China Sunshine Paper Holdings (HKG:2002) Takes On Some Risk With Its Use Of Debt

Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. Importantly, China Sunshine Paper Holdings Company Limited (HKG:2002) does carry debt. But the more important question is: how much risk is that debt creating?

Why Does Debt Bring Risk?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. When we think about a company's use of debt, we first look at cash and debt together.

See our latest analysis for China Sunshine Paper Holdings

What Is China Sunshine Paper Holdings's Net Debt?

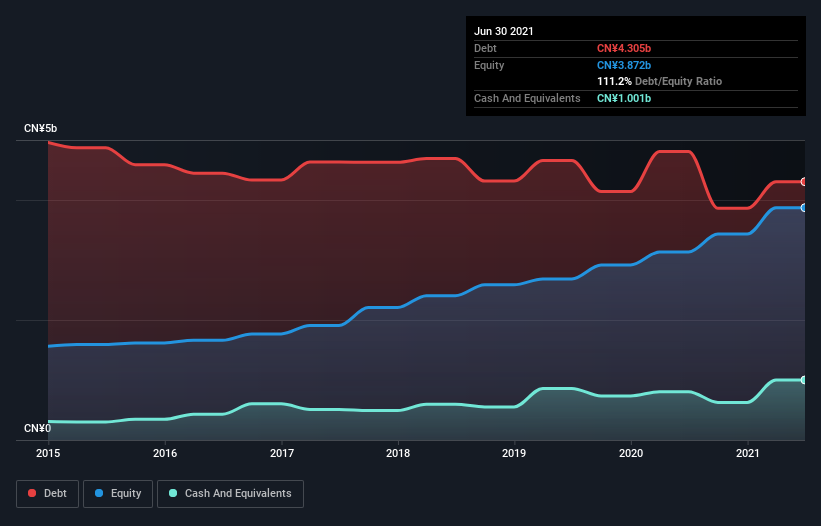

As you can see below, China Sunshine Paper Holdings had CN¥4.30b of debt at June 2021, down from CN¥4.81b a year prior. However, it also had CN¥1.00b in cash, and so its net debt is CN¥3.30b.

How Strong Is China Sunshine Paper Holdings' Balance Sheet?

The latest balance sheet data shows that China Sunshine Paper Holdings had liabilities of CN¥5.54b due within a year, and liabilities of CN¥1.01b falling due after that. On the other hand, it had cash of CN¥1.00b and CN¥654.0m worth of receivables due within a year. So its liabilities total CN¥4.90b more than the combination of its cash and short-term receivables.

The deficiency here weighs heavily on the CN¥1.41b company itself, as if a child were struggling under the weight of an enormous back-pack full of books, his sports gear, and a trumpet. So we'd watch its balance sheet closely, without a doubt. After all, China Sunshine Paper Holdings would likely require a major re-capitalisation if it had to pay its creditors today.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

With net debt to EBITDA of 3.0 China Sunshine Paper Holdings has a fairly noticeable amount of debt. But the high interest coverage of 8.7 suggests it can easily service that debt. One way China Sunshine Paper Holdings could vanquish its debt would be if it stops borrowing more but continues to grow EBIT at around 18%, as it did over the last year. The balance sheet is clearly the area to focus on when you are analysing debt. But you can't view debt in total isolation; since China Sunshine Paper Holdings will need earnings to service that debt. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. So the logical step is to look at the proportion of that EBIT that is matched by actual free cash flow. During the last three years, China Sunshine Paper Holdings generated free cash flow amounting to a very robust 84% of its EBIT, more than we'd expect. That positions it well to pay down debt if desirable to do so.

Our View

China Sunshine Paper Holdings's level of total liabilities and net debt to EBITDA definitely weigh on it, in our esteem. But the good news is it seems to be able to convert EBIT to free cash flow with ease. We think that China Sunshine Paper Holdings's debt does make it a bit risky, after considering the aforementioned data points together. That's not necessarily a bad thing, since leverage can boost returns on equity, but it is something to be aware of. When analysing debt levels, the balance sheet is the obvious place to start. However, not all investment risk resides within the balance sheet - far from it. For example - China Sunshine Paper Holdings has 2 warning signs we think you should be aware of.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:2002

China Sunshine Paper Holdings

Produces and sells paper products in the People's Republic of China and internationally.

Mediocre balance sheet and slightly overvalued.

Market Insights

Community Narratives