- Hong Kong

- /

- Metals and Mining

- /

- SEHK:1636

Some Shareholders Feeling Restless Over China Metal Resources Utilization Limited's (HKG:1636) P/S Ratio

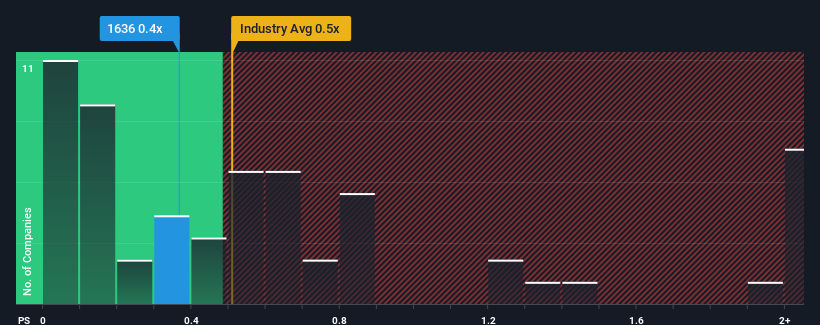

There wouldn't be many who think China Metal Resources Utilization Limited's (HKG:1636) price-to-sales (or "P/S") ratio of 0.4x is worth a mention when the median P/S for the Metals and Mining industry in Hong Kong is similar at about 0.5x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

View our latest analysis for China Metal Resources Utilization

What Does China Metal Resources Utilization's P/S Mean For Shareholders?

For example, consider that China Metal Resources Utilization's financial performance has been poor lately as its revenue has been in decline. Perhaps investors believe the recent revenue performance is enough to keep in line with the industry, which is keeping the P/S from dropping off. If not, then existing shareholders may be a little nervous about the viability of the share price.

Although there are no analyst estimates available for China Metal Resources Utilization, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.How Is China Metal Resources Utilization's Revenue Growth Trending?

In order to justify its P/S ratio, China Metal Resources Utilization would need to produce growth that's similar to the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 19%. This means it has also seen a slide in revenue over the longer-term as revenue is down 88% in total over the last three years. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Comparing that to the industry, which is predicted to deliver 14% growth in the next 12 months, the company's downward momentum based on recent medium-term revenue results is a sobering picture.

With this in mind, we find it worrying that China Metal Resources Utilization's P/S exceeds that of its industry peers. Apparently many investors in the company are way less bearish than recent times would indicate and aren't willing to let go of their stock right now. Only the boldest would assume these prices are sustainable as a continuation of recent revenue trends is likely to weigh on the share price eventually.

The Bottom Line On China Metal Resources Utilization's P/S

Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our look at China Metal Resources Utilization revealed its shrinking revenues over the medium-term haven't impacted the P/S as much as we anticipated, given the industry is set to grow. When we see revenue heading backwards in the context of growing industry forecasts, it'd make sense to expect a possible share price decline on the horizon, sending the moderate P/S lower. Unless the the circumstances surrounding the recent medium-term improve, it wouldn't be wrong to expect a a difficult period ahead for the company's shareholders.

And what about other risks? Every company has them, and we've spotted 4 warning signs for China Metal Resources Utilization (of which 3 are a bit concerning!) you should know about.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1636

China Metal Resources Utilization

Engages in the manufacturing and trading of copper and related products in the People’s Republic of China.

Moderate risk and slightly overvalued.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Waiting for the Inevitable

Near zero debt, Japan centric focus provides future growth

Corning's Revenue Will Climb by 12.73% in Just Five Years

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026