- Hong Kong

- /

- Metals and Mining

- /

- SEHK:2259

Zijin Mining (SEHK:2259): Digging Into the Current Valuation Profile as Trading Stays Flat

Reviewed by Kshitija Bhandaru

Price-to-Earnings of 30.7x: Is it justified?

Current valuation data shows Zijin Gold International is trading at a Price-to-Earnings (P/E) ratio of 30.7 times. This is significantly above the Hong Kong Metals and Mining industry average of 15.9 times, as well as the peer average of 26.5 times. This indicates the stock appears overvalued compared to similar companies in its sector.

The P/E ratio measures how much investors are willing to pay for each dollar of company earnings. In the materials sector, a high P/E can reflect strong earnings expectations, rapid historical growth, or a premium attached by the market for certain business qualities.

For Zijin Gold International, investors are currently paying a premium relative to both peers and the broader sector average. This could suggest that the market is pricing in further earnings growth, or it may highlight consensus optimism about the company's profit sustainability. However, if future growth does not materialize as expected, the valuation could prove difficult to justify.

Result: Fair Value of $16.75 (OVERVALUED)

See our latest analysis for Zijin Gold International.However, risks such as stagnant revenue growth or shifting sector sentiment could quickly challenge any lingering optimism surrounding Zijin Gold International's premium valuation.

Find out about the key risks to this Zijin Gold International narrative.Another View: What Does Our DCF Model Say?

Taking a different angle, our SWS DCF model also evaluates Zijin Gold International and arrives at an overvalued conclusion. This alternative perspective reinforces the current view, but does it capture the full story?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Zijin Gold International Narrative

If your perspective differs from these conclusions or you prefer to dig into the numbers yourself, you can quickly shape your own view to suit your research approach. Do it your way. Do it your way

A great starting point for your Zijin Gold International research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Eager to widen your investing universe? Power up your search with these creative screens that spotlight companies most investors miss. You could spark your next big opportunity right here.

- Uncover stocks paying robust income and take advantage of dividend stocks with yields > 3% to enjoy yields over 3% while supporting your portfolio with steady cash flows.

- Jump on the future of healthcare by tapping into breakthroughs powered by AI with our healthcare AI stocks. Find medical innovators transforming patients' lives.

- Seize overlooked bargains in the market by using our tool for undervalued stocks based on cash flows. Let undervalued gems based on real cash flows work for your goals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

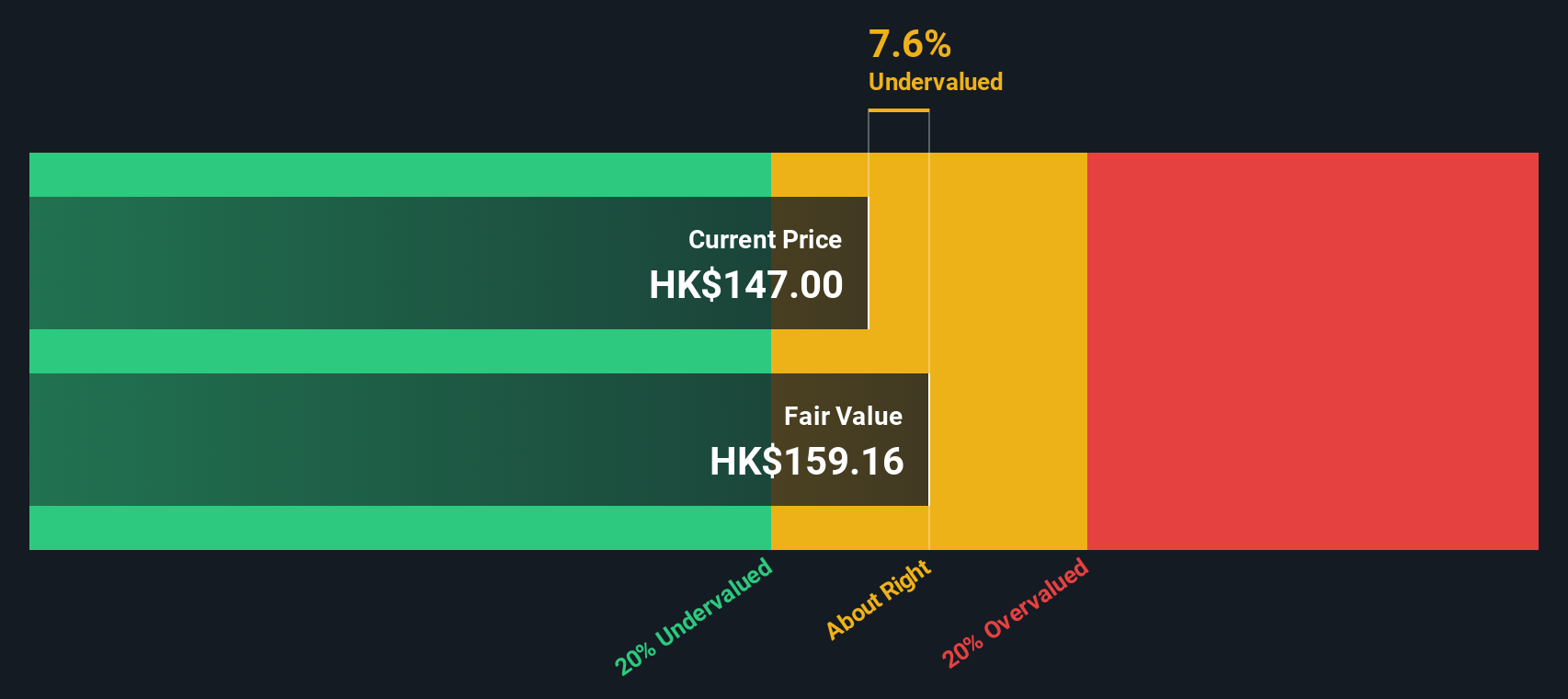

Discover if Zijin Gold International might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:2259

Zijin Gold International

Engages in the exploration, mining, processing, smelting, refining, and sale of gold and other mineral resources in the PRC.

Exceptional growth potential with proven track record.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)