Benign Growth For China Gas Industry Investment Holdings Co. Ltd. (HKG:1940) Underpins Stock's 27% Plummet

The China Gas Industry Investment Holdings Co. Ltd. (HKG:1940) share price has fared very poorly over the last month, falling by a substantial 27%. Indeed, the recent drop has reduced its annual gain to a relatively sedate 8.0% over the last twelve months.

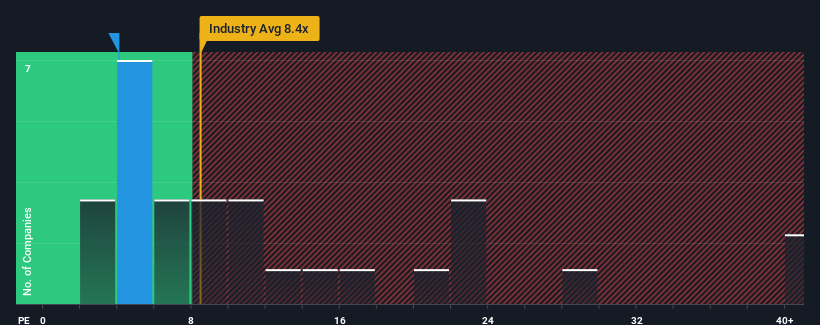

Even after such a large drop in price, China Gas Industry Investment Holdings may still be sending very bullish signals at the moment with its price-to-earnings (or "P/E") ratio of 4.1x, since almost half of all companies in Hong Kong have P/E ratios greater than 10x and even P/E's higher than 18x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so limited.

The earnings growth achieved at China Gas Industry Investment Holdings over the last year would be more than acceptable for most companies. One possibility is that the P/E is low because investors think this respectable earnings growth might actually underperform the broader market in the near future. If that doesn't eventuate, then existing shareholders have reason to be optimistic about the future direction of the share price.

Check out our latest analysis for China Gas Industry Investment Holdings

How Is China Gas Industry Investment Holdings' Growth Trending?

In order to justify its P/E ratio, China Gas Industry Investment Holdings would need to produce anemic growth that's substantially trailing the market.

Retrospectively, the last year delivered a decent 14% gain to the company's bottom line. Although, the latest three year period in total hasn't been as good as it didn't manage to provide any growth at all. So it appears to us that the company has had a mixed result in terms of growing earnings over that time.

Weighing that recent medium-term earnings trajectory against the broader market's one-year forecast for expansion of 21% shows it's noticeably less attractive on an annualised basis.

In light of this, it's understandable that China Gas Industry Investment Holdings' P/E sits below the majority of other companies. It seems most investors are expecting to see the recent limited growth rates continue into the future and are only willing to pay a reduced amount for the stock.

The Bottom Line On China Gas Industry Investment Holdings' P/E

Shares in China Gas Industry Investment Holdings have plummeted and its P/E is now low enough to touch the ground. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As we suspected, our examination of China Gas Industry Investment Holdings revealed its three-year earnings trends are contributing to its low P/E, given they look worse than current market expectations. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. If recent medium-term earnings trends continue, it's hard to see the share price rising strongly in the near future under these circumstances.

You always need to take note of risks, for example - China Gas Industry Investment Holdings has 2 warning signs we think you should be aware of.

You might be able to find a better investment than China Gas Industry Investment Holdings. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1940

China Gas Industry Investment Holdings

China Gas Industry Investment Holdings Co.

Flawless balance sheet and good value.

Market Insights

Community Narratives