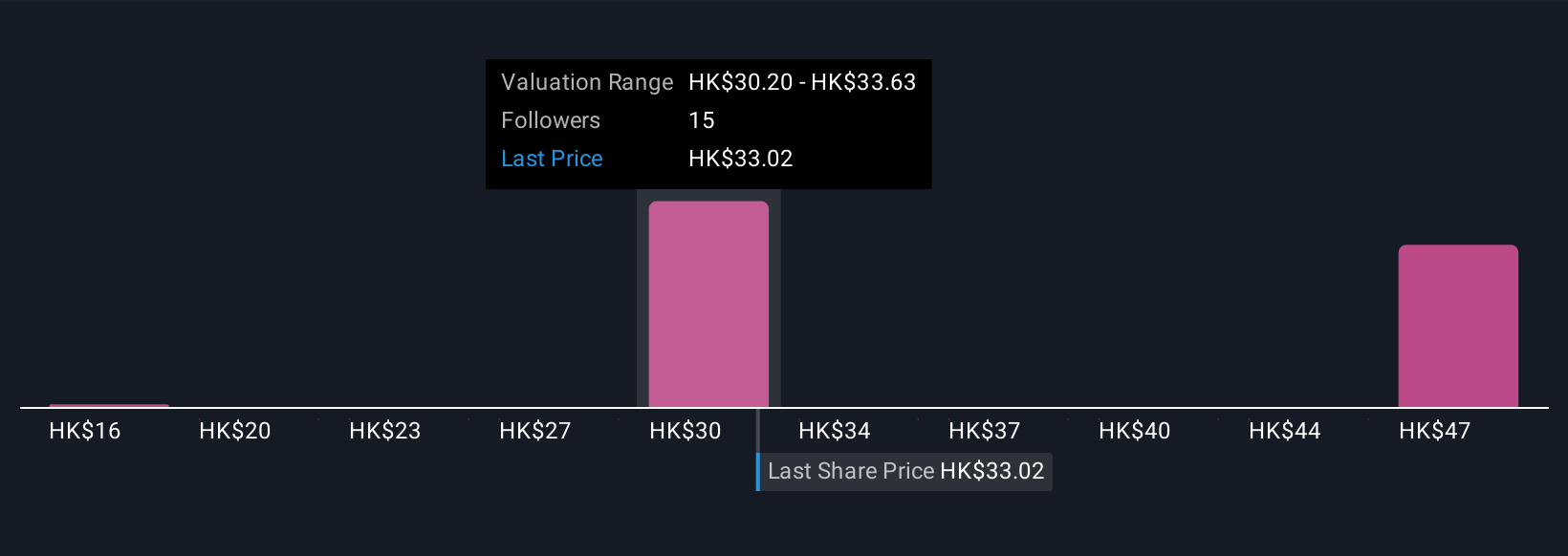

Five individual fair value estimates from the Simply Wall St Community for Zijin Mining Group range from HK$16.46 to HK$50.80. With diverse views on upside, remember that fragile lithium demand remains a key test for near-term earnings as you consider these different perspectives.

Explore 5 other fair value estimates on Zijin Mining Group - why the stock might be worth as much as 51% more than the current price!

Build Your Own Zijin Mining Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Zijin Mining Group research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Zijin Mining Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Zijin Mining Group's overall financial health at a glance.

Want Some Alternatives?

Our top stock finds are flying under the radar-for now. Get in early:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Zijin Mining Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:2899

Zijin Mining Group

Engages in the exploration, mining, processing, refining, and sale of gold, non-ferrous metals, and other mineral resources in Mainland China and internationally.

Outstanding track record with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)