- Hong Kong

- /

- Semiconductors

- /

- SEHK:522

3 Prominent Stocks Estimated To Be Up To 49.8% Below Intrinsic Value

Reviewed by Simply Wall St

In recent weeks, global markets have experienced notable fluctuations, with U.S. stocks retracting some of their previous gains amid uncertainties surrounding the incoming administration's policies and rising long-term interest rates. Meanwhile, the Federal Reserve's cautious stance on rate cuts and mixed economic signals from major regions like Europe and China have further added to investor apprehensions. In this environment of uncertainty, identifying undervalued stocks can offer potential opportunities for investors seeking to capitalize on discrepancies between market prices and intrinsic values.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Tibet Rhodiola Pharmaceutical Holding (SHSE:600211) | CN¥38.49 | CN¥76.93 | 50% |

| Cambi (OB:CAMBI) | NOK15.10 | NOK30.20 | 50% |

| Wuhan Keqian BiologyLtd (SHSE:688526) | CN¥14.57 | CN¥29.09 | 49.9% |

| Insyde Software (TPEX:6231) | NT$464.50 | NT$927.39 | 49.9% |

| SeSa (BIT:SES) | €75.50 | €150.49 | 49.8% |

| Zhaojin Mining Industry (SEHK:1818) | HK$11.58 | HK$23.06 | 49.8% |

| CS Wind (KOSE:A112610) | ₩41150.00 | ₩82262.52 | 50% |

| Advanced Energy Industries (NasdaqGS:AEIS) | US$109.84 | US$219.25 | 49.9% |

| Intellian Technologies (KOSDAQ:A189300) | ₩44450.00 | ₩88757.99 | 49.9% |

| St. James's Place (LSE:STJ) | £8.21 | £16.37 | 49.9% |

We'll examine a selection from our screener results.

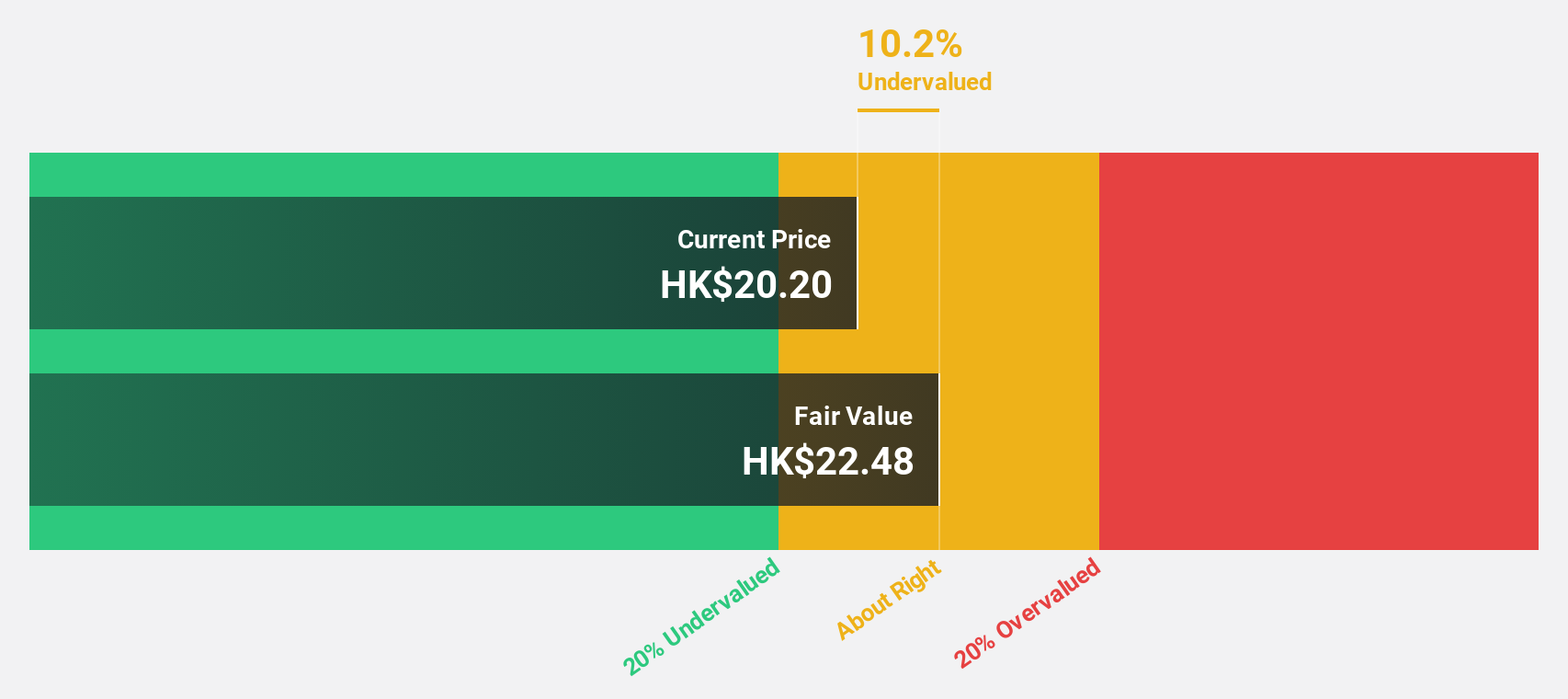

Zhaojin Mining Industry (SEHK:1818)

Overview: Zhaojin Mining Industry Company Limited is an investment holding company involved in the exploration, mining, processing, smelting, and sale of gold and silver products in China with a market capitalization of approximately HK$38.38 billion.

Operations: Zhaojin Mining Industry Company Limited generates its revenue primarily through the exploration, mining, processing, smelting, and sale of gold and silver products in China.

Estimated Discount To Fair Value: 49.8%

Zhaojin Mining Industry is trading significantly below its estimated fair value, with analysts forecasting earnings growth of 34.9% annually, outpacing the Hong Kong market. Despite recent shareholder dilution and a low future return on equity forecast, the company's revenue and profit have grown substantially over the past year. Recent strategic alliances and robust earnings reports highlight potential for improved cash flows, suggesting it may be undervalued based on current financial metrics.

- In light of our recent growth report, it seems possible that Zhaojin Mining Industry's financial performance will exceed current levels.

- Get an in-depth perspective on Zhaojin Mining Industry's balance sheet by reading our health report here.

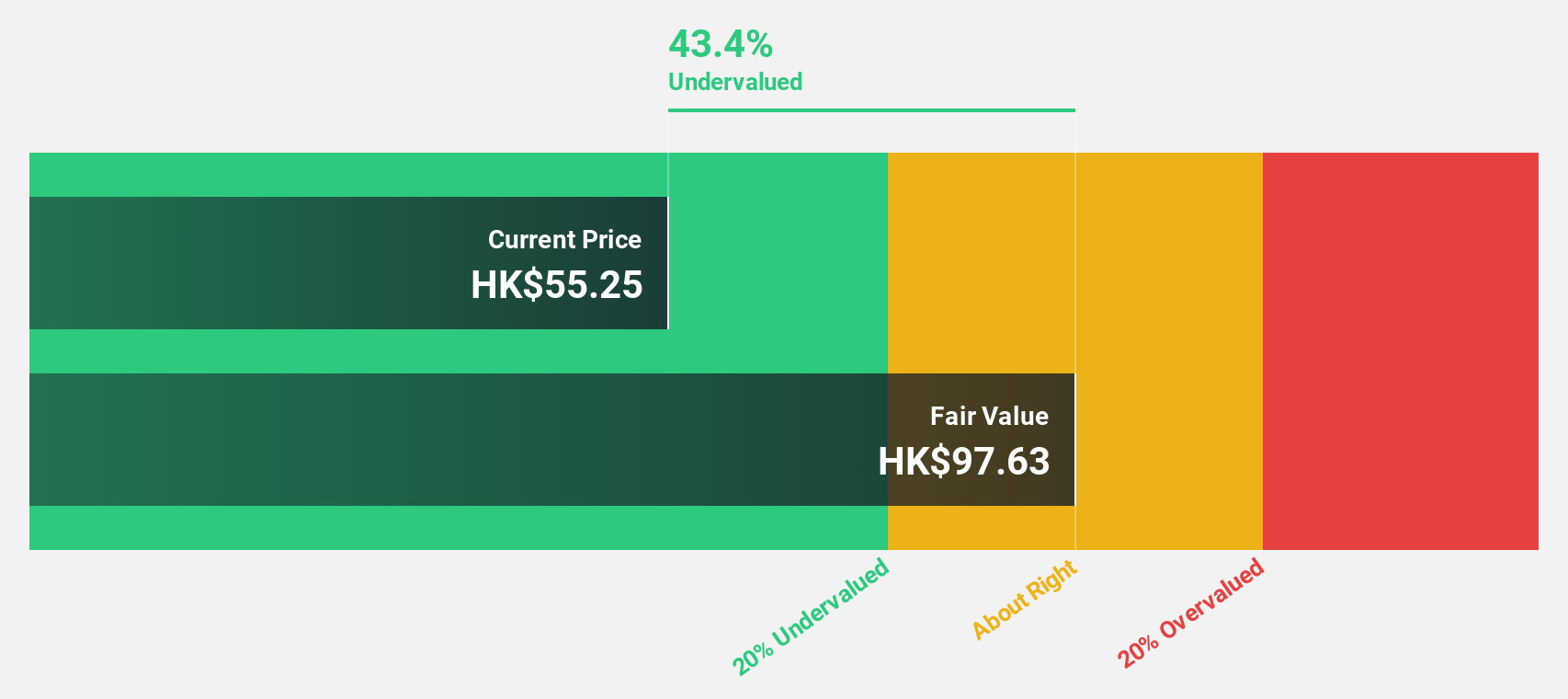

ASMPT (SEHK:522)

Overview: ASMPT Limited is an investment holding company that designs, manufactures, and markets machines, tools, and materials for the semiconductor and electronics assembly industries globally, with a market cap of approximately HK$31.13 billion.

Operations: The company's revenue is primarily derived from its Semiconductor Solutions segment, generating HK$6.42 billion, and its Surface Mount Technology (SMT) Solutions segment, contributing HK$6.81 billion.

Estimated Discount To Fair Value: 48.5%

ASMPT is trading significantly below its estimated fair value of HK$146.26, with a current price of HK$75.25, and analysts expect earnings to grow at 45.7% annually, surpassing the Hong Kong market average. Despite a decline in profit margins from 5.8% to 3.1%, revenue growth is projected at 13.7% per year, faster than the market's rate. Recent interest from KKR for a potential takeover highlights its perceived value amidst ongoing strategic evaluations.

- The growth report we've compiled suggests that ASMPT's future prospects could be on the up.

- Unlock comprehensive insights into our analysis of ASMPT stock in this financial health report.

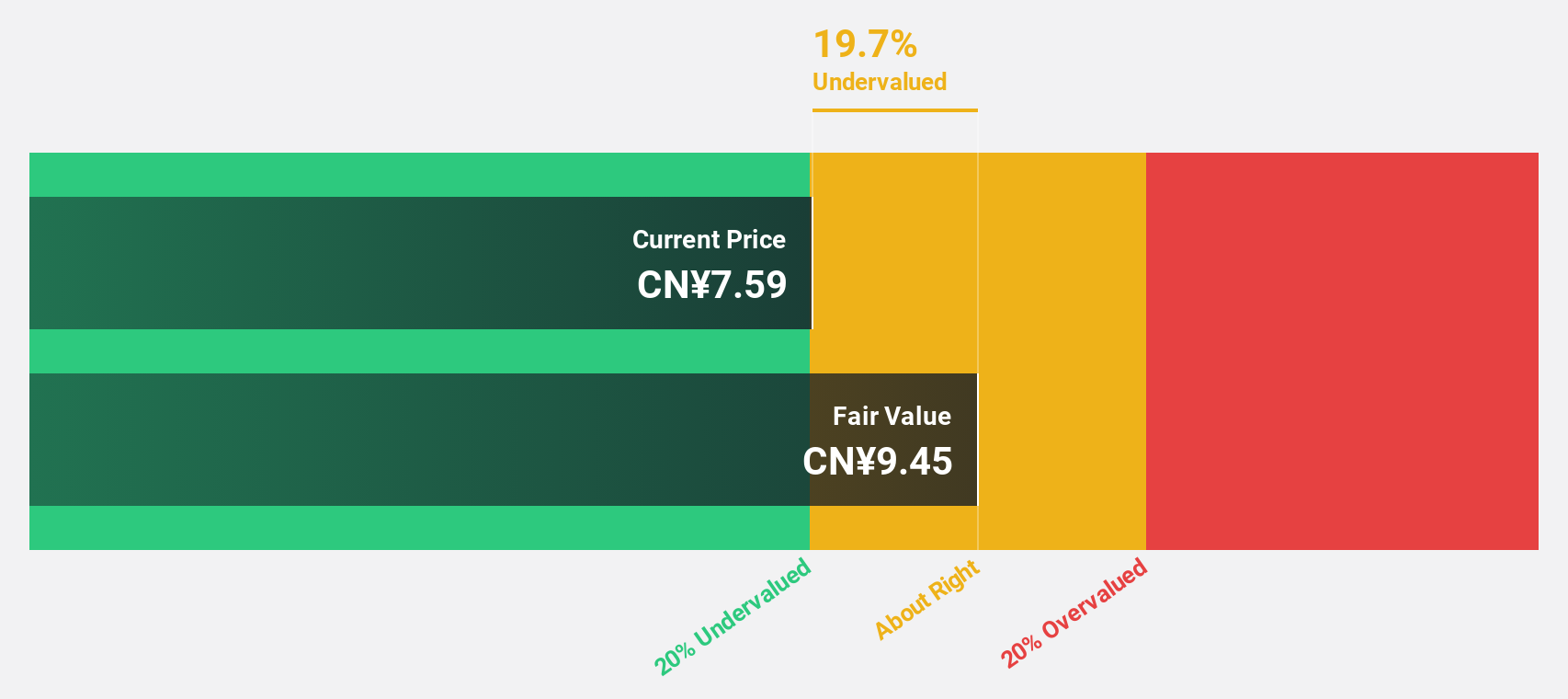

Xiamen Bank (SHSE:601187)

Overview: Xiamen Bank Co., Ltd. offers a range of banking products and services to individuals, corporate clients, and small and micro finance businesses, with a market cap of CN¥14.94 billion.

Operations: The company's revenue is derived from providing banking products and services to individual customers, corporate clients, and small and micro finance enterprises.

Estimated Discount To Fair Value: 49.3%

Xiamen Bank is trading at CN¥5.81, significantly below its estimated fair value of CN¥11.45, indicating potential undervaluation based on cash flows. Analysts forecast robust revenue and earnings growth rates of 22.7% and 26.4% annually, respectively, both outpacing the Chinese market averages. Despite a drop in net interest income from CN¥3.31 billion to CN¥2.98 billion over nine months ending September 30, net income rose to CN¥1.93 billion from the previous year’s figures.

- Our comprehensive growth report raises the possibility that Xiamen Bank is poised for substantial financial growth.

- Take a closer look at Xiamen Bank's balance sheet health here in our report.

Summing It All Up

- Access the full spectrum of 933 Undervalued Stocks Based On Cash Flows by clicking on this link.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:522

ASMPT

An investment holding company, engages in the design, manufacture, and marketing of machines, tools, and materials used in the semiconductor and electronics assembly industries worldwide.

Flawless balance sheet with reasonable growth potential.