With EPS Growth And More, China XLX Fertiliser (HKG:1866) Makes An Interesting Case

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like China XLX Fertiliser (HKG:1866). While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

View our latest analysis for China XLX Fertiliser

China XLX Fertiliser's Earnings Per Share Are Growing

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS) outcomes. That means EPS growth is considered a real positive by most successful long-term investors. It certainly is nice to see that China XLX Fertiliser has managed to grow EPS by 36% per year over three years. If the company can sustain that sort of growth, we'd expect shareholders to come away satisfied.

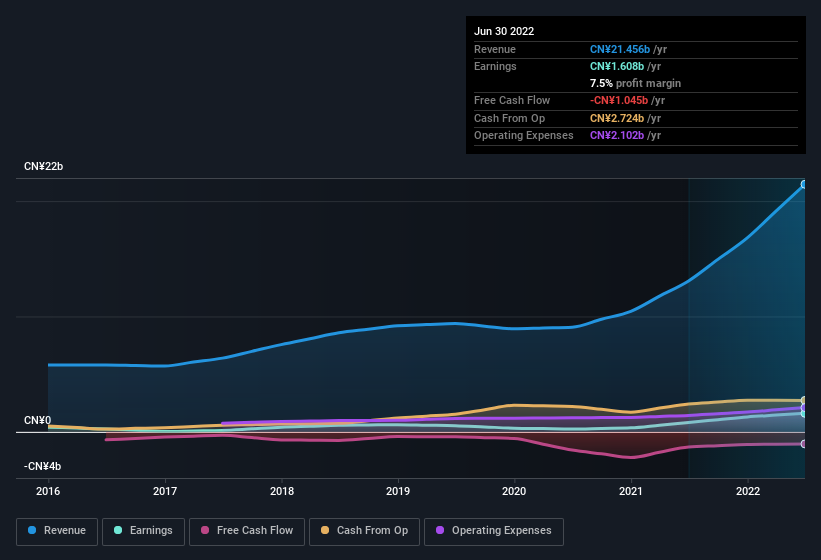

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. China XLX Fertiliser maintained stable EBIT margins over the last year, all while growing revenue 64% to CN¥21b. That's progress.

The chart below shows how the company's bottom and top lines have progressed over time. To see the actual numbers, click on the chart.

While it's always good to see growing profits, you should always remember that a weak balance sheet could come back to bite. So check China XLX Fertiliser's balance sheet strength, before getting too excited.

Are China XLX Fertiliser Insiders Aligned With All Shareholders?

It's said that there's no smoke without fire. For investors, insider buying is often the smoke that indicates which stocks could set the market alight. Because often, the purchase of stock is a sign that the buyer views it as undervalued. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

One gleaming positive for China XLX Fertiliser, in the last year, is that a certain insider has buying shares with ample enthusiasm. Specifically, in one large transaction Executive Director Yunhua Yan paid HK$367m, for stock at HK$6.50 per share. Big insider buys like that are a rarity and should prompt discussion on the merits of the business.

On top of the insider buying, it's good to see that China XLX Fertiliser insiders have a valuable investment in the business. We note that their impressive stake in the company is worth CN¥953m. This totals to 18% of shares in the company. Enough to lead management's decision making process down a path that brings the most benefit to shareholders. Very encouraging.

While insiders are apparently happy to hold and accumulate shares, that is just part of the big picture. That's because on our analysis the CEO, Tongsheng Ma, is paid less than the median for similar sized companies. For companies with market capitalisations between CN¥2.8b and CN¥11b, like China XLX Fertiliser, the median CEO pay is around CN¥4.3m.

China XLX Fertiliser's CEO took home a total compensation package of CN¥810k in the year prior to December 2021. That's clearly well below average, so at a glance that arrangement seems generous to shareholders and points to a modest remuneration culture. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. Generally, arguments can be made that reasonable pay levels attest to good decision-making.

Is China XLX Fertiliser Worth Keeping An Eye On?

For growth investors, China XLX Fertiliser's raw rate of earnings growth is a beacon in the night. Moreover, the management and board of the company hold a significant stake in the company, with one party adding to this total. These things considered, this is one stock worth watching. Before you take the next step you should know about the 3 warning signs for China XLX Fertiliser that we have uncovered.

The good news is that China XLX Fertiliser is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1866

China XLX Fertiliser

An investment holding company, engages in the development, manufacture, and sale of urea primarily in Mainland China and internationally.

Reasonable growth potential and fair value.

Market Insights

Community Narratives