- Hong Kong

- /

- Metals and Mining

- /

- SEHK:1378

Risks To Shareholder Returns Are Elevated At These Prices For China Hongqiao Group Limited (HKG:1378)

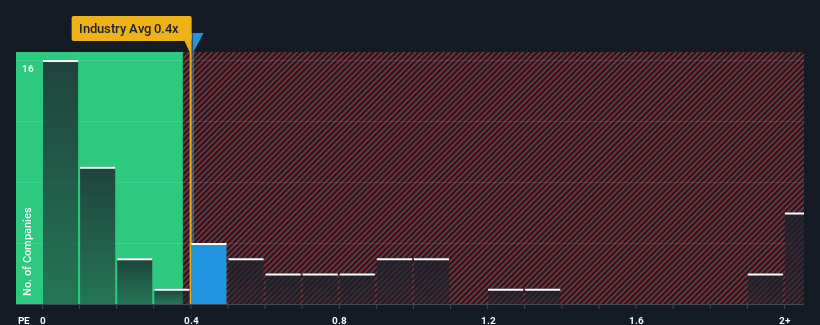

There wouldn't be many who think China Hongqiao Group Limited's (HKG:1378) price-to-sales (or "P/S") ratio of 0.4x is worth a mention when the median P/S for the Metals and Mining industry in Hong Kong is very similar. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Check out our latest analysis for China Hongqiao Group

What Does China Hongqiao Group's Recent Performance Look Like?

China Hongqiao Group hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. It might be that many expect the dour revenue performance to strengthen positively, which has kept the P/S from falling. If not, then existing shareholders may be a little nervous about the viability of the share price.

Want the full picture on analyst estimates for the company? Then our free report on China Hongqiao Group will help you uncover what's on the horizon.Do Revenue Forecasts Match The P/S Ratio?

China Hongqiao Group's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Retrospectively, the last year delivered a frustrating 1.6% decrease to the company's top line. However, a few very strong years before that means that it was still able to grow revenue by an impressive 56% in total over the last three years. Accordingly, while they would have preferred to keep the run going, shareholders would definitely welcome the medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 1.9% during the coming year according to the analysts following the company. Meanwhile, the rest of the industry is forecast to expand by 10%, which is noticeably more attractive.

In light of this, it's curious that China Hongqiao Group's P/S sits in line with the majority of other companies. It seems most investors are ignoring the fairly limited growth expectations and are willing to pay up for exposure to the stock. Maintaining these prices will be difficult to achieve as this level of revenue growth is likely to weigh down the shares eventually.

The Bottom Line On China Hongqiao Group's P/S

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Our look at the analysts forecasts of China Hongqiao Group's revenue prospects has shown that its inferior revenue outlook isn't negatively impacting its P/S as much as we would have predicted. At present, we aren't confident in the P/S as the predicted future revenues aren't likely to support a more positive sentiment for long. Circumstances like this present a risk to current and prospective investors who may see share prices fall if the low revenue growth impacts the sentiment.

Don't forget that there may be other risks. For instance, we've identified 2 warning signs for China Hongqiao Group that you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1378

China Hongqiao Group

An investment holding company, manufactures and sells aluminum products in the People's Republic of China and Indonesia.

Flawless balance sheet, undervalued and pays a dividend.