If You Like EPS Growth Then Check Out China Sanjiang Fine Chemicals (HKG:2198) Before It's Too Late

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it completely lacks a track record of revenue and profit. But as Warren Buffett has mused, 'If you've been playing poker for half an hour and you still don't know who the patsy is, you're the patsy.' When they buy such story stocks, investors are all too often the patsy.

If, on the other hand, you like companies that have revenue, and even earn profits, then you may well be interested in China Sanjiang Fine Chemicals (HKG:2198). While that doesn't make the shares worth buying at any price, you can't deny that successful capitalism requires profit, eventually. Loss-making companies are always racing against time to reach financial sustainability, but time is often a friend of the profitable company, especially if it is growing.

View our latest analysis for China Sanjiang Fine Chemicals

How Fast Is China Sanjiang Fine Chemicals Growing?

If a company can keep growing earnings per share (EPS) long enough, its share price will eventually follow. That means EPS growth is considered a real positive by most successful long-term investors. We can see that in the last three years China Sanjiang Fine Chemicals grew its EPS by 12% per year. That growth rate is fairly good, assuming the company can keep it up.

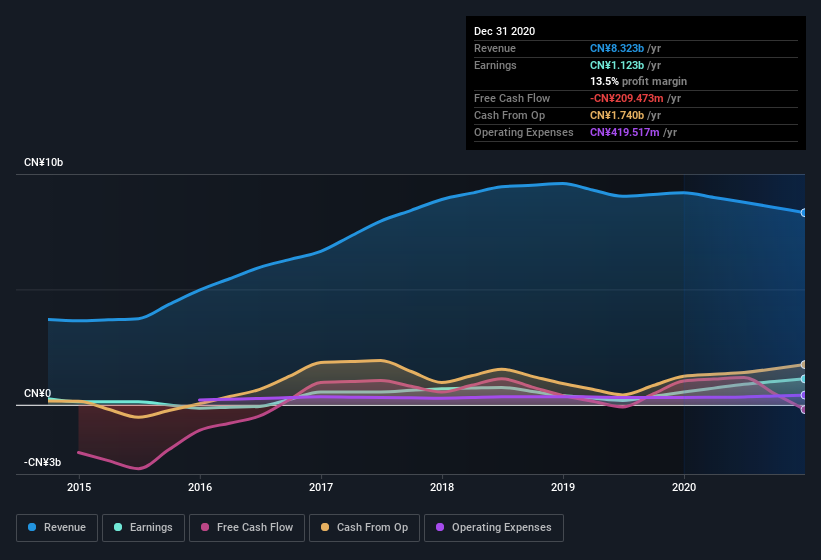

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. China Sanjiang Fine Chemicals's EBIT margins have actually improved by 5.1 percentage points in the last year, to reach 13%, but, on the flip side, revenue was down 9.4%. That falls short of ideal.

In the chart below, you can see how the company has grown earnings, and revenue, over time. Click on the chart to see the exact numbers.

While profitability drives the upside, prudent investors always check the balance sheet, too.

Are China Sanjiang Fine Chemicals Insiders Aligned With All Shareholders?

Like the kids in the streets standing up for their beliefs, insider share purchases give me reason to believe in a brighter future. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

It's a pleasure to note that insiders spent CN¥9.8m buying China Sanjiang Fine Chemicals shares, over the last year, without reporting any share sales whatsoever. And so I find myself almost expectant, and certainly hopeful, that this large outlay signals prescient optimism for the business. It is also worth noting that it was Jianzhong Guan who made the biggest single purchase, worth HK$2.7m, paying HK$2.10 per share.

Is China Sanjiang Fine Chemicals Worth Keeping An Eye On?

One important encouraging feature of China Sanjiang Fine Chemicals is that it is growing profits. While some companies are struggling to grow EPS, China Sanjiang Fine Chemicals seems free from that morose affliction. The gravy on the mushroom pie is the insider buying, which has me tasting potential opportunity; one for the watchlist, I'd posit. Still, you should learn about the 2 warning signs we've spotted with China Sanjiang Fine Chemicals .

There are plenty of other companies that have insiders buying up shares. So if you like the sound of China Sanjiang Fine Chemicals, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

If you’re looking to trade a wide range of investments, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

If you're looking to trade China Sanjiang Fine Chemicals, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:2198

China Sanjiang Fine Chemicals

An investment holding company, manufactures and supplies ethylene oxide and glycol, propylene, polypropylene, methyl tert-butyl ether (MTBE), surfactants, and ethanolamine in the People’s Republic of China, Japan, and Singapore.

Low with imperfect balance sheet.